The cryptocurrency market has been rattled by the geopolitical tensions in the Middle East, a factor external to the market itself. Yet, Polkadot (DOT) has been hit harder than most, sliding over 16% last week and dropping to just $4, wiping out all the gains made in the past month following the Federal Reserve’s interest rate cut. In the broader context, Polkadot’s decline is even more dramatic—it was trading above $10 for several weeks as recently as March.

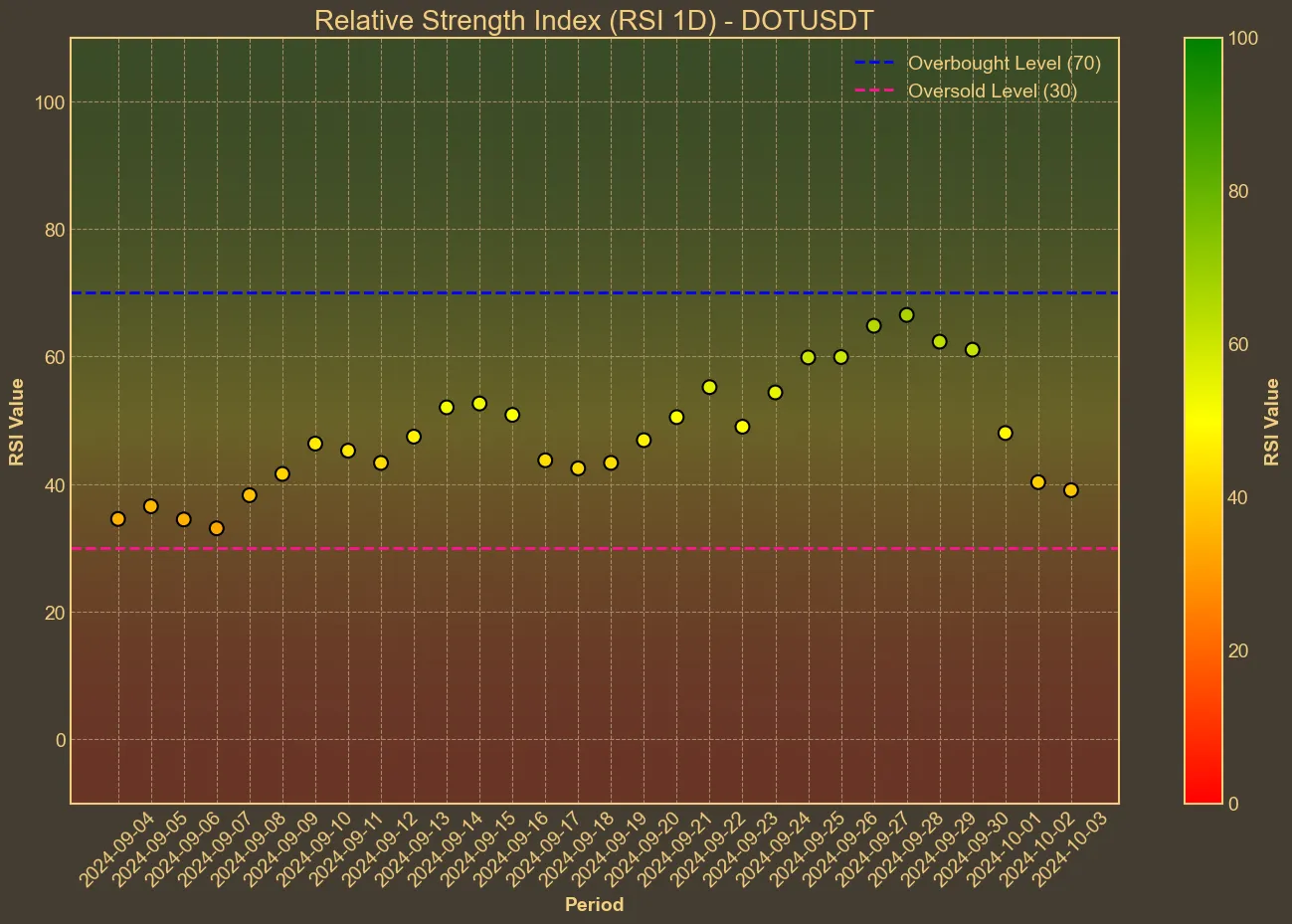

From a technical perspective, the outlook remains grim. The Relative Strength Index (RSI) has been trending downward, sitting at 38, indicating Polkadot is teetering on the edge of being oversold. This aligns with bearish signals from the Moving Average Convergence Divergence (MACD) and the Awesome Oscillator, both pointing to the potential for continued downward pressure.

The overall market climate complicates things further. Heightened geopolitical tensions are fostering a cautious, risk-averse atmosphere. Many fear the conflict may escalate into a full-scale war, which could exacerbate the already negative market sentiment. While Polkadot has no direct ties to these events, the broader market’s fear could weigh heavily on its price.

Adding to the challenges, Polkadot’s recent $400,000 marketing spend at the Token 2049 event in Singapore has come under scrutiny. Despite the initial boost, the long-term effects of this expenditure seem minimal, especially with Polkadot ranking among the worst-performing cryptocurrencies in the top 20 over the past week.

However, there are glimmers of hope. Polkadot’s adaptability remains a key strength. Increased trading activity has been observed, with a notable uptick in volume recently, suggesting that speculators might be positioning themselves for a potential rebound. Yet, without clear momentum, the outlook remains uncertain. Additionally, recent developments such as token airdrops and new partnerships for decentralized applications show that interest and activity in the Polkadot ecosystem continue, which may provide some cushion against broader market declines.

While the technical indicators lean bearish in the short term, they are only part of the story. Polkadot’s unique architecture and long-term potential still make it an attractive prospect for strategic investors. However, the price action in the coming days will likely be influenced by how the geopolitical situation in the Middle East unfolds.