Polymesh (POLYX) has been struggling with a prolonged downtrend, with its price dropping significantly over the past quarter. Despite a small rebound in the last 24 hours, overall momentum remains weak. The current price sits at $0.153, down 62% in the past three months and 31% over the past year. Market cap and volume have also seen substantial declines, indicating reduced investor interest. However, some indicators suggest that selling pressure could be easing.

Table of Contents

Momentum Indicators

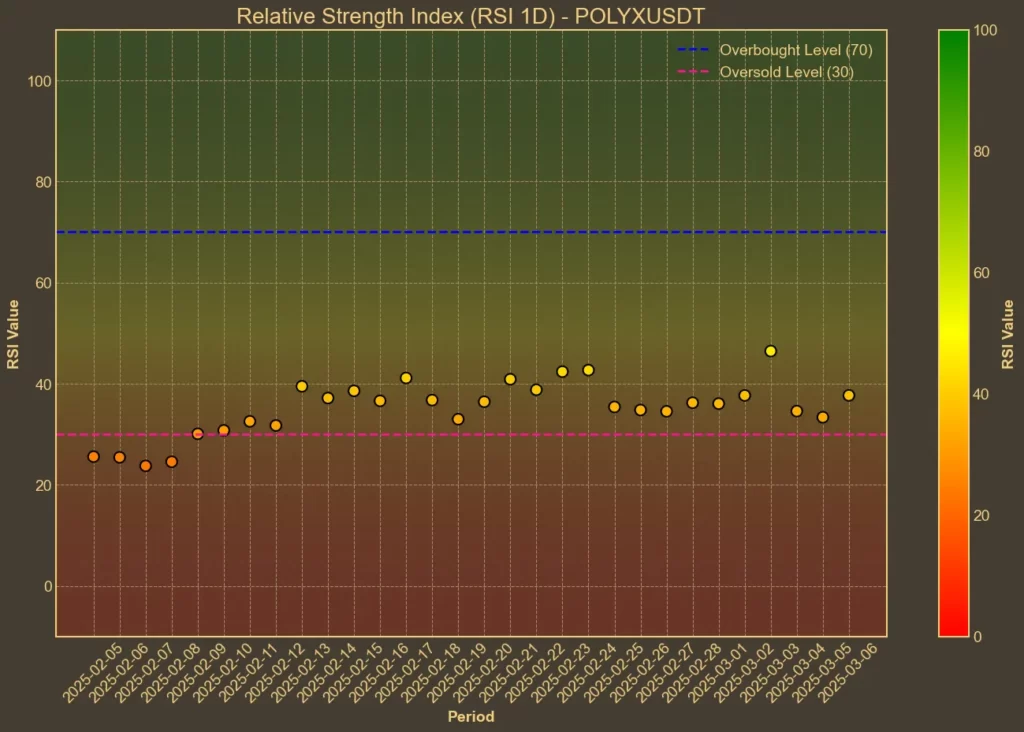

RSI: Neutral

The Relative Strength Index (RSI) measures whether an asset is overbought or oversold. Today, the RSI(14) is 38, the same as yesterday and slightly higher than 36 a week ago. The short-term RSI(7) is 40, showing a marginal increase from 38. While still in bearish territory, it suggests that POLYX is not yet in a strong oversold condition.

MFI: Neutral

The Money Flow Index (MFI) incorporates both price and volume to assess buying and selling pressure. Today’s MFI(14) is 46, slightly lower than 48 yesterday but up from 44 a week ago. This points to stable but weak buying activity.

Fear & Greed Index: Fear

This index measures the overall market sentiment. Today’s value is 25, slightly up from 20 yesterday but down from 33 three days ago. This indicates that fear still dominates the market, but sentiment is slightly improving.

Moving Averages

SMA & EMA: Bearish

Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) are important for understanding price trends. POLYX’s SMA(9) is $0.1586 and EMA(9) is $0.1581, both below the SMA(26) of $0.1715 and EMA(26) of $0.173. This crossover suggests a bearish trend, indicating downward momentum in the short to medium term.

Bollinger Bands: Increased Volatility

Bollinger Bands measure price volatility. The upper band is 0.1917, and the lower band is 0.1439. Since the price is nearing the lower band, it suggests possible oversold conditions, though there’s no confirmation of a reversal yet.

Trend & Volatility Indicators

ADX: Moderate Trend

The Average Directional Index (ADX) measures trend strength. The ADX(14) is 34, the same as yesterday and slightly lower than 35 last week. This suggests that the bearish trend is still in play but losing some momentum.

ATR: High Volatility

The Average True Range (ATR) indicates volatility. The ATR(14) today is 0.0154, slightly lower than 0.016 yesterday and 0.0161 a week ago. Although volatility has slightly decreased, it remains high.

AO: Bearish

The Awesome Oscillator (AO) is used to confirm trend momentum. Today, AO is -0.0193, slightly better than -0.02 yesterday but still negative, meaning downward momentum continues.

VWAP: Below Average

The Volume Weighted Average Price (VWAP) shows whether an asset is trading above or below its average price. Today’s VWAP is 0.2857, well above the current price, which suggests continued bearish pressure.

Relative Performance

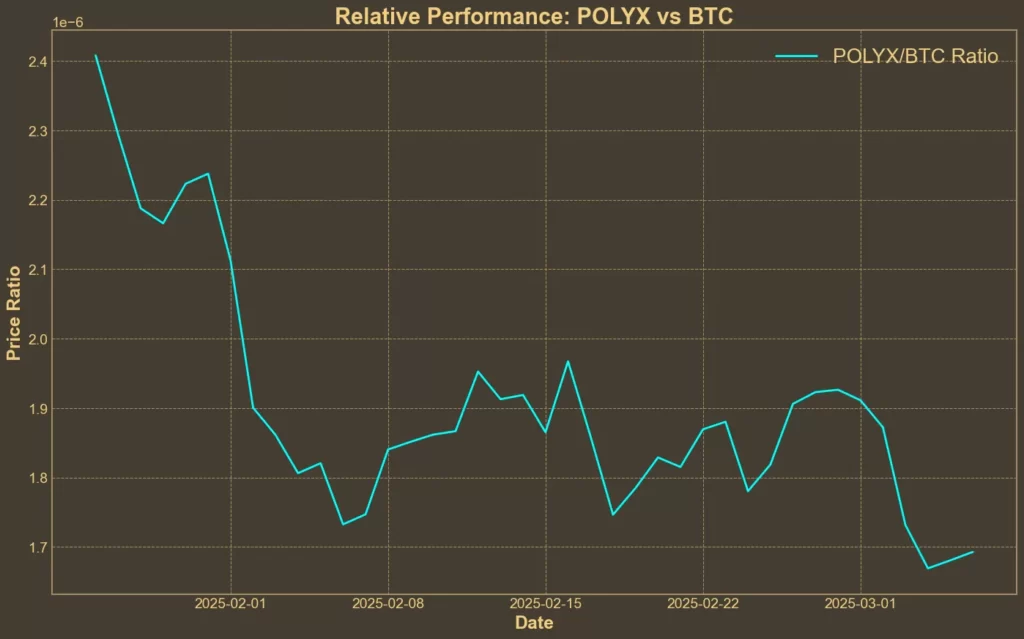

Comparison Against BTC: Weakening

The POLYX/BTC ratio has declined by 11.8% over the past week and 6.9% in the last 30 days. This confirms that POLYX is underperforming relative to Bitcoin.

Final Thoughts

Most indicators suggest that POLYX remains in a bearish trend, though selling pressure might be stabilizing. RSI and MFI are neutral, indicating that the coin is not deeply oversold, while the ADX suggests the current downtrend is still in place but weakening. The low price near the Bollinger Band’s lower boundary could indicate a potential rebound, but there are no strong signals of a reversal yet.

It’s important to remember that technical analysis alone cannot predict unexpected market events, and with decreasing trading volume, any recovery attempt might lack momentum. A decisive break above key resistance levels, combined with an increase in volume, would be needed for a meaningful reversal.

Need a quick and easy way to see what’s happening in crypto over the next few days? Check out our Crypto Events Calendar!