Avalanche (AVAX) has a position as the 12th largest cryptocurrency by market cap. While the recent data points to a mixed bag of short-term trends, the overall image is quite intriguing for AVAX investors. Despite a price drop over the past day and week, the monthly performance stands strong with a significant rise. This is a stark contrast to the quarterly performance, which shows a slight dip. On a yearly scale, Avalanche has experienced a dramatic rise – but the biggest gains were to be made in March, where AVAX was above $50.

Recent Market Dynamics

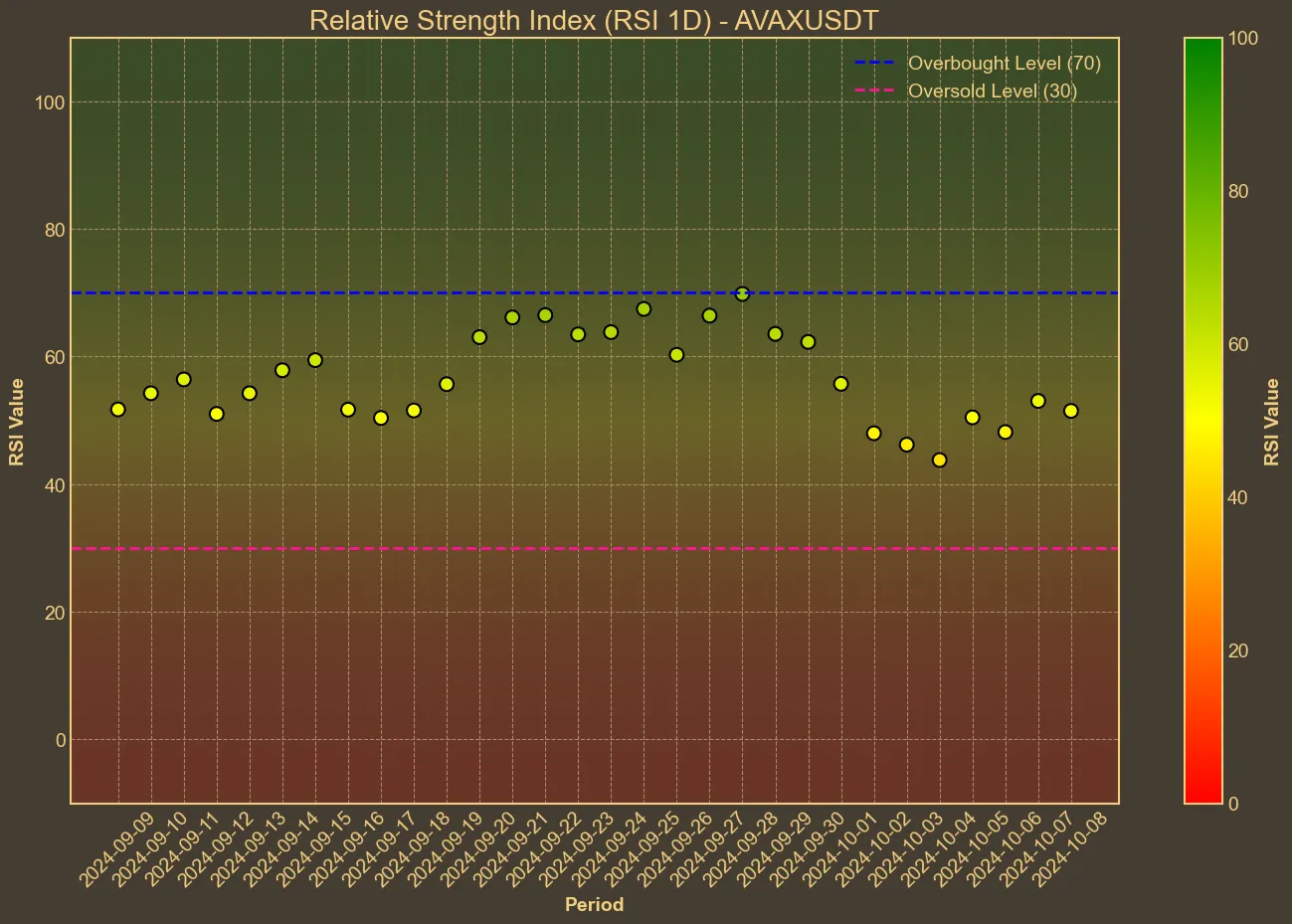

Observing the technical indicators reflects a dynamic scenario. The Relative Strength Index (RSI) oscillates around the midpoint, signaling a possibly balanced momentum in the market.

Moving Average Convergence Divergence (MACD) and other indicators, such as the simple and exponential moving averages, suggest limited momentum. Meanwhile, the Bollinger Bands outline a price range, which could hint at potential volatility in the near term. Notably, market capitalization grew over the last month, aligning with the increase in trading volume, which shows a fresh interest from investors.

Implications of the Current Trends

While technical analysis provides insights into past and current pricing actions, it’s crucial to remember its limitations. Market sentiment and external factors can be significant drivers that influence future prices – we have seen that with FED interest rate cuts and recent geopolitical tension – technical analysis cannot predict those factors. In forming an investment strategy, one should consider technical indicators, but not solely rely on them, as they cannot account for unforeseen market shifts or external events.

Avalanche’s recent drop could deter some investors – however, its longer-term growth and increasing market cap may still appeal to those with a higher risk tolerance. Current technical indicators are neutral and show that market is balanced – but also that some volatility might happen in the coming days. However, this neutral stance might quickly change if the next economic reports from the US are positive.