Hedera (HBAR) investors are experiencing a surge of excitement, as one of the largest American asset management firms, Canary Capital, has filed for an HBAR-based exchange-traded fund (ETF) with the U.S. Securities and Exchange Commission (SEC). While some people were anticipating it after Canary Capital created HBAT Trust, this development has generated a notable uptick in the coin’s market activity and price, as reflected by its recent bullish momentum. For a moment, the price went even above $0.075.

Canary Capital’s move is significant. It represents the very first ETF proposal for Hedera, aiming to offer a more straightforward access point for investors to engage with the coin. Given Hedera’s reputation for speed and scalability, the ETF application has the potential to open doors to a broader acceptance of HBAR in conventional finance. However, the SEC’s approval process is never a sure bet and remains an unpredictable hurdle.

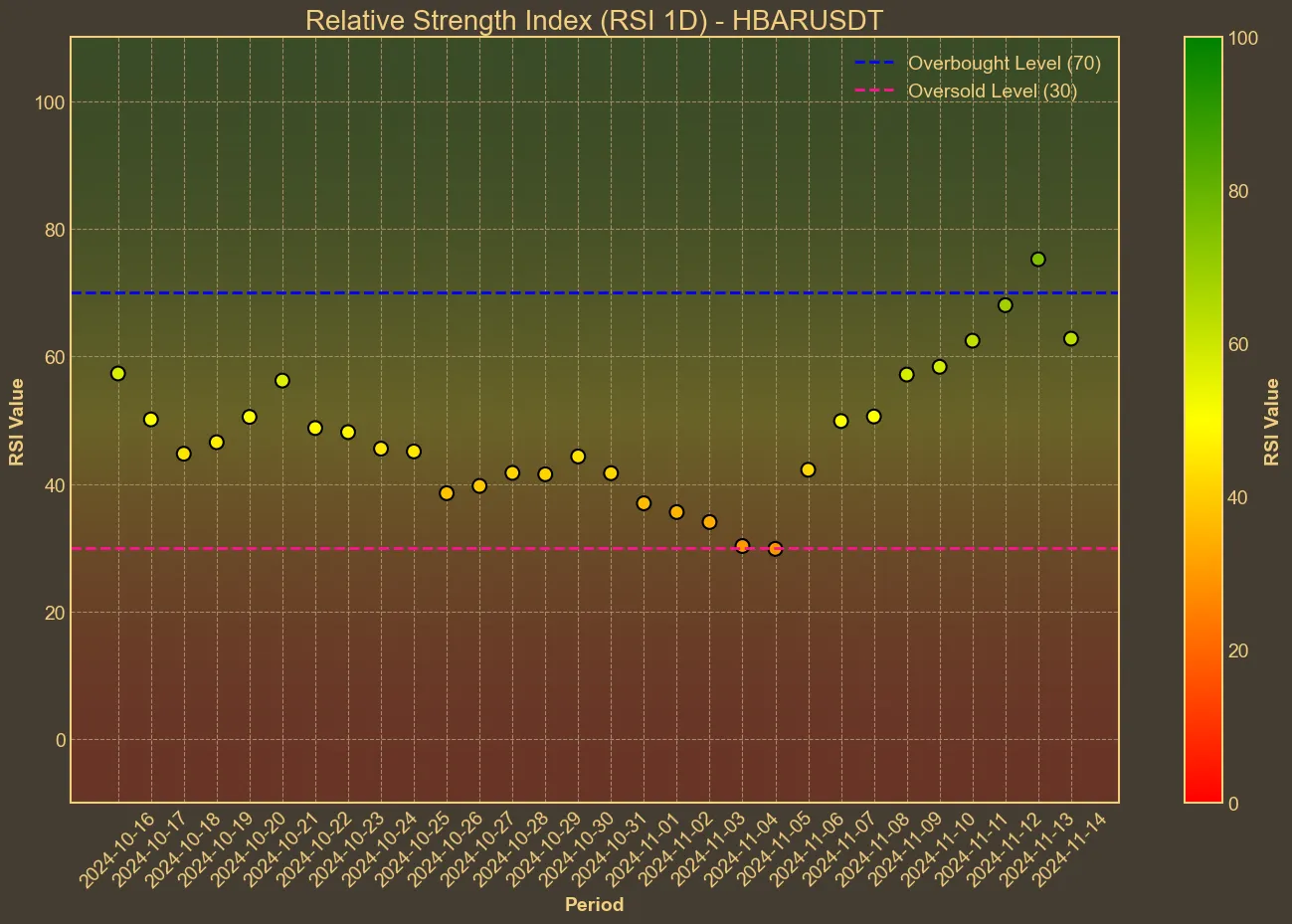

Beyond the ETF buzz, technical indicators support the recent price surge. Over the last week, HBAR’s price has seen a 28.53% increase, reinforcing a positive market sentiment. The Relative Strength Index (RSI) has fluctuated, reflecting shifting market dynamics, but remains on the higher side at 65 today, indicating bullish momentum.

Moreover, with the latest news, the trading volume of HBAR has experienced a significant rise of 168.44% over the past month, suggesting increasing investor interest. On the technical analysis front, indicators like the Simple Moving Average (SMA) and the Exponential Moving Average (EMA) have maintained a steady upward trend. The Moving Average Convergence Divergence (MACD) also points towards potential bullish continuance. Coupled with the Average True Range (ATR) indicating moderate volatility, the path for HBAR indicates resilience and potential for further gains.

As much as technical analysis serves as a useful tool in forecasting market trends, it’s essential to acknowledge its limitations. Market sentiments and external factors such as regulatory decisions can heavily influence outcomes, which are not always predictable through statistics alone. The move by Canary Capital to file for an HBAR ETF could, if approved, mark a pivotal moment for the coin, but patience and a cautious outlook are necessary as the SEC’s response remains pending.