Aave’s recent performance presents a mixed image, showing significant price growth over more extended periods but with a hint of shorter-term volatility, caused mainly by geopolitical tensions. The AAVE token, a mainstay of the DeFi lending protocol, demonstrated an impressive 122% increase over the past year. Notably, it climbed 83% in the last quarter alone. However, recent days have shown signs of fluctuating momentum, with a modest 1.59% increase over the last day even as the price dipped 9.02% for the week.

Market Position and Institutional Interest

As Aave is ranked 40th by market capitalization, the interest it garners from major financial players is noteworthy. The Grayscale Aave Trust is a fresh development that’s particularly important. This initiative by Grayscale Investments accentuates the increasing institutional gravitation towards DeFi assets like AAVE. Such ventures not only raise the profile of cryptocurrencies in traditional investment spheres but also serve to reinforce the perceived usefulness and potential stability of protocols like Aave in the long run. This influx of institutional interest could signify broader acceptance and confidence in decentralized financial systems, though it does not entirely dampen the realities of potential price swings reflected in recent volume trends.

Reading Beyond the Indicators

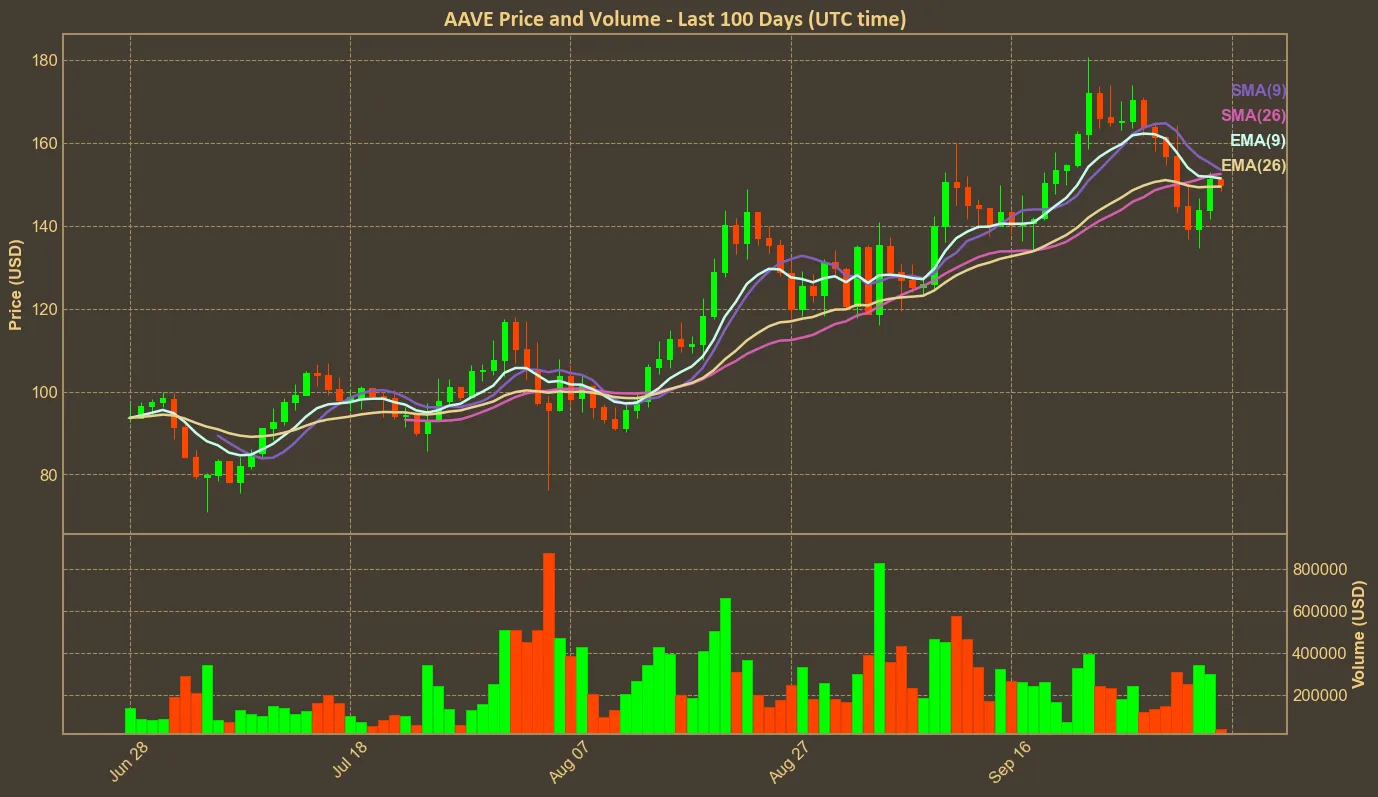

Current technical analysis indicators for Aave provide a snapshot of where the token might be heading, yet they must be approached with caution. The Relative Strength Index (RSI) is close to a neutral stance at 51, while the Simple Moving Average (SMA) and Exponential Moving Average (EMA) maintain closely aligned positions just above the current price level, signifying a relatively stable trend.

On the other hand, the Moving Average Convergence Divergence (MACD) crossing below the signal could indicate bearish sentiment. Adding to this complex picture, we see the Awesome Oscillator (AO) showing a pattern of decline. Despite these insights, relying solely on technical indicators can be misleading, often requiring the context of broader market forces and news events to frame an accurate assessment.

In summary, while technical indicators present a mixed picture, it’s essential to remember they don’t account for every factor. Considering the recent decline was driven by geopolitical tensions, it’s encouraging to see AAVE starting to recover. Looking ahead, the long-term outlook for this cryptocurrency remains promising.