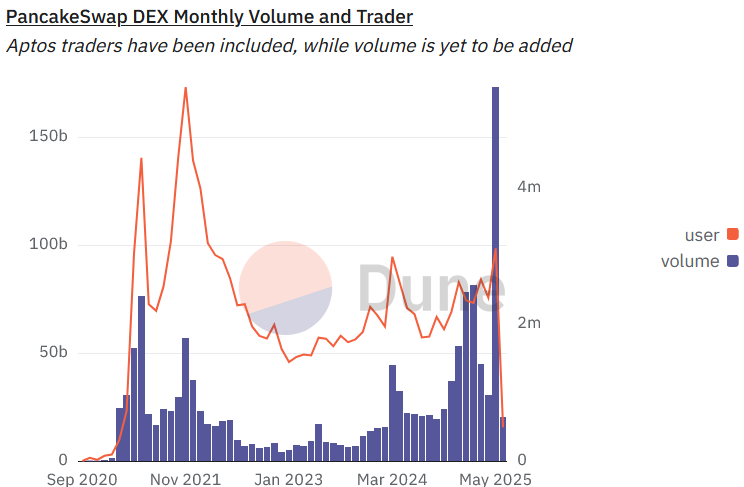

PancakeSwap, a decentralized exchange built on the Binance Smart Chain, closed in May 2025 with the highest monthly trading volume in its history. The protocol recorded $173.54 billion in transactions during the month, surpassing any previous monthly figure since its 2020 launch. Despite this sharp increase in trading activity, its native token CAKE has shown only modest movement in price, raising questions about the link between protocol usage and token valuation.

Table of Contents

PancakeSwap Nears Q1 Volume with $203B in Two Months

The exchange’s total trading volume for April and May combined reached $203 billion, merely short of surpassing its entire Q1 volume of $205 billion. A single week in late May brought in $75 billion worth of trades, marking a 131% increase from the previous week, according to data from analytics firms Dune and SeaLaunch.

PancakeSwap’s record-setting week also brought in $14 million in revenue, placing it fourth among all crypto protocols during that period. A large portion of the activity was linked to trades involving the PolyhedraZK token, one of the top three pairs by trading volume at the time.

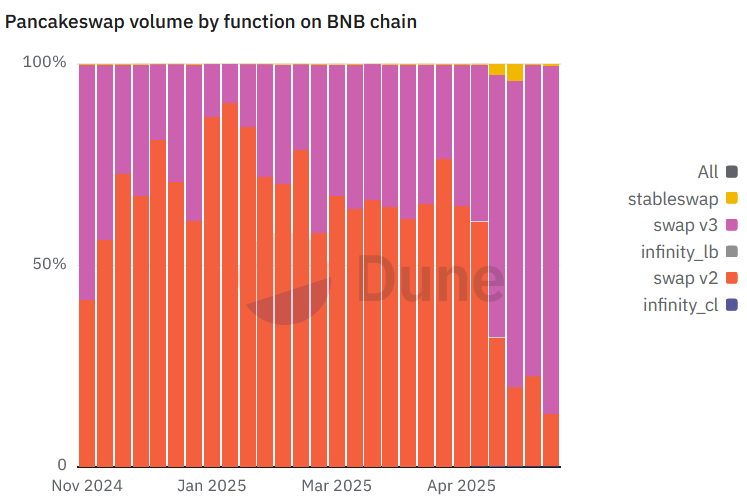

Cumulatively, PancakeSwap has now facilitated over $1.5 trillion in trades since its launch, across ten different blockchains. Its share on BNB Chain remains dominant, with $1.14 trillion of that total coming from Binance’s own network.

Other chains such as Base, Arbitrum, and Ethereum have also contributed, with trading volumes of $21.1 billion, $20.28 billion, and $20 billion respectively.

Despite the improvements and record-breaking volumes, the price of CAKE has not risen dramatically. As of early June, CAKE is trading at $2.28, which reflects a 14% increase over the past month. However, looking at daily and weekly frames, the CAKE token registers 7.7% and 5.7% decline respectively.

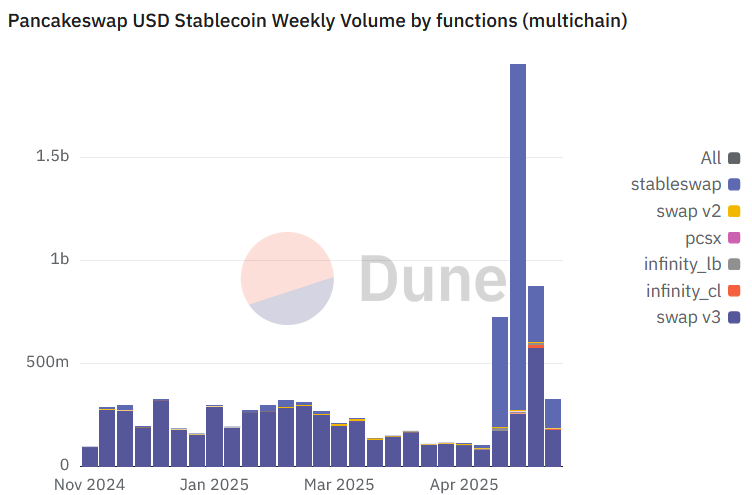

$2.3B Monthly Volume Pushes USD1 to #2 on BNB Chain

Much of the recent growth can be linked to the launch of PancakeSwap Infinity. This upgrade introduced new liquidity pool types – CLAMM and LBAMM – along with gas-saving measures and customizable smart contracts referred to as “hooks.” These changes attracted more trading volume by offering greater flexibility and reduced costs for users.

A separate development also helped drive increased interest. PancakeSwap began a four-week campaign on June 4, designed to boost the adoption of the USD1 stablecoin through a partnership with World Liberty Financial (WLFI), BNB Chain, and BUILDon.

The campaign, backed by $1 million in incentives, runs until July 4. So far, the stablecoin has seen $2.3 billion in monthly trading volume, nearly all of it on PancakeSwap. USD1 is now the second-largest stablecoin on the BNB Chain by supply, trailing only Tether. Chef Kids, Head Chef of PancakeSwap, said:

“This record-breaking volume is a testament to what’s possible when DeFi is made accessible, innovative, and user-friendly.”

PancakeSwap Revamps Tokenomics, Ends Rewards System

While usage numbers are on the rise, PancakeSwap’s tokenomics have shifted significantly in recent months. The updated Tokenomics 3.0 model was introduced in April through a community-driven process that moved quickly. Initial proposals were shared on April 8, with a vote held one week later and implementation finalized on April 23.

The update removed the veCAKE and Gauges Voting systems, ending their rewards by May 7. CAKE and veCAKE staking were unlocked, and six months were granted for users to redeem their holdings. Farming boosts and revenue sharing through v3 were also discontinued. Instead of returning fees to users, the protocol began burning CAKE tokens with collected fees.

These changes also impacted emissions. From April 25, daily CAKE output was first cut to 20,000 tokens and then further lowered to 14,500. Half of the Ecosystem Growth Fund’s emissions were burned. Though some groups, such as Cakepie DAO, opposed the changes, a $1.5 million CAKE package was issued to ease transition concerns.

Read also: PancakeSwap CAKE Tokenomics 3.0 – Everything You Need to Know

Final Words

The USD1 campaign continues through early July and could help sustain the protocol’s momentum into the next quarter. With over 98% of USD1’s supply on BNB Chain and most of its activity centered on PancakeSwap, the partnership adds another layer of use case for the platform.

Looking forward, it remains to be seen how CAKE’s price will respond to ongoing token burns and shifting incentive structures. For now, the exchange continues to grow in size and scope, backed by infrastructure changes, stablecoin promotions, and broad chain support.