A governance proposal within the Polkadot ecosystem has stirred strong opinions about whether to convert 500,000 DOT tokens into Bitcoin over a year, using a gradual purchase strategy. With Bitcoin holding above $100,000 and DOT near yearly lows, some see the plan as a chance to build a more resilient treasury. Others remain skeptical, warning the move could bring more downside than protection during a volatile period for the network’s native token.

Table of Contents

Risk Hedge or Misplaced Bet?

The idea, introduced in early June 2025 by a user known as hippiestank, aims to create a Bitcoin reserve using Threshold BTC (tBTC), a decentralized, non-custodial asset-backed 1:1 by Bitcoin. The reserve would be managed using a dollar-cost averaging strategy to avoid lump-sum exposure. The plan proposes a conversion rate of 1 DOT to about 0.000041 tBTC.

Supporters argue that the reserve could act as a cushion, allowing the Polkadot treasury to withstand future downturns. They believe Bitcoin, which has grown into a widely accepted reserve asset, could help maintain value across different market phases. The proposal states:

“This proposal is about risk management and operational continuity, not market timing or speculation.”

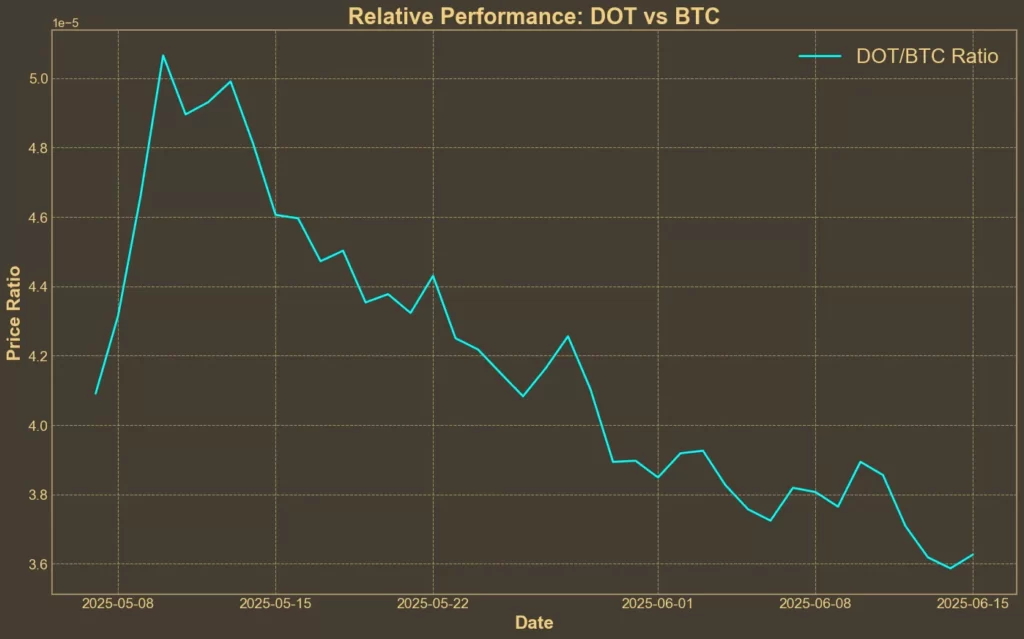

However, others disagree, mainly due to the current price levels of both assets. DOT is trading near its lowest point in over three years, while Bitcoin remains above $100,000. A community member questioned the logic:

“Even with amazing yields, it’s likely to do more harm than good with the additional downward pressure that we’re already contending with from other DCAs mixed with a lack of interest.”

Long-Term Price Decline Pressures DOT Holders

Polkadot has struggled to maintain price support since its all-time high above $55 in November 2021. As of June 2025, the token had dropped more than 93%, now trading near $3.80. Attempts to recover over the past months brought it near $6 but were short-lived, with each bounce met by renewed selling.

Technical indicators have not offered encouragement. Momentum indicators often turn negative after brief rallies, with tools like the Chaikin Money Flow and MACD showing consistent downward trends. Combined with macroeconomic pressure and minimal developer traction, this has limited any sustained recovery.

While staking remains strong, with about 55% of DOT locked up, inflation from token issuance and weak demand growth continue to weigh on the price. Reddit threads and forums often highlight that staking rewards have not been enough to keep participants engaged during downtrends.

Supporters Argue It’s a Strategic Reserve, Not a Trade

The author of the proposal and others backing it reject the idea that the reserve move is about market speculation. Their argument focuses on building a broader treasury strategy that doesn’t rely solely on DOT. The proposer wrote:

“I believe the ‘DOT ATL, BTC ATH’ argument misframes the situation.”

According to their calculations, had the treasury adopted a Bitcoin reserve earlier in 2025 when the Weighted Financial Committee proposal was first discussed, the results could have shown a $1.5 million net gain. They estimate that such a strategy would have brought the treasury to $124 million in assets instead of $122.5 million, with a 2.46% annualized return.

Supporters argue that this is a solid outcome, especially during a 60% decline in DOT relative to BTC. They emphasize that while the returns seem modest, the value compounds if DOT’s weakness continues and the reserve helps fund ongoing ecosystem development.

Public Companies Are Loading Up on Bitcoin

The concept of Bitcoin as a reserve asset is becoming more common outside of Polkadot as well. In June 2025, Nasdaq-listed fintech firm Mercurity announced plans to raise $800 million to build its own long-term Bitcoin reserve. The firm said it would integrate Bitcoin into its treasury through custody, staking, and tokenization frameworks.

If Mercurity follows through, it would rank just ahead of GameStop in terms of corporate Bitcoin holdings. This shift reflects wider adoption across institutions. As of June, 223 public companies have reported Bitcoin holdings on their balance sheets, up from 124 in mid-2024. These companies now collectively hold more than 819,000 BTC, accounting for nearly 4% of the total supply.

For Polkadot, this trend coincides with its other efforts to expand into crypto-finance. A recently approved non-custodial payment card, compatible with Visa, signals a larger move to provide real-world utility and access.

A small portion of the proposed Bitcoin reserve – 0.005 tBTC – would also be contributed to the Hydration Omnipool to help maintain liquidity via Threshold Network’s bridge.

Conclusion Awaits As Vote Nears

The Polkadot community faces a decision with long-term implications. Supporters see the Bitcoin reserve plan as a way to protect the treasury and maintain funding regardless of DOT’s price performance. Critics are wary of the timing and potential negative effects on an already declining asset. If adopted, Polkadot would stand among a growing group of projects and companies turning to Bitcoin for long-term asset protection. The choice now rests with its stakeholders.