Raydium’s RAY token has recently experienced a sharp decline, losing 30% of its value within 24 hours. This drop came after rumors spread that Pump.fun, a popular Solana-based meme coin launchpad, is developing its own automated market maker (AMM). If these rumors are true, it could significantly impact Raydium’s role as the primary liquidity provider for new Solana tokens.

Table of Contents

What’s Behind the Drop?

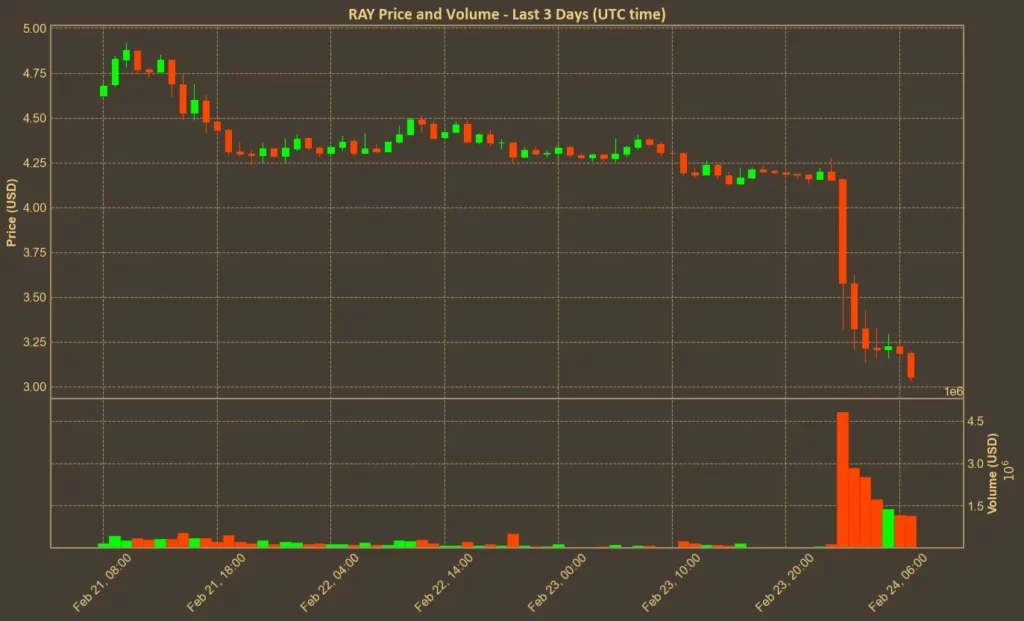

The market reacted very quickly to the news of a potential AMM from Pump.fun. The RAY token fell from $4.25 to $3.05, with most of the losses occurring within an hour. Investors are worried about Raydium’s future as Pump.fun’s AMM could attract a large portion of the trading volume that currently flows through Raydium’s liquidity pools. This would reduce Raydium’s trading volumes and, consequently, its fee revenues.

Speculation grew after a test version of Pump.fun’s AMM was discovered online. Although the platform hasn’t officially confirmed its development, analysts believe the move is aimed at keeping more liquidity within Pump.fun’s ecosystem. Given that Pump.fun has rapidly grown in popularity, this shift could be a major threat to Raydium’s market position.

Why Is This Important?

Raydium has long been the go-to platform for liquidity and trading for newly launched Solana tokens. It charges a 0.25% fee on swaps, making it a significant revenue source. However, if Pump.fun implements its AMM, it would allow the platform to capture these fees, directly challenging Raydium’s business model.

The competition between Raydium and Pump.fun is more than just about trading fees. Pump.fun’s rise has been tied to its popularity among meme coin creators, and it now processes millions in daily fees. If the AMM is implemented successfully, it could secure Pump.fun’s dominance in this niche.

Interestingly, only about 1.4% of tokens launched on Pump.fun currently migrate to Raydium’s pools. An internal AMM would likely increase liquidity retention within Pump.fun, making it more appealing. But at the same time, it would be a serious issue for Raydium.

What Could Happen Next?

If Pump.fun confirms the launch of its AMM, Raydium could face a steep decline in trading volumes. This would drastically impact its fee revenue and market position, as well as investor confidence. Raydium would be forced to rethink its strategy, possibly leading to new features or incentives to retain liquidity providers.

Meanwhile, Pump.fun has not yet commented on the rumors, and Raydium’s team has remained silent as well. This lack of communication is adding to the uncertainty, with investors left to speculate on what the future holds.

Need a quick and easy way to see what’s happening in crypto over the next few days? Check out our Crypto Events Calendar!