Hovering at a current price of $65.53, Litecoin’s journey has been characterized by minor fluctuations within the past day but with a promising 2.22% rise over the past week. Even more optimistic is its strong monthly gain of over 8%. Despite a slight cooling down in the last quarter, with a decline of 3.25%, the annual shift shows a modest increase, hinting at its resilient nature.

Key Indicators Signal Calmness and Potential

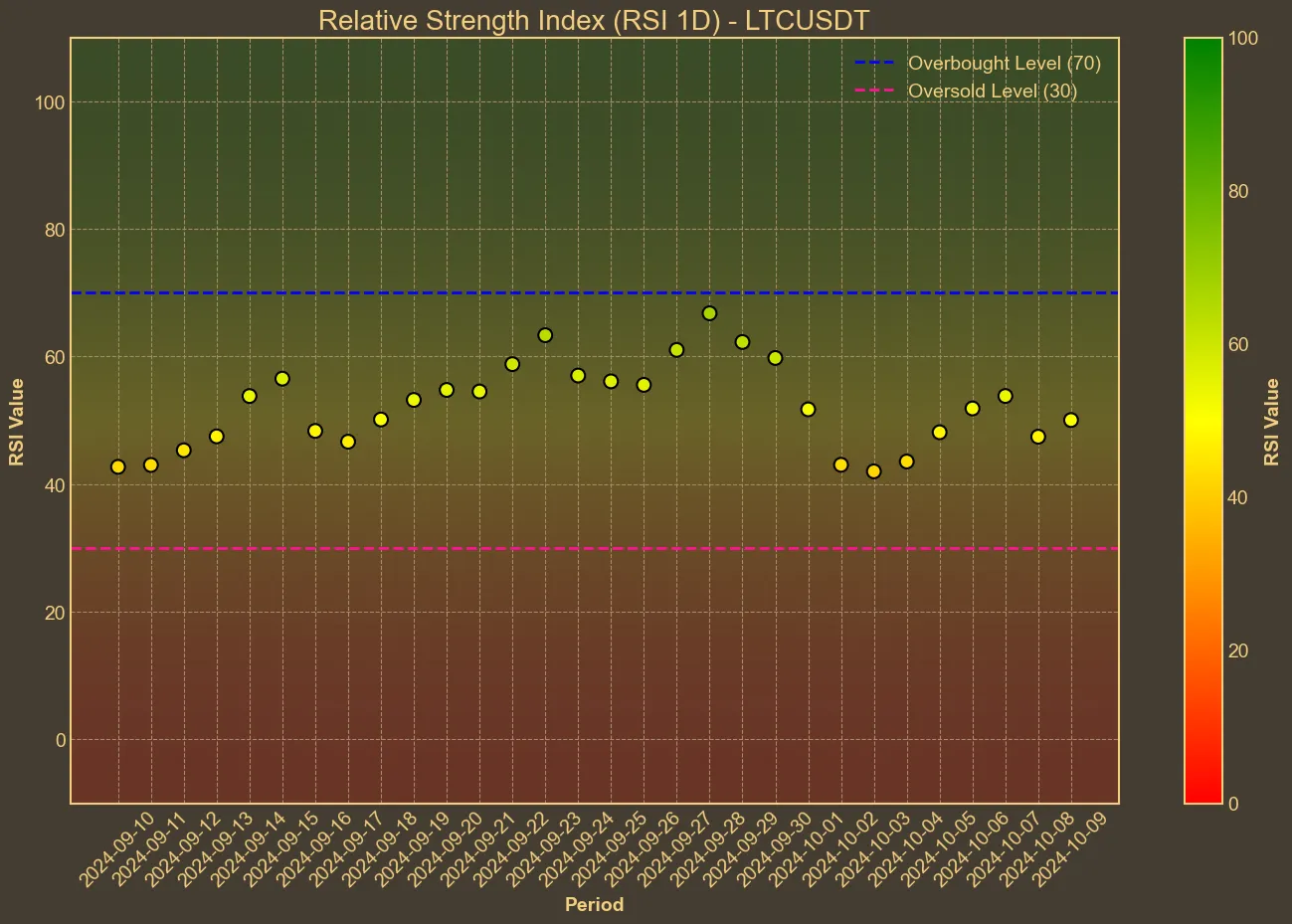

Diving into the technical indicators, the current Relative Strength Index (RSI) stands neutral at 50, signaling no clear overbought or oversold conditions. This stability in RSI over the past days implies a lack of significant buying or selling pressure, suggesting that the market is still contemplating its next move.

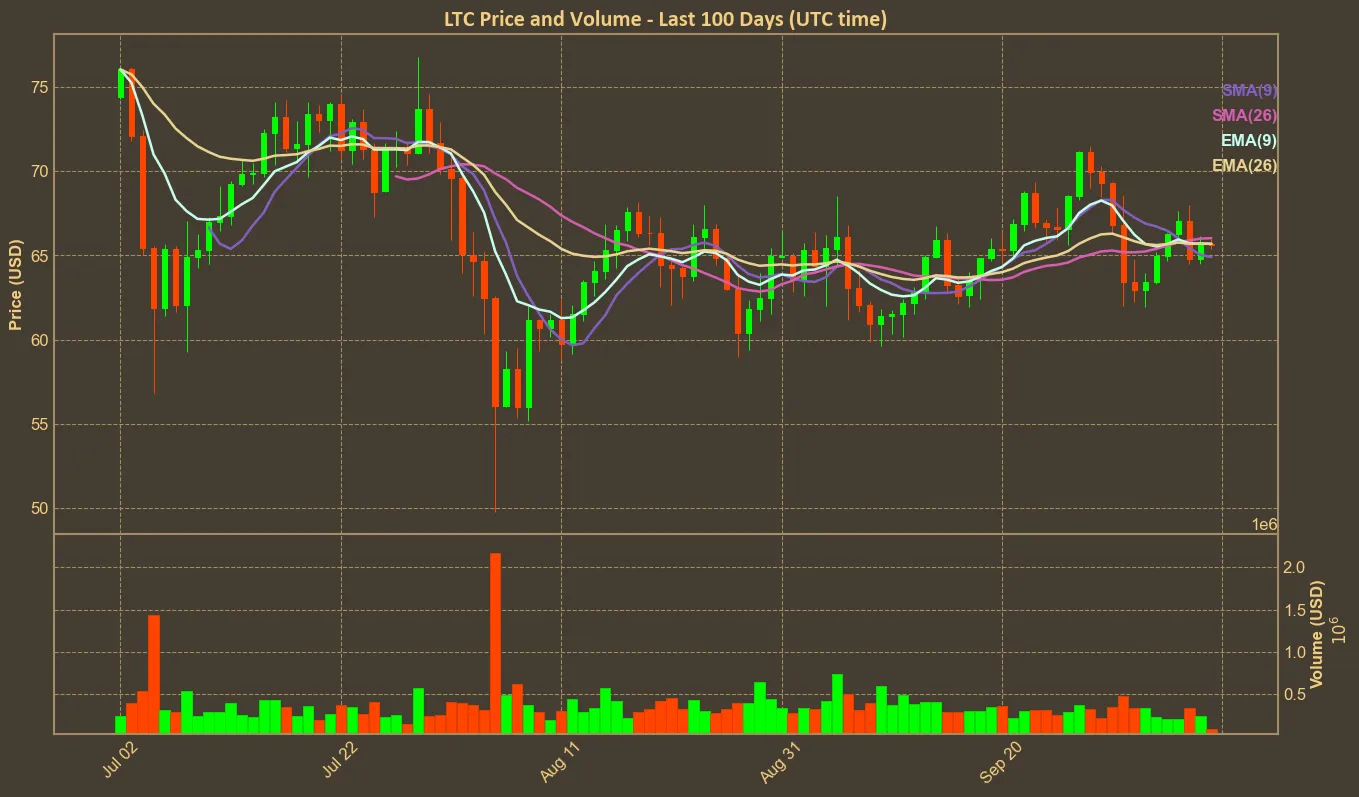

The moving averages align with this narrative, as the Simple Moving Average (SMA) hovers just above at 66.03, with the Exponential Moving Average (EMA) slightly lower at 65.69. A steady trend between these averages indicates a balanced momentum in the market.

The moving averages align with this narrative, as the Simple Moving Average (SMA) hovers just above at 66.03, with the Exponential Moving Average (EMA) slightly lower at 65.69. A steady trend between these averages indicates a balanced momentum in the market.

Meanwhile, the MACD, sitting at 0.08 against its signal line at 0.29, hints at mild bullish divergence, but nothing enough to declare an impending boom. Conversely, the Awesome Oscillator (AO) reflects a gradual uptick, closing today at 0.85. This upward trend in AO can be perceived as a slight optimism among the market participants.

Volume and Market Cap Dynamics

In terms of market activity, Litecoin’s current market cap of $4.92 billion experienced a slight shrink over the past day. A notable increase in the market cap over the last month signifies renewed investor interest, perhaps anticipating a positive price shift. However, the decrease in trading volume over recent days suggests that investors remain cautious. The declining trade volume might indicate that while interest is present, participants are merely observing rather than actively trading.

My take on these trends centers around the restrained enthusiasm seen among traders. The indicators don’t suggest imminent drastic price changes, which may present an opportunity for those willing to play the long game. But technical analysis in cryptocurrency is fraught with uncertainties. Markets can shift rapidly due to new developments or broader economic factors. Therefore, it is essential to couple such analysis with a broader understanding of market sentiment and ongoing news affecting Litecoin. Keeping an eye on whale activity and potential ETF news could be pivotal in predicting significant movements in Litecoin’s price.