Recent data about Aave presents an intriguing picture of the cryptocurrency’s current state and potential future movements. Over the last quarter, Aave has enjoyed a robust 46% price increase, suggesting a shift in investor sentiment. This quarter’s positive price change aligns with increased anticipation around the protocol’s GHO launch and the significance of its presence on Optimism. However, when we look closely at the last month’s 8.3% price drop, accompanied by a decrease in trading volume, it becomes clear that Aave is experiencing mixed sentiments and conflicting signals in its market.

Evaluating Recent Trends and Indicators

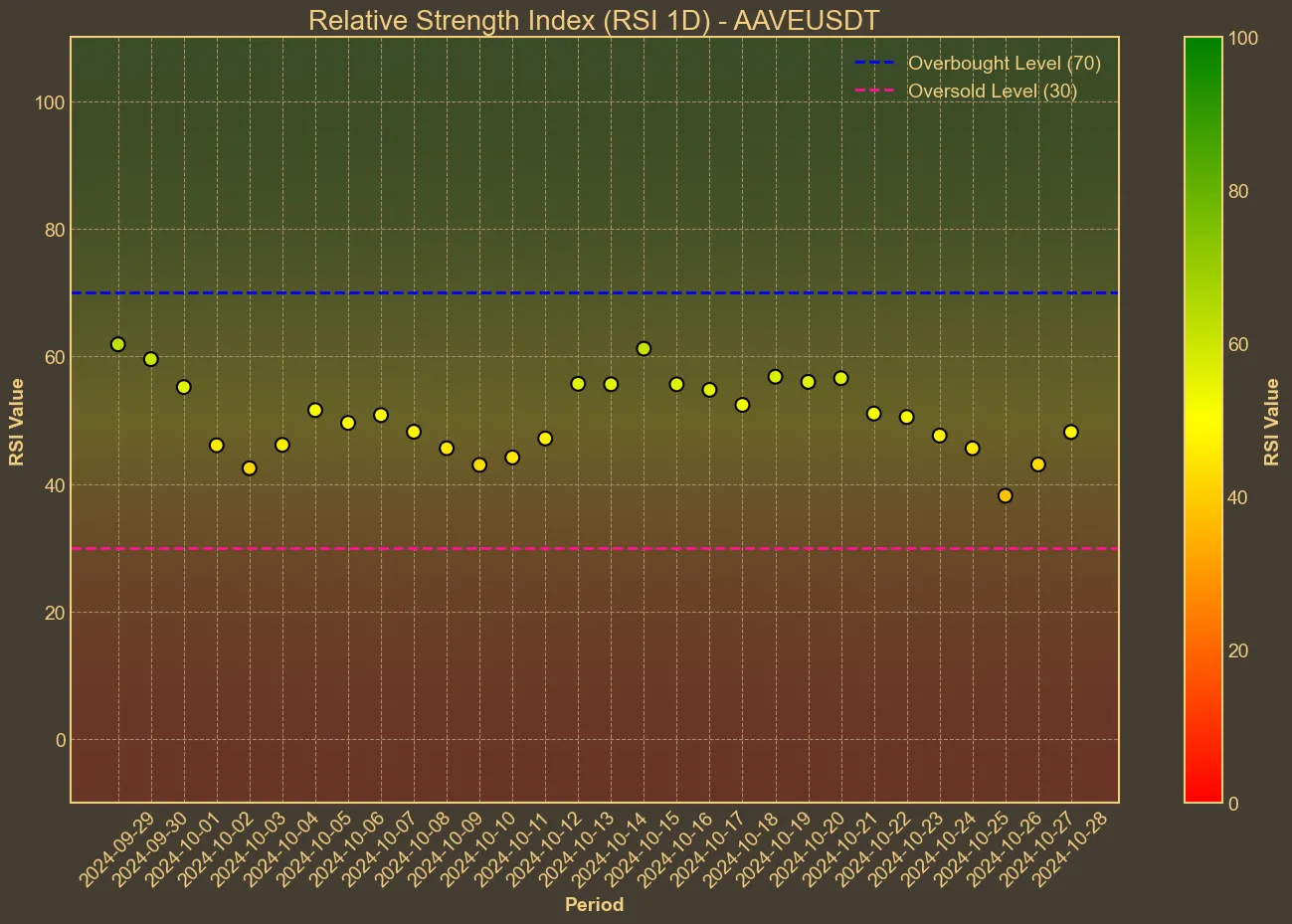

The Relative Strength Index (RSI) for Aave improved from 38 just three days ago to 52 today, indicating a recovery from near-oversold conditions. The MACD value of -1.0, contrasted with the MACD signal at zero, suggests potential convergence, hinting at a positive shift.

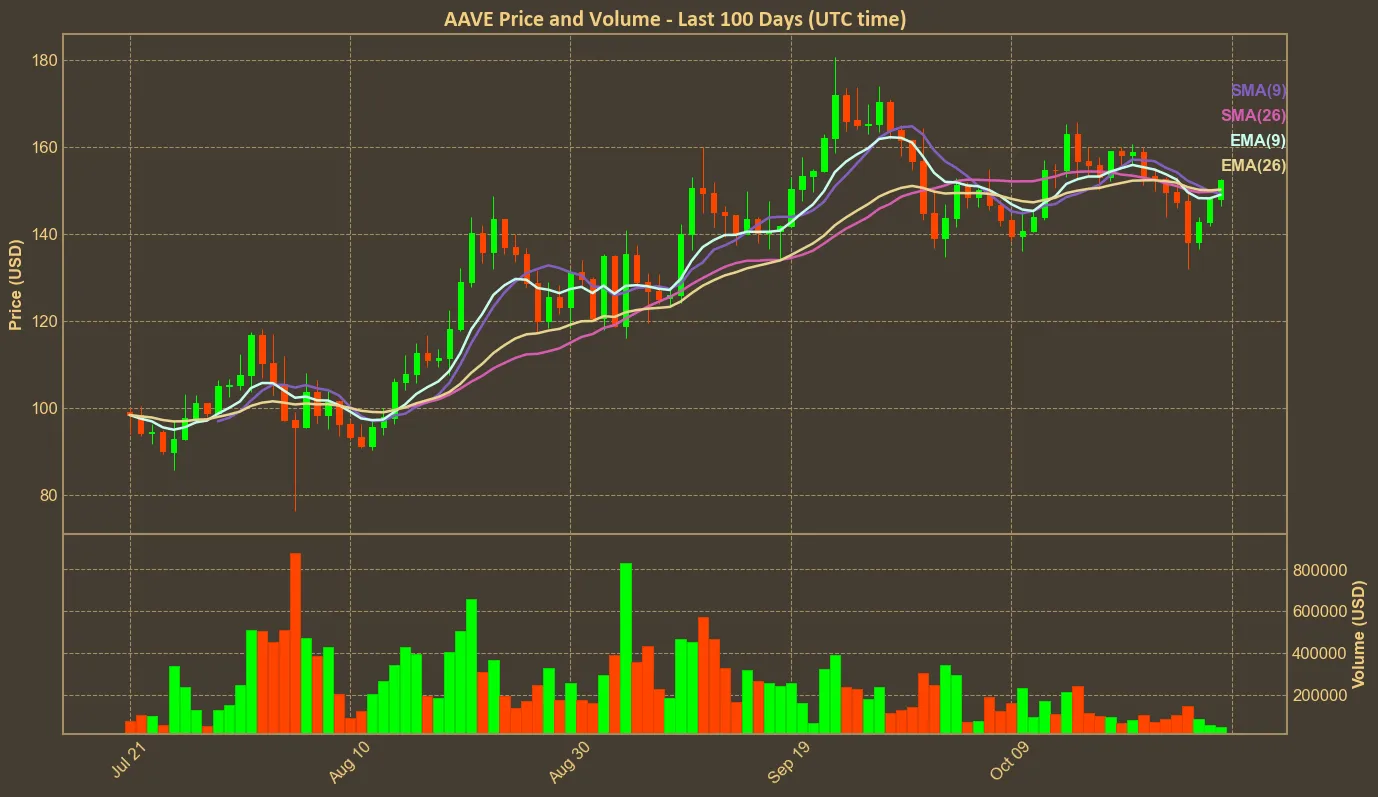

Moreover, Aave’s current price is tightly aligned with the Simple Moving Average (SMA) and the Exponential Moving Average (EMA) at $150, revealing no immediate trend. Yet, Aave’s position relative to the Bollinger Bands, where the price remains stable within the bands, indicates relatively moderate volatility. This means that although a significant move could be brewing, it might require a more substantial catalyst to push through the $170 resistance point mentioned in recent news.

Moreover, Aave’s current price is tightly aligned with the Simple Moving Average (SMA) and the Exponential Moving Average (EMA) at $150, revealing no immediate trend. Yet, Aave’s position relative to the Bollinger Bands, where the price remains stable within the bands, indicates relatively moderate volatility. This means that although a significant move could be brewing, it might require a more substantial catalyst to push through the $170 resistance point mentioned in recent news.

Aave’s Awesome Oscillator (AO) figures show a transition from negative to neutral in past days. This tool can often point to the beginning of a new trend or a reversal, yet right now, it seems Aave is in a holding pattern, waiting for a decisive move. This kind of environment is often tricky for traders who need to decide whether to stay positioned or wait for clearer signals.

Market Implications

The current mixed technical indicators for Aave pose an interesting challenge for traders and investors alike. Signs of consolidation could lead to a potential breakout if the external market conditions remain favorable, especially considering recent upgrades and protocol enhancements that Aave Labs has been rolling out. While some traders may consider recent drops and fluctuations as an opportunity to buy at a lower cost, others might exercise caution and wait for confirmation of a steady uptrend.

As always, it’s essential to keep in mind that technical analysis has its limitations. Many factors, including market sentiment, macroeconomic events, and regulatory changes, can significantly influence cryptocurrency prices. In the coming days, the most important event will likely be the US Presidential Election. Therefore, while technical indicators provide valuable insights, they should be part of a broader strategy encompassing both technical and fundamental analysis before making any investment decisions.