Algorand has recently captured the attention of cryptocurrency enthusiasts with an impressive surge in its price action and market capitalization. Currently trading at $0.215, Algorand has experienced a remarkable 74.7% increase over the past month, including an 18% rise today alone. This upward momentum is reflected in the steep ascent of its market cap and trading volume, indicating strong buying interest fueled by the cryptocurrency’s recent breakout above key resistance levels.

Reasons Behind the Hype

The excitement surrounding Algorand in recent weeks can be attributed to growing confidence in its potential to secure a place among major crypto assets. Compared to many other popular blockchains, Algorand offers ultra-fast transactions, minimal fees, and low energy consumption, making it an attractive option for developers and users. The overall positive sentiment in the crypto market following Donald Trump’s victory in the recent U.S. presidential election has also contributed to Algorand’s upward momentum.

However, there’s likely another reason behind the surge in the last week. A few days ago, Donald Trump proposed significant tax changes for the crypto sector, aiming to eliminate capital gains taxes for American-based cryptocurrency companies. Such regulatory shifts could provide a competitive advantage to U.S. cryptocurrencies and possibly encourage other crypto companies to relocate to the United States.

The introduction of this law would significantly benefit Algorand. While the Algorand Foundation is based in Singapore due to favorable financial laws, the Algorand company responsible for developing the protocol is American. Therefore, the introduction of favorable taxation would greatly enhance the development and adoption of Algorand.

This optimism is further confirmed by the recent performance of other major American cryptocurrencies like Cardano, Ripple, and Hedera. Cardano is up 25% this week, Ripple has increased by 85%, and Hedera has surged by 134%. Alongside Algorand’s 44% weekly growth, these coins are among the best-performing cryptocurrencies recently.

Technical Indicators Are Bullish, But Suggest Caution

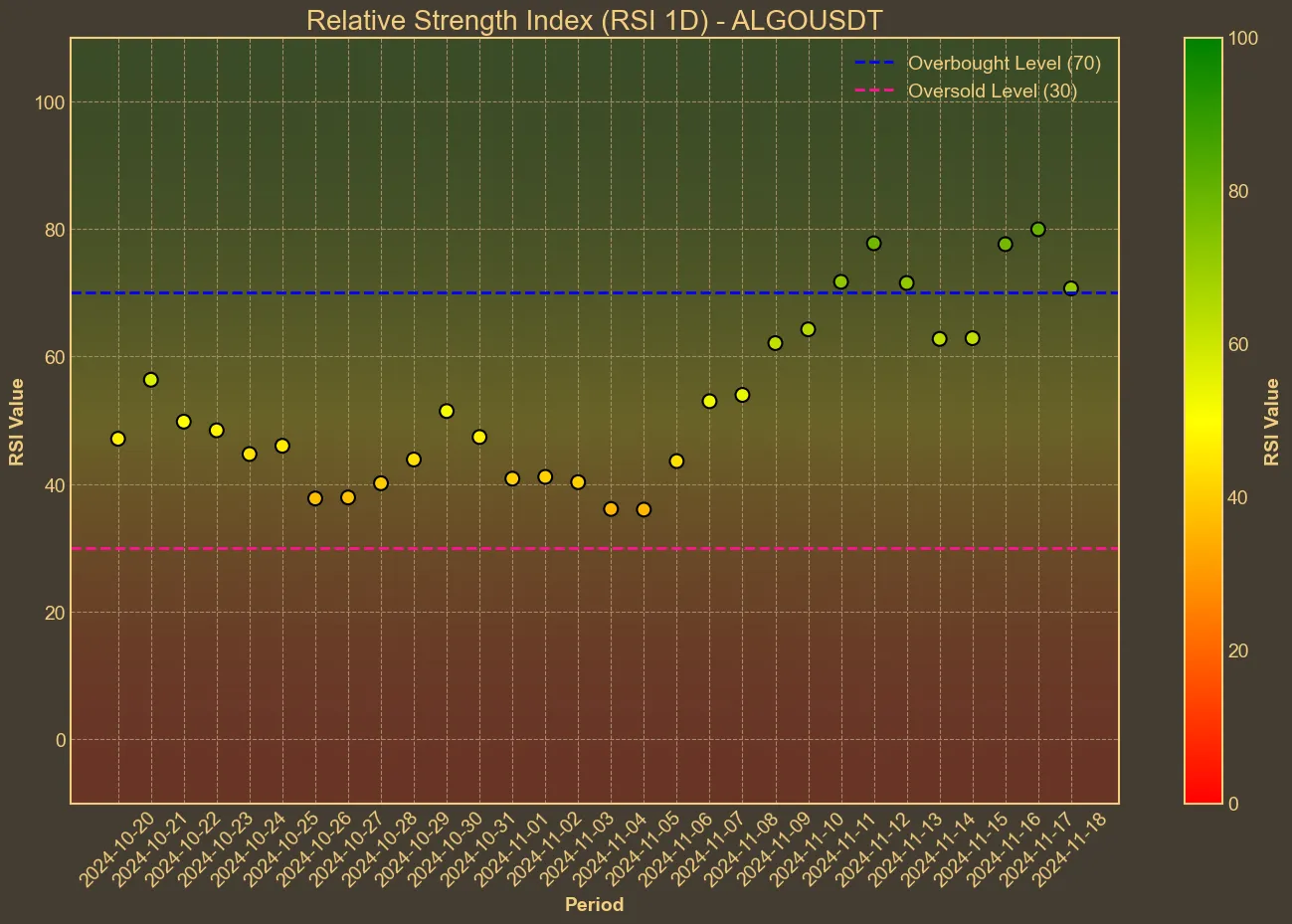

The technical indicators surrounding Algorand present a compelling case for sustained bullish behavior, albeit with caution. The RSI (Relative Strength Index) is positioned at 78, signaling an overbought condition, which could suggest a potential cooling-off period. Furthermore, the price action has exceeded the upper limit of the Bollinger Bands, another telltale signal that a pullback might be imminent. The MACD and Awesome Oscillator continue to show positive momentum, consistent with the sustained increase in price and market activity.

On the moving averages front, the Simple and Exponential Moving Averages both indicate a relatively high upward trajectory. While these indicators reinforce the bullish sentiment, it is crucial to consider them within the context of the broader financial market environment and potential market corrections.

What’s Next For Algorand

Algorand’s recent performance has revitalized investor confidence after a period of lackluster activity, during which the coin was down over 95% from its all-time high. The continuous development of the protocol, coupled with the anticipation of favorable regulatory changes, has breathed new life into the project.

While the recent gains are encouraging, it’s crucial for investors to exercise caution. Technical indicators suggest the possibility of a short-term correction following the recent surge. Nonetheless, the long-term outlook for Algorand appears optimistic, supported by its technological strengths and potential regulatory developments that could favor its growth.