Chainlink (LINK) LINK is currently priced at $11.53, sitting at the 15th spot in the cryptocurrency market by capitalization. While experiencing a slight downturn in the past day, the past week’s upward movement indicates a positive trend, suggesting that investors’ interest remains stable. Over the last year, LINK has gained 15.74%, reflecting its resilience amidst market fluctuations, but underperforming compared to many other altcoins.

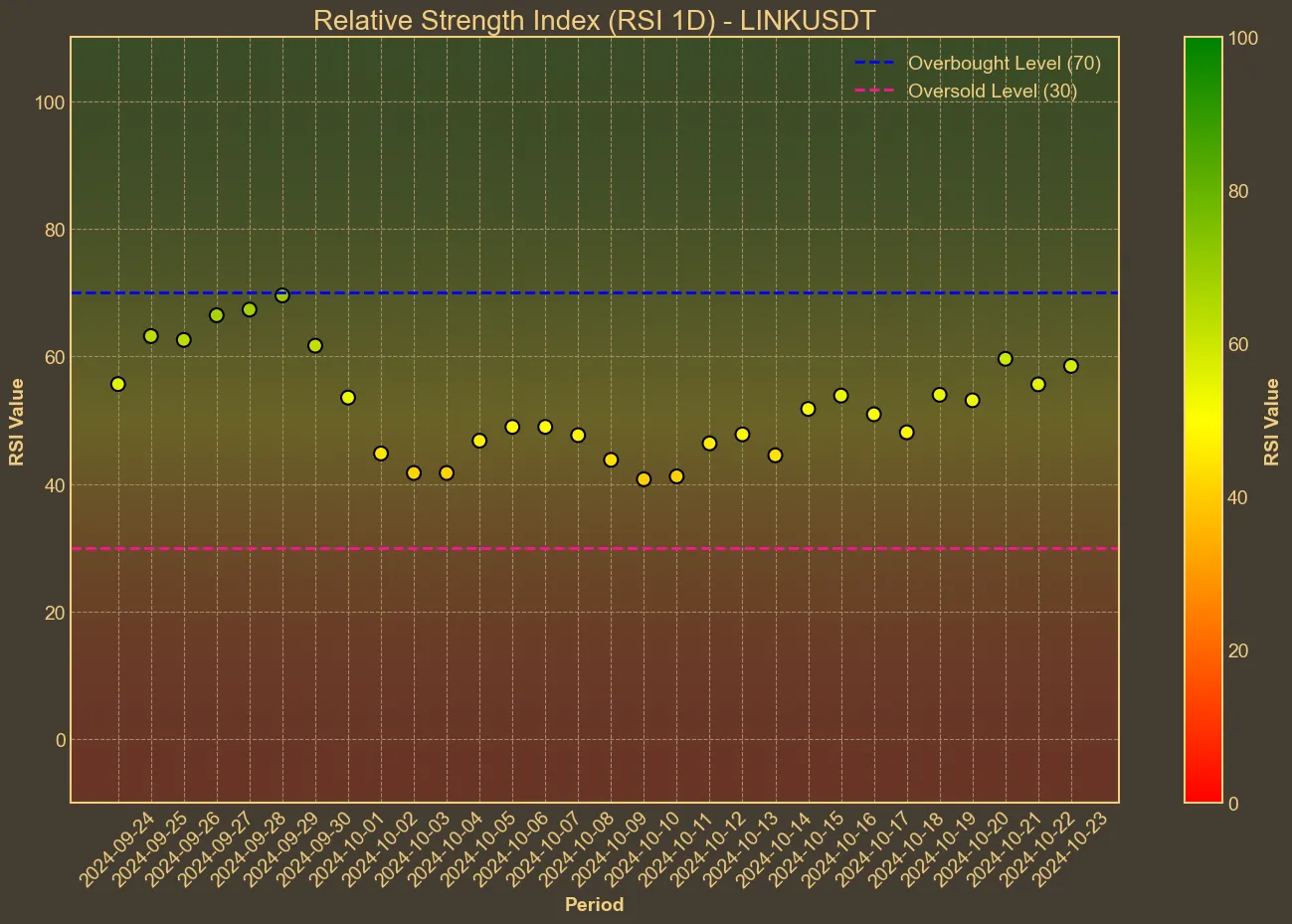

The technical analysis of Chainlink highlights mixed signals. The Relative Strength Index (RSI) has moved up this week but remains below the overbought threshold, hinting at room for upward momentum.

Meanwhile, the Moving Average Convergence Divergence (MACD) shows a potential bullish scenario, while the Average True Range (ATR) suggests restrained volatility. Furthermore, Trading indicators such as the Simple Moving Average (SMA) and Exponential Moving Average (EMA) are not displaying dramatic shifts, which implies a more stabilized movement in the current market conditions.

Meanwhile, the Moving Average Convergence Divergence (MACD) shows a potential bullish scenario, while the Average True Range (ATR) suggests restrained volatility. Furthermore, Trading indicators such as the Simple Moving Average (SMA) and Exponential Moving Average (EMA) are not displaying dramatic shifts, which implies a more stabilized movement in the current market conditions.

Recent partnerships and updates from Chainlink continue to bolster its narrative in the tech realm. Collaborations with financial giants aim to enhance data accuracy and financial processing efficiency. These initiatives underline Chainlink’s role in advancing blockchain utility in traditional financial environments. While speculative, the news around potential partnerships with major players like BlackRock could, if realized, dramatically improve Chainlink’s position as a leading blockchain connector.

Yhese data points and developments collectively indicate that Chainlink has the elements in place for sustained growth – both in technical indicators, and development of the project. However, while Chainlink’s current outlook appears promising, investors should remain cautious and consider the unpredictable nature of blockchain markets.