Hyperliquid (HYPE) has reached its highest price ever once again, climbing sharply by 15% in a single day and peaking at $43.86. This rise came after the coin briefly struggled with resistance just a few days earlier. The recent jump broke the $40 mark, which had served as a psychological and technical ceiling for the asset.

Table of Contents

Whale Buying Plays a Central Role

The largest factor behind the latest spike in Hyperliquid’s value was heavy buying by major holders. On June 9, blockchain tracking revealed that one wallet spent $2.5 million to buy 70,617 HYPE at around $35.40. Later the same day, another large investor bought 28,500 tokens for $1 million. This influx of capital created a strong base of support for price acceleration.

More activity followed within hours. One whale – already holding $10 million in profit from earlier positions – added 259,367 HYPE to their portfolio at an average cost of $38.46, investing just under $10 million. These large transactions limited the available supply and sparked increased demand. With minimal profit-taking, the momentum continued as HYPE climbed further beyond the $40 line.

Read also: Hyperliquid (HYPE) Token Surges 13% After Binance Listing

Technical Indicators Confirm Bullish Setup

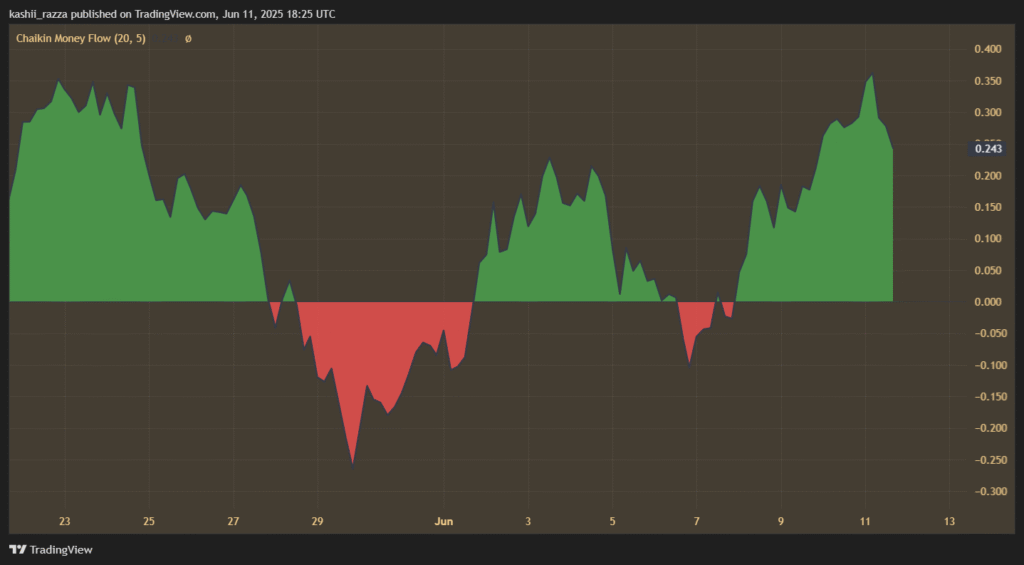

Momentum indicators also reflected the trend. The Chaikin Money Flow (CMF), which gauges the strength of buying pressure, rose to 0.36. This suggested consistent capital inflow rather than short-term speculation.

On the short-term 4-hour chart, the Awesome Oscillator (AO) displayed green bars – another sign that upward momentum remains intact.

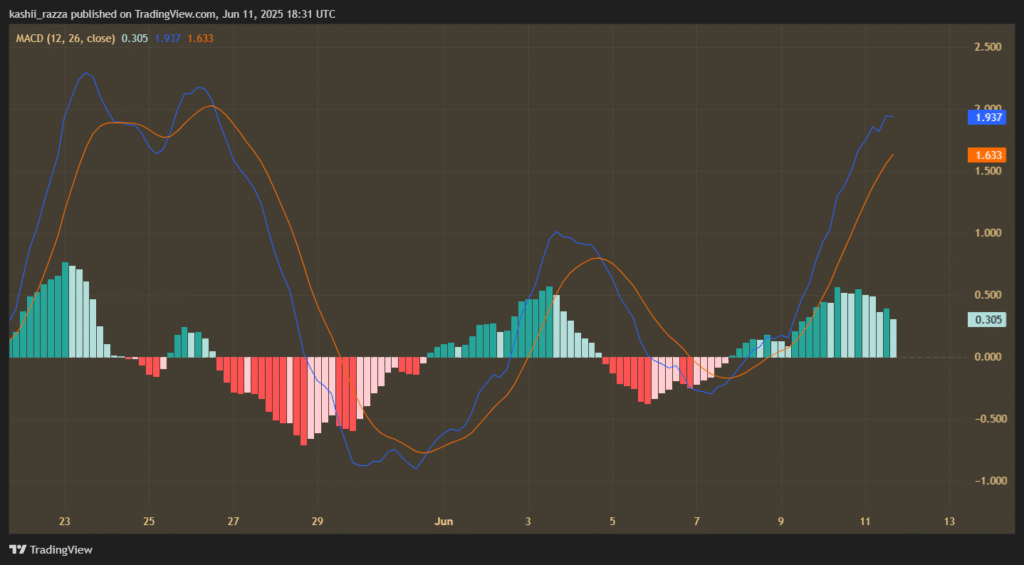

Moving averages on the daily chart added more confirmation. A bullish crossover occurred when the 12-period Exponential Moving Average (EMA) crossed above the 26-period EMA.

The Moving Average Convergence Divergence (MACD) indicator turned positive at the same time. Both signs support a continued price rally as long as overall market sentiment does not shift drastically.

On-Chain Activity Confirms Rising User Trust

Hyperliquid’s Total Value Locked (TVL) rose to $1.79 billion, according to DeFiLlama. This figure marks a new peak in the number of assets locked into the protocol’s smart contracts. The increase reflects broader trust and usage among decentralized finance participants.

As TVL climbs, more attention shifts to the platform and its token. This also creates more need for HYPE tokens, potentially putting more pressure on price.

The direct link between TVL growth and token demand presents a clear reason for the market response. Investors appear to be viewing Hyperliquid not only as a speculative asset but as a place where capital can be parked with confidence.

Read also: Hyperliquid Chaos: $20M Exploit, Forced Shutdown, and a Surprise Twist

Can HYPE Token Hit $50?

With the token having recorded a 21% gain across two days and a 7x return since its initial listing, speculative sentiment continues to build. Some forecasts place the next major target at $50 if current momentum continues. Others suggest that long-term projections above $100 are circulating, though no analysis has yet provided clear data to support that range.

Still, the short-term trend clearly points to strong support from large buyers and market participants. So far, the structure of the trend has been supported by a mix of on-chain data, technical signals, and market behavior.