Hamster Kombat (HMSTR) has shown some signs of stability after a volatile period, with its price hovering around $0.00195. Over the past month, the token has gained nearly 18%, but its quarterly losses remain significant at over 54%, and yearly losses surpass 80%. Trading volume has seen a recent decline, dropping nearly 4% in the past day, but the seven-day trend suggests increased interest.

Table of Contents

Momentum Indicators

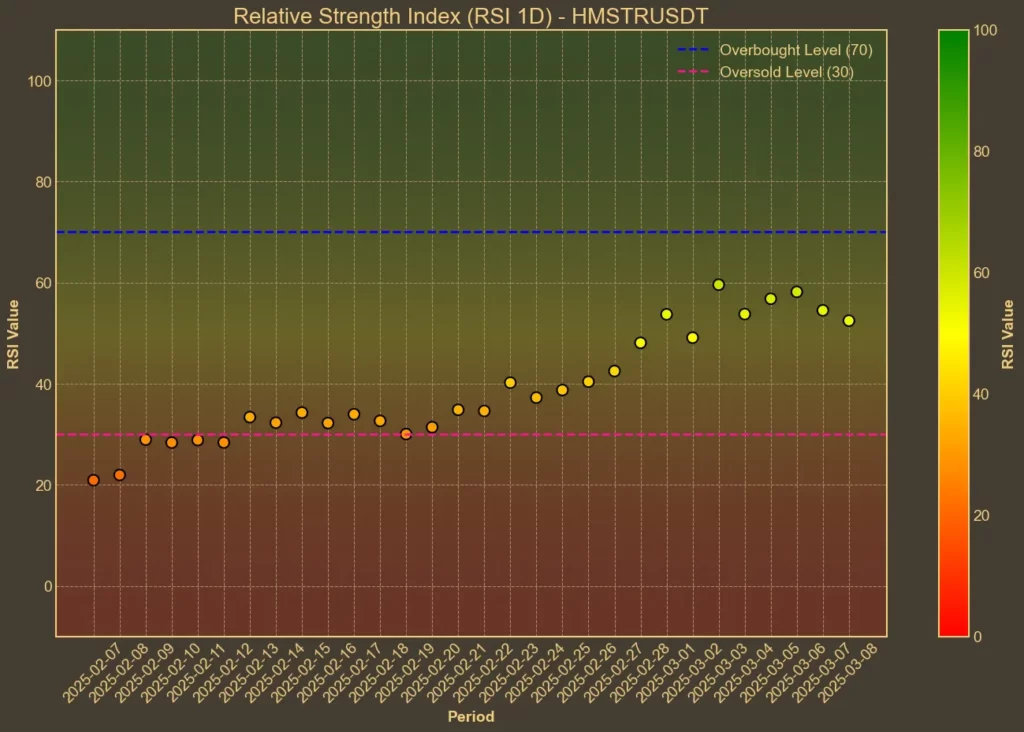

RSI: Neutral

The Relative Strength Index (RSI) helps determine whether an asset is overbought or oversold. Currently, HMSTR’s RSI(14) stands at 50, indicating a balanced market without strong buying or selling pressure. Short-term RSI(7) has dropped from 56 yesterday to 50, reflecting weakening momentum.

MFI: Overbought

The Money Flow Index (MFI) incorporates volume to assess buying and selling strength. HMSTR’s MFI(14) is 82, showing that buying pressure remains high but has slightly decreased from 83 yesterday. If the MFI remains high, a correction could follow as traders take profits.

Fear & Greed Index: Fear

The overall crypto market sentiment, measured by the Fear & Greed Index, stands at 28, indicating fear among investors. This is a drop from 34 yesterday but an improvement from 20 earlier in the week. While market sentiment can influence HMSTR’s price, the token has shown resilience, gaining 18% over the past month despite concerns over tariff wars and weakness in major cryptocurrencies.

Moving Averages

SMA & EMA: Bullish

Short-term moving averages signal a potential uptrend. The SMA(9) is at 0.002009, while the EMA(9) is at 0.001971, both above the current price. Longer-term trends also appear supportive, with the SMA(26) at 0.001806 and the EMA(26) at 0.001937. These averages suggest underlying bullish momentum, but price action needs to confirm the trend.

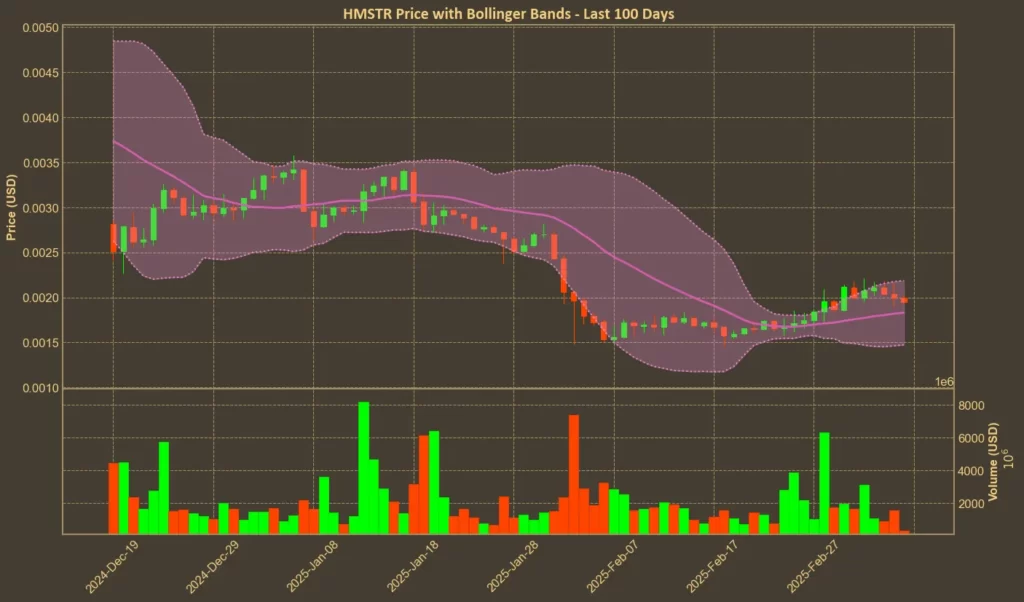

Bollinger Bands: Neutral

Bollinger Bands measure volatility and potential breakout points. The upper band is at 0.002187, while the lower band is at 0.001473. HMSTR is currently near the middle of this range, suggesting neutral conditions. A move toward the upper band could indicate overbought conditions, while a dip toward the lower band would suggest overselling.

Trend & Volatility Indicators

ADX: Weakening Trend

The ADX(14) is at 29, down from 31 yesterday and 41 last week. This signals that the current trend is losing strength, making future price movements less predictable. A continued decline could suggest range-bound trading.

ATR: Stable Volatility

The ATR(14) is 0.000192, nearly unchanged from last week. This suggests that while HMSTR is experiencing price fluctuations, they remain within expected levels.

AO: Weak Momentum

The Awesome Oscillator (AO) stands at 0.000276, down from 0.00029 yesterday. This suggests that while bullish momentum exists, it is fading, making a price breakout less likely in the short term.

VWAP: Above Price

Volume Weighted Average Price (VWAP) shows whether the current price is above or below the market’s fair value based on trading volume. The VWAP is at 0.002918, well above the current price, indicating that HMSTR might be undervalued. However, it also suggests that traders are not yet willing to push the price higher.

Relative Performance

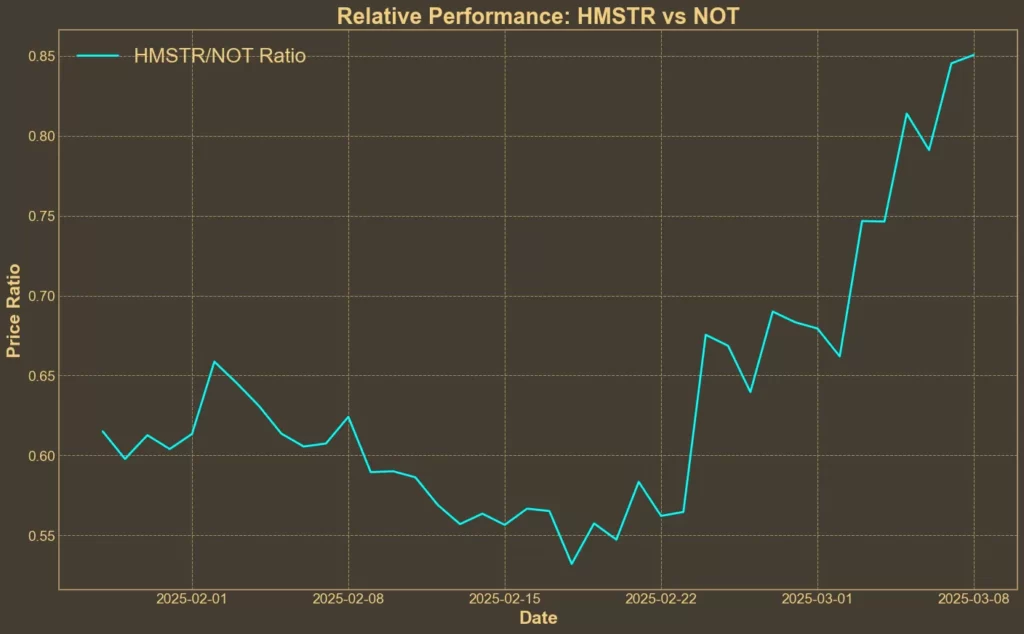

Comparison Against NOT: Rising

We compared HMSTR’s price action to NOT, another gaming-related cryptocurrency with a higher market cap. The HMSTR/NOT ratio is currently 0.8477, reflecting a 24.77% increase in the past week and a 39.55% rise over the past month. This indicates that HMSTR has outperformed NOT in relative terms, which could attract more buyers.

Recent Developments and Market Sentiment

Hamster Kombat has launched its own Layer-2 blockchain on TON, aiming to expand HMSTR’s utility within decentralized gaming. Additionally, it recently hit 34,028 TPS, surpassing Solana’s transaction speed.

However, there are also concerns. Reports indicate that interest in tap-to-earn games has declined sharply, with user activity dropping 80% between June and December 2024. HMSTR’s long-term success will depend on its ability to retain players and offer meaningful incentives beyond basic gameplay.

Conclusion

HMSTR’s technical indicators provide mixed signals. Moving averages and relative performance suggest a bullish outlook, but momentum indicators show signs of weakening buying pressure.

The successful launch of Layer-2 network might bring renewed interest, but technical analysis alone cannot predict how fundamental developments will impact the price. If bullish momentum fades, HMSTR could consolidate or retest lower support levels. On the other hand, sustained buying pressure could push it toward the $0.0020–$0.0023 range in the coming weeks.

Are you investing in crypto presales? We’ve launched Presale Index – your go-to resource for checking if a project is legit before you invest. Don’t get caught in a scam – look it up in our index first!