Hedera (HBAR) has recently seen an interesting mix of movement, both in terms of its price and technical indicators. Ranking 48th in the cryptocurrency market, the current price is $0.054. The data indicates positive shifts, particularly in short-term metrics. A 2.92% price increase in the last day and an 8.63% rise over the past week show a recent upward trajectory. However, there’s a notable 24.7% decline in the last quarter, hinting at previous bearish pressures.

The market capitalization, currently at $2.04 billion, has witnessed an increase, matching the recent price progress. Meanwhile, trading volume paints a different picture. Despite a 6% rise in market cap over the past month, trading volume has dropped by 26.5%, suggesting reduced trading activity. This divergence may reflect cautious sentiment among traders despite the price recovery.

Technical Indicators Signal Stability but Not Oblivious to Challenges

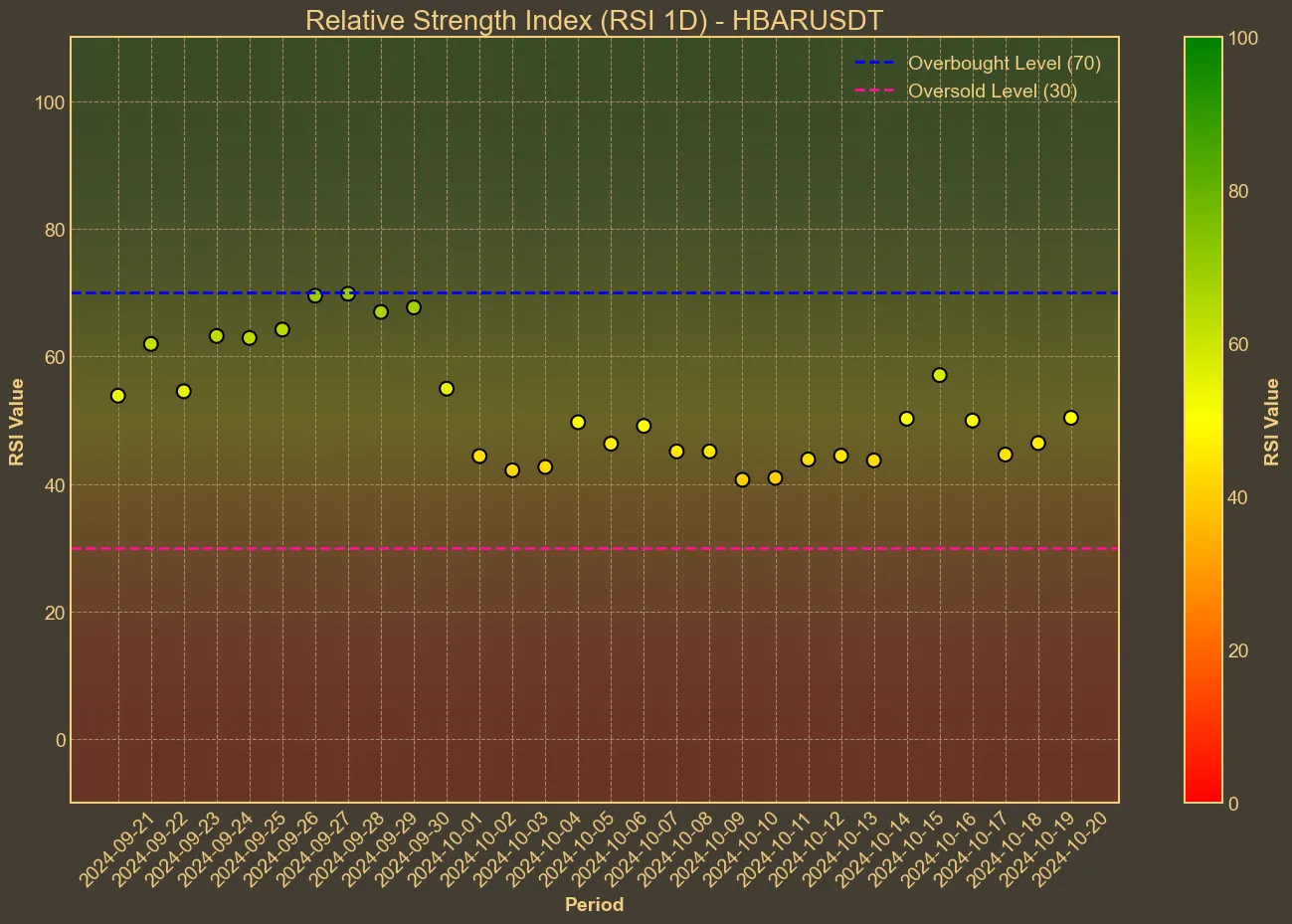

A look at technical indicators offers valuable insights into the current state of Hedera. The Relative Strength Index (RSI) sits at 53, suggesting that the market is neither overbought nor oversold.

The steady SMA and EMA values imply consistency with recent price actions, hovering near the current market price. Hedera’s Bollinger Bands are showing a moderate spread, indicating some stability but with potential for movement.

The Moving Average Convergence Divergence (MACD) and Awesome Oscillator (AO) are in negative territory, pointing to cautious optimism. MACD’s trend is slightly more optimistic compared to the previous days but still indicates cautious sentiment. The ATR, measuring the volatility, is relatively low, which supports the view of the current stability in the price movement.

Possible Future Movements and Limitations of Analysis

The recent news and analyses from various sources highlight optimistic projections, suggesting the potential for significant upward movement in the future. Reports speculate substantial growth rates that could come into play if market conditions improve. However, it’s crucial to understand that these remain speculative until concrete changes take place.

While technical analysis provides a useful picture of current trends, it comes with limitations. It cannot predict unforeseen variables that can shift market dynamics rapidly. Hedera’s near-term future will likely depend on broader market conditions and any significant updates or partnerships it might announce. Therefore, while the indicators show cautious optimism, potential investors should approach the market with a balanced view of both opportunities and risks.