The Avalanche cryptocurrency fluctuates, painting a complex picture for investors and analysts. Currently ranked at number 14 in the market, Avalanche experiences ongoing price declines since March. The last day alone saw the price drop by over 4%. Throughout the past week, the decline has persisted with a reduction of around 6.5%. However, a broader look at the yearly performance shows a surge of approximately 125%.

Technical Indicators: A Closer Look

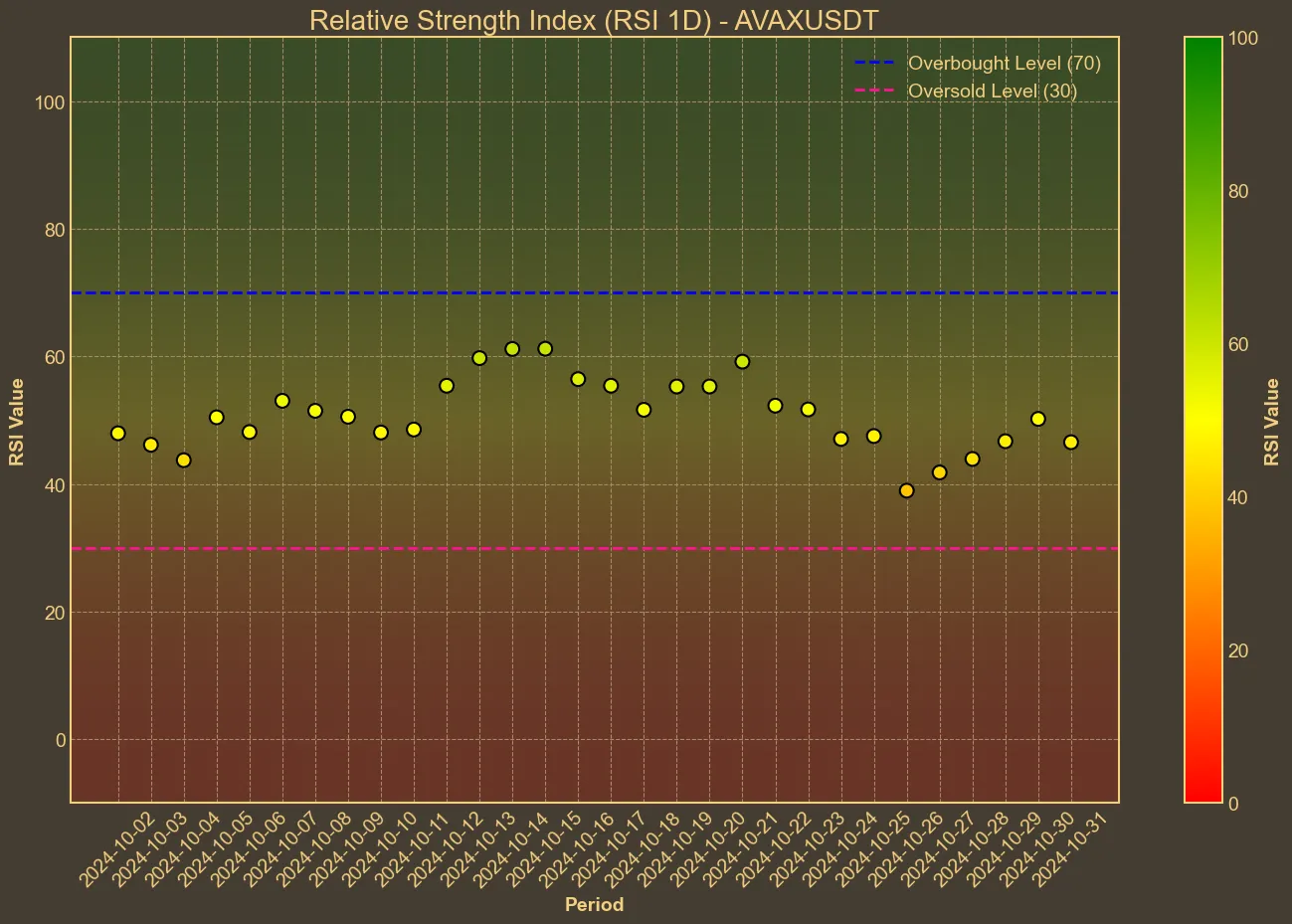

Avalanche’s performance isn’t just about the price trends. Key technical indicators offer profound insights. The Relative Strength Index (RSI) for the past week has mostly stayed below 50, ending at 41. This might suggest a bearish sentiment prevailing in the market.

Additionally, examining the Moving Average Convergence Divergence (MACD) reveals a negative divergence, with the current MACD at -0.31 against a signal line of -0.06. This reflects a momentum that leans towards further potential depreciation. The Awesome Oscillator (AO) too points to a continued downtrend, hinting at the persistent struggles.

Examining the Moving Averages provides another layer of understanding. The Simple Moving Average (SMA) hovers around 27, slightly above the current price of $25.03, potentially indicating a resistance level or ceiling for the crypto’s price. Meanwhile, the Exponential Moving Average (EMA) of 26.67 suggests a more dynamic and recent resistance level that aligns closely with current valuations.

Opportunities and Risks

Despite this volatile picture, Avalanche continues to capture attention within the DeFi space. The release of a $40 million grant aimed at developers, alongside the Avalanche9000 upgrade, keeps the community hopeful and enthusiastic. These developments show the network’s dedication to fostering growth and innovation, signaling potential future bullish sentiment. Other factors, such as market sentiment, Bitcoin performance, regulatory changes, technological advancements and incoming elections can also significantly impact the price movement.

The pure data underscores a cautious approach. The technical indicators lean bearish, yet the community’s active developments and recent initiatives could spur new opportunities. Investors should tread carefully, considering both technical signals and external variables before making decisions.