South Korea’s blockchain sector witnessed a sharp spike in interest after KAIA, a Layer-1 blockchain backed by Kakao, gained momentum tied to fresh political developments. The catalyst came after the inauguration of President Lee Jae-myung, who ran on a crypto-forward platform.

Within hours of his swearing-in on Wednesday, trading volumes of KAIA tokens soared, driven by expectations of a South Korean won-pegged stablecoin and friendlier crypto regulations.

Table of Contents

New Law May Clear Path for KAIA’s Stablecoin

President Lee’s victory means a shift in national policy, particularly around digital assets. His administration is pushing for legal frameworks to accommodate private-sector stablecoins, a move that would be a major departure from previous restrictive stances. While South Korea’s Constitution limits currency issuance to the Bank of Korea, Lee’s Democratic Party is exploring ways to allow stablecoins tied to the won to circulate under regulated conditions.

Min Byoung-dug, who leads the Democratic Party’s Digital Asset Committee, plans to introduce the Digital Asset Basic Act. This legislation is expected to include specific rules for stablecoin approval and oversight. If passed, it could offer legal clarity to firms like KAIA aiming to issue such digital assets.

Backed by tech giant Kakao, KAIA will strongly benefit in this environment. Kakao controls several essential digital platforms in South Korea and has already integrated blockchain into its fintech services through Kakao Pay, which operates a digital wallet and QR code-based payment system. These capabilities give KAIA practical utility and strategic advantage in adopting stablecoin-based financial products.

Read also: Stablecoin Market Surpasses $250 Billion Amid Regulatory Clarity

Merger Fuels KAIA’s Cross-Border Potential

The current surge in value is also connected to structural changes within the blockchain. KAIA is the product of a merger between Klaytn and Finschia, a Japanese messenger LINE-backed blockchain. This combined structure brings a broader user base and more cross-border application potential, both of which are appealing in light of a won-pegged stablecoin.

Investor interest has risen sharply. A report from the Korea Chamber of Commerce and Industry found that nearly 60% of respondents intended to increase their crypto exposure under the new administration. That sentiment directly boosted blockchain and payment firms on Monday, with Kakao Pay and its competitor Danal both closing the trading day at 51.45% gains in the last 5 days.

As stablecoin-related legislation moves forward, KAIA’s integration with Kakao services could give it a distinct market advantage. While still early, indicators suggest that KAIA could become one of the first major platforms to issue a won-backed stablecoin in South Korea.

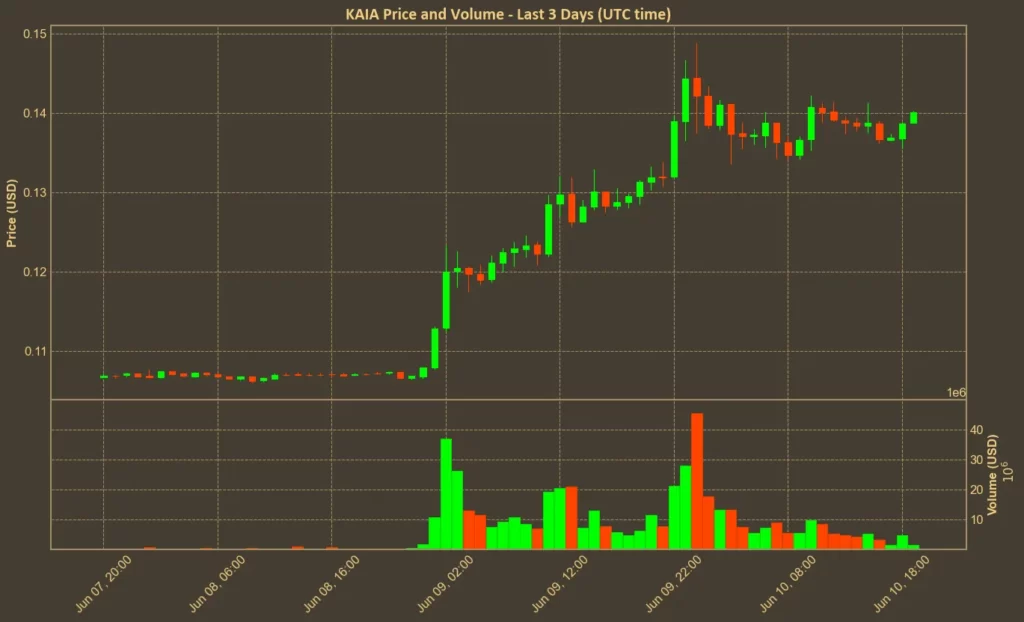

KAIA token has seen a major spike, with its price rising over 20% in the past 7 days to $0.14. The market cap increased to $840.1M, and the volume has also risen. The total supply and circulating supply remain steady at 6.03B KAIA.

Court Ruling Clears the Way for Key Crypto Reforms

Lee’s political situation initially cast doubts over the timeline for his administration’s crypto-related goals. He has been involved in several criminal trials that predate his election, with the most-watched case involving alleged election law violations during the 2022 campaign. That trial was scheduled to resume on June 18.

However, on Monday, the Seoul High Court ruled that Article 84 of the Constitution does apply to his case, effectively pausing the proceedings indefinitely. The law protects sitting presidents from prosecution except for treason or insurrection. This ruling removed a major obstacle, giving Lee a clear path to focus on legislative work, including crypto policy.

With legal distractions now less likely to interfere, the administration’s crypto objectives appear more achievable. This clarity has reinforced investor confidence in projects directly aligned with those goals – with KAIA being a top example.

Real-World Use Drives KAIA’s Market Momentum

Kakao’s control of services ranging from messaging to finance gives KAIA practical integration options for any stablecoin. Kakao Pay, the fintech arm, is one of the most popular cashless services in the country and could easily adopt a won-based digital currency.

Its QR code payment structure and digital wallet make it a viable tool for the real-world use of such a stablecoin. This is important in a market where practical use cases often decide the long-term fate of blockchain projects.

With its merger complete and the political environment more favorable, KAIA’s recent spike in value reflects more than just speculation. It reflects investor recognition that real-world applications are likely under the new regulatory approach.

Read also: South Korea’s Crypto Boom: 1 in 3 Citizens Invest in Crypto

Legislative Follow-Through

The rally in KAIA’s price is the result of multiple factors converging in a short time – political change, legal clarity, institutional support, and corporate readiness. What happens next depends on how quickly the proposed Digital Asset Basic Act moves through South Korea’s legislative process.

If passed without dilution, it could make South Korea one of the first major economies to allow private sector stablecoin issuance under regulatory supervision. KAIA, with its direct link to Kakao and support from a favorable administration, stands to benefit the most.