Aave has positioned itself strongly within the top 50 cryptocurrencies by market cap, currently sitting at number 40. Its trajectory recently shows promising upward momentum, sparking interest from investors who are tracking its progress closely. Over the past week, Aave’s price has increased by over 12%, and in the last quarter, it has seen a significant rise of nearly 60%. This resurgence in value aligns closely with broader market trends, although there are distinct factors influencing Aave’s potential future performance.

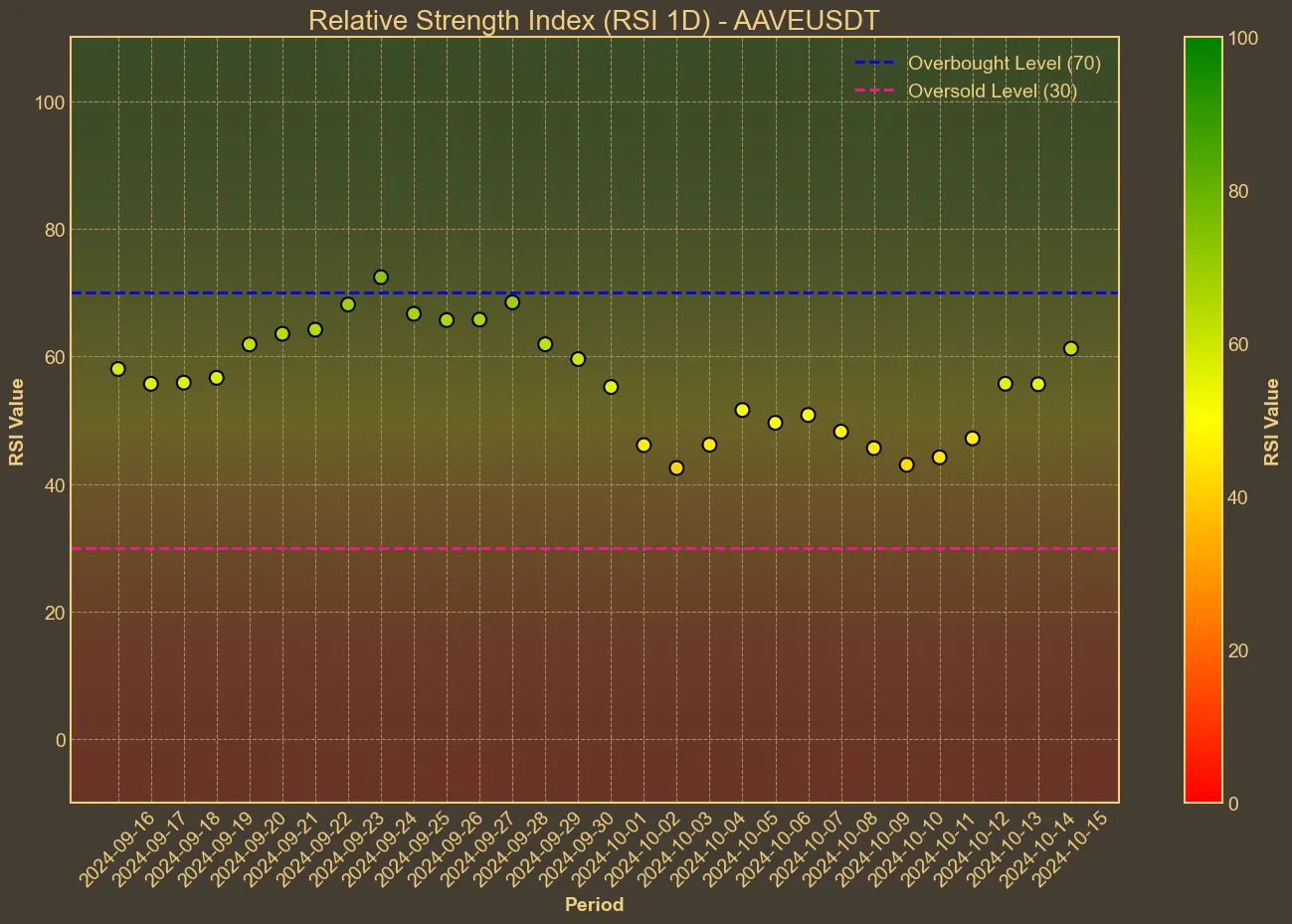

Current technical indicators suggest a relatively stable growth pattern for Aave, though some mixed signals necessitate caution. The Relative Strength Index (RSI) over the past week suggests a movement away from oversold conditions, currently stabilizing around a neutral zone.

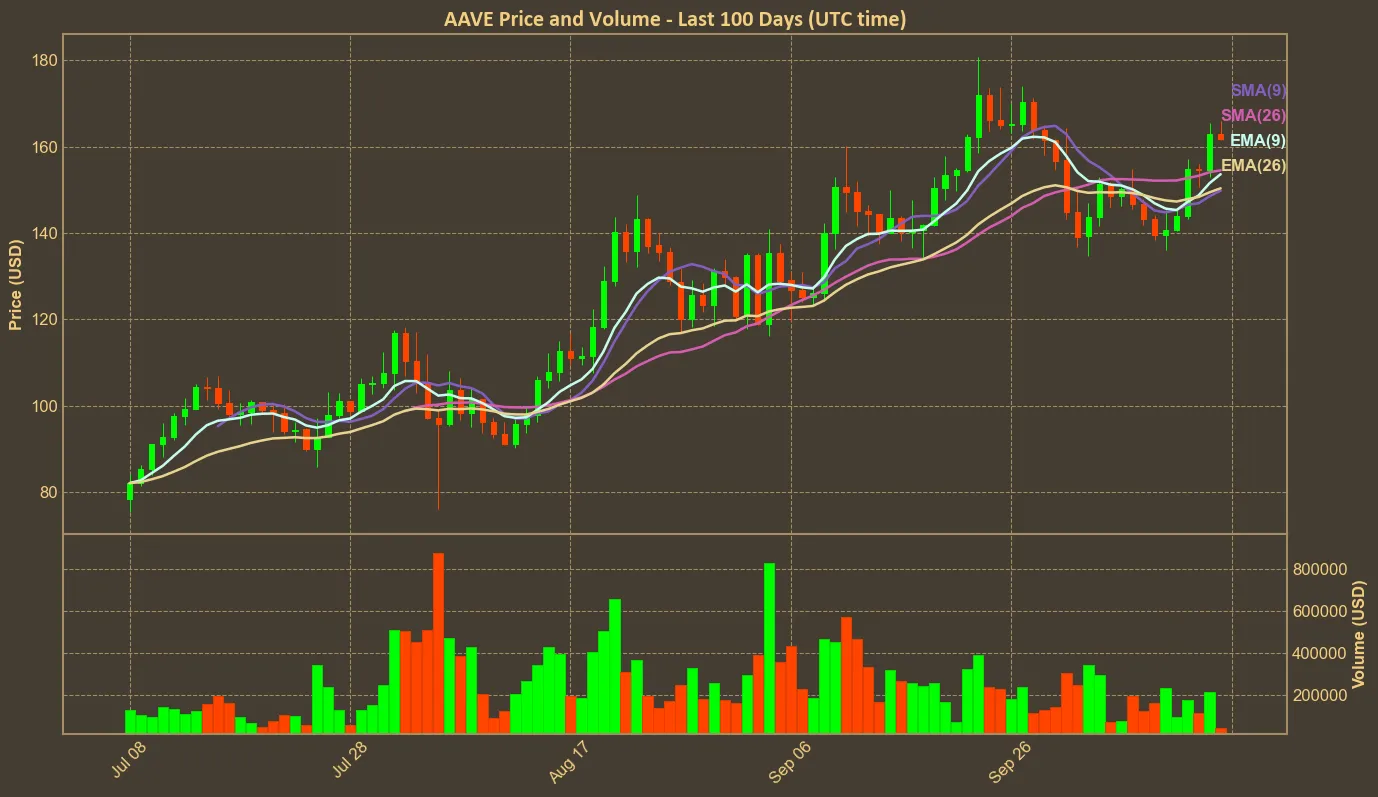

Simultaneously, moving averages, both simple (SMA) and exponential (EMA), show gradual increases, which could indicate a positive trend in price action. The upward movement in the Awesome Oscillator (AO) over recent days hints at potential bullish momentum, while the Moving Average Convergence Divergence (MACD) maintains a proactive stance, with the MACD line crossing above the signal line.

A sudden shift in volume could also play a significant role in Aave’s trajectory. In the last month, trading volume has surged by nearly 70%, suggesting heightened interest and investment activity around this asset. However, it’s worth noting that on the shorter term, daily and weekly volume changes present declines, reflecting some volatility that investors must consider.

The narrative around Aave continues to be filled with optimism, as evidenced by new projects and partnerships like the Grayscale Aave Trust. These external developments have the potential to bolster investor confidence and enhance liquidity, potentially driving the price toward key resistance levels around $170 that analysts are watching closely. While a breakout could propel Aave to even greater highs, surpassing the $200 mark is speculative at best in the immediate term, as it hinges on a complex interplay of market sentiment and concrete developments within the DeFi sector.

While Aave presents an opportunity for growth, especially for those tracking DeFi innovations, it’s crucial to remain aware of the limitations inherent in technical analysis. Indicators provide clues, not certainties, and are best utilized in conjunction with broader market research and individual risk assessments. Investors should consider fundamental aspects like ongoing developments, ecosystem integrations, and market trends to make more informed decisions.