The Movement (MOVE) token has plunged to an all-time low following a series of controversies, including allegations of market manipulation, a major exchange delisting, and the suspension of a key executive. The token, which once traded at $1.45 in December 2024, has collapsed below $0.1720 after Coinbase announced its suspension.

The crisis began with a questionable market-making deal that triggered a $38 million sell-off, drawing regulatory attention and shaking investor confidence. As Binance moved to freeze suspicious funds and Movement Labs rolled out a buyback program, the project now struggles to rebuild trust.

Table of Contents

Controversy Surrounds MOVE Token

Movement Labs struck a market-making agreement with Rentech, a firm that had kept a low profile in the crypto scene. This deal handed over 66 million MOVE tokens – about 5% of the entire supply – to Rentech. Shockingly, on December 10, 2024, just a single day after MOVE’s much-anticipated launch, these tokens were dumped on the open market in rapid succession. The sell-off, totaling around $38 million, triggered an immediate price collapse and raised serious suspicions.

In March, Binance banned Web3Port, the company linked to Rentech, and froze all funds generated by the massive token sale. Coinbase now followed, suspending MOVE’s trading activities while citing that the token had failed to meet its listing requirements. The series of events sparked outrage in the crypto community and brought significant negative attention to Movement Labs.

Internal documents revealed that the agreement with Rentech was structured in a way that encouraged inflating MOVE’s price to a $5 billion market cap before unloading the tokens. This revelation suggested potential self-dealing, as Rentech reportedly represented both sides of the agreement – both as Web3Port’s agent and as an actor for the Movement Foundation. The governance failure drew sharp criticism from all corners.

MOVE Token Plunges to Record Lows

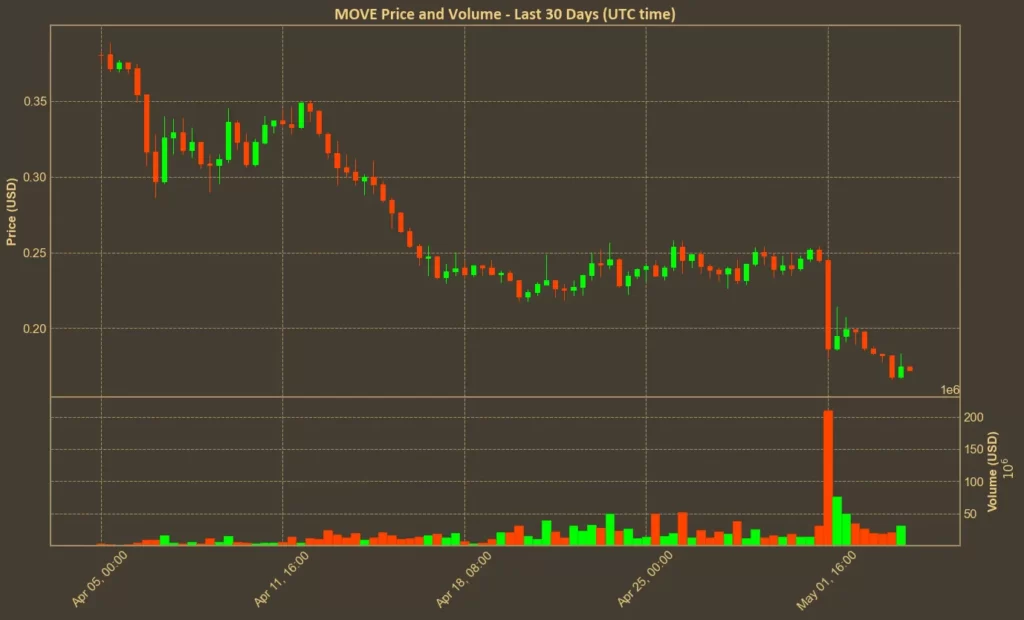

The impact on MOVE’s price was severe. From its peak of $1.45 in December 2024, MOVE has now nosedived nearly 88% to its current value of $0.172. In the past 24 hours alone, the token saw another 5% slide.

Over the past month, MOVE has shed more than 54%, with its market capitalization also facing a major decline of around 52% in the same period.

Relative Strength Index (RSI) is hovering around 30, nearing oversold conditions but offering no clear sign of a rebound. Bollinger Bands reveal the token’s price clinging to the lower range, indicating high volatility and the likelihood of continued downward momentum. There are fears of another sharp decline to the $0.12 mark if current support levels fail.

Despite a minority hoping for a recovery, sentiment across forums remains largely pessimistic, reflecting deep concern about the token’s future viability.

Coinbase’s Exit and Co-Founder’s Suspension

The Coinbase delisting was the final blow in a saga already rife with controversy. The exchange’s decision marked a critical moment, showing its commitment to stricter listing standards amid growing regulatory pressures. MOVE’s suspension came after Binance had already acted by freezing Rentech’s funds and severing ties with the implicated market maker.

Amidst growing pressure, Movement Labs suspended its co-founder, Rushi Manche. In an official statement posted to X, the company said:

“This decision was made in light of ongoing events and as the third-party review is still being conducted by Groom Lake regarding organizational governance and recent incidents involving a market maker.”

The foundation clarified that it had believed Web3Port was the firm providing liquidity for MOVE’s launch. However, CoinDesk reports show that Rentech not only represented Web3Port but also appeared to act on behalf of the Foundation. Manche, according to insiders, had been involved in both entities despite their supposed independence. Legal advisors later described the Rentech deal as “possibly the worst agreement” they had ever reviewed.

Can MOVE Recover From This Crisis?

Analysts are skeptical about any near-term recovery, especially given the depth of the token’s price drop and the cloud of controversy still hanging over Movement Labs. Technical indicators suggest the token is oversold, which could hint at a short-lived bounce, but overall market sentiment remains firmly bearish.

However, some believe if the team makes the right decision, the token could recover, citing the Pengu Token recovery after a 100% crash.

Read also: Virtuals Protocol Surges 100% in a Week – But Warning Signs Remain