Ethena has recently gained traction in the cryptocurrency market, showcasing a notable surge in its value. Despite short-term fluctuations, the past month has painted a positive picture for the token. The current price sits at $0.383, reflecting a 43% jump over the last week and over 70% last month. This upward movement also aligns with several proposals and developments within its network, signaling investor optimism. However, present day-to-day volatility and recent short-term price declines may suggest that this bullish run could encounter resistance before defining a distinct trajectory.

Momentum Indicators: RSI and Moving Averages

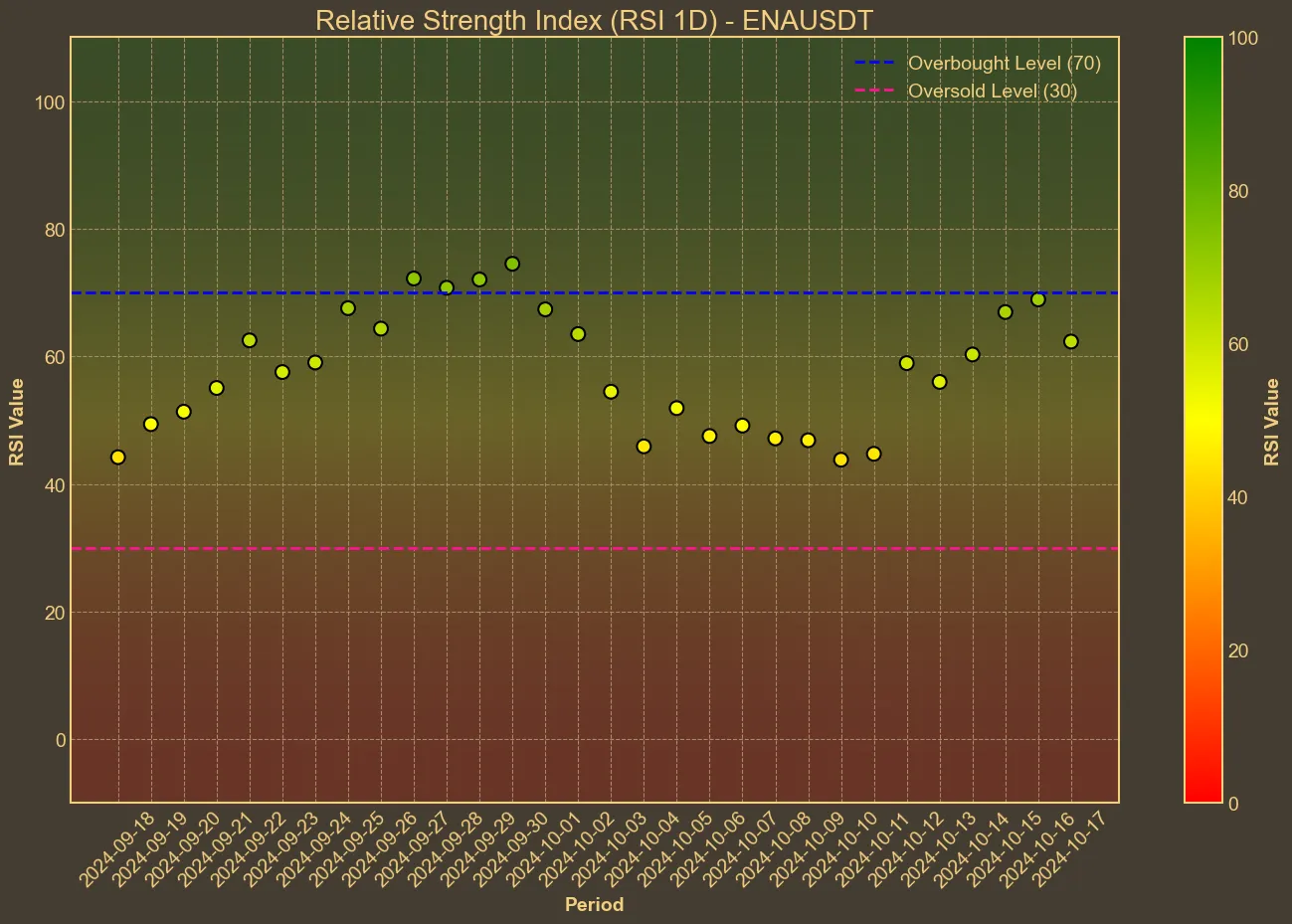

Ethena’s technical analysis through the Relative Strength Index (RSI) reveals a slight decline since earlier this week, currently landing at 59. This RSI value indicates a neutral position, reflecting neither overbought nor oversold conditions, which leaves room for future growth without suggesting an immediate reversal. It underscores that the near-term investor sentiment is cautious but not bearish.

Meanwhile, the simple and exponential moving averages highlight a gradual uptick in value. The current SMA and EMA hover around $0.33, suggesting a trend of steady upward movement.

Meanwhile, the simple and exponential moving averages highlight a gradual uptick in value. The current SMA and EMA hover around $0.33, suggesting a trend of steady upward movement.

Trading volumes present an intriguing picture, with a marked increase over the past month despite recent declines in the past week. Substantial jumps in trading volume usually signal heightened interest and activity, often preluding price volatility. As volume remains a critical metric for validating price movements, its recent volatility might contribute to potential shifts in Ethena’s trajectory.

Conclusion

While Ethena’s bull run may have paused, technical indicators suggest the rally might be far from over. The RSI remains near 60, providing room for further growth, and the moving averages indicate continued upward momentum. Though short-term volatility is expected, Ethena appears to have found stability above $0.34.

It’s important to keep in mind the limitations of technical analysis. While Ethena’s recent performance points to the potential for continued gains, external factors and broader market conditions can quickly shift the narrative. Therefore, a single set of data should not be the sole basis for investment decisions. Observing broader market trends, potential systemic risks, and ongoing proposals like the use of Solana as new collateral can greatly influence the token’s future. Understanding these factors is crucial for interpreting Ethena’s prospects with a balanced perspective.