In recent months, SNX has faced consistent downward pressure, with today’s drop of nearly 6% adding to the negative trend. The rally sparked by the FED’s recent interest rate cut proved short-lived, as most of the gains have since evaporated. However, from a broader perspective, SNX still shows promise: the coin’s monthly performance is up by 10.6%, and weekly gains of 0.5% suggest some degree of stability. These price movements indicate potential optimism or at least attempts at recovery in the long term.

Market Metrics and Indicators

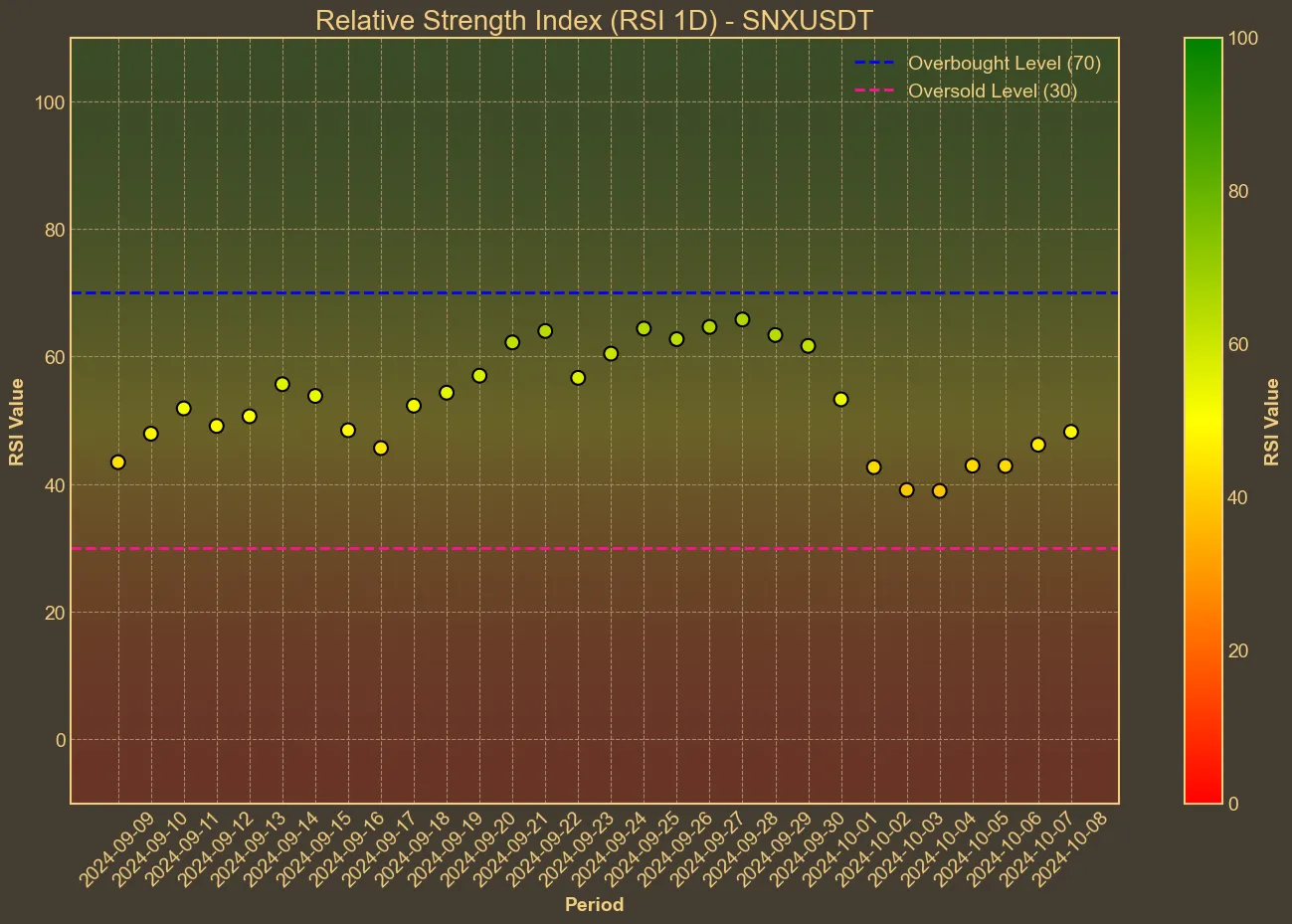

The market cap has decreased over the past week, but there’s been a noticeable increase over the past month by 8.30%. Trading volume mirrors this month’s optimism. The recorded spike over the last month implies heightened trader interest or activity. This is mirrored by the current RSI, which stands at 45. Such a level might suggest a moderate market outlook, with neither overbought nor oversold conditions.

Examining simple and exponential moving averages, it’s evident that SMA and EMA are below the current market price. This divergence may hint at a price correction or consolidation phase. Meanwhile, indicators like MACD and Awesome Oscillator lean towards a bearish sentiment. The MACD below its signal line alongside a negative AO reinforces this cautious sentiment.

What’s Next?

While technical indicators point towards a bearish trend, some stability has emerged following the recent declines. The RSI suggests that SNX is not in a vulnerable overbought or oversold position, leaving room for potential price movement. But can Synthetix return to its March highs?

One key factor will be future decisions from the Federal Reserve on interest rates. SNX rallied strongly following the 0.5% rate cut in September, gaining alongside the broader crypto market. Further positive macroeconomic developments could serve as catalysts for SNX to break through current levels.