If there has been one cryptocurrency stealing the limelight lately, it’s Sui. This layer-1 blockchain token is creating a buzz in the digital market with its steady rise in value. From the inception of its journey in May 2023, Sui hasn’t just marked its territory but is now closing in on its all-time high of $3.93. Over recent weeks, its price kept going up – the altcoin is up 80% since last month, and almost 20% since last week. Just look at the chart:

Sui Adjusts Its Sails for the Next Rally

What’s fueling this surge? The answer lies in a mix of clever network developments and wider market interest. The increase in active wallets and on-chain activity provides a solid foundation for investor confidence. Sui is proving its worth by engaging with its community and attracting developers. The release of the NS token is one such move that has empowered community involvement, signaling a shift towards a more decentralized model and hinting at exciting future prospects.

One cannot overlook the impact of notable players like VanEck stepping in, contributing to the network’s credibility and enhancing its profile beyond the usual crypto fans. Moreover, the rise in Total Value Locked (TVL) within the network echoes this growing trust. Such strides have made Sui a darling in the eyes of analysts who are optimistic about its future trajectory.

It’s easy to see why the predictions are bullish, suggesting that Sui may not just flirt with the $4 mark but could surpass it if the momentum continues. It is however it’s important to approach such forecasts with caution. While some outlets are dubbing SUI as the ‘Solana killer,’ such claims seem premature – especially in light of Solana’s recent strong performance and the fact that Solana currently has nearly 12 times the market capitalization of Sui.

Technical Indicators: Bullish, But Market Might Be Overheated

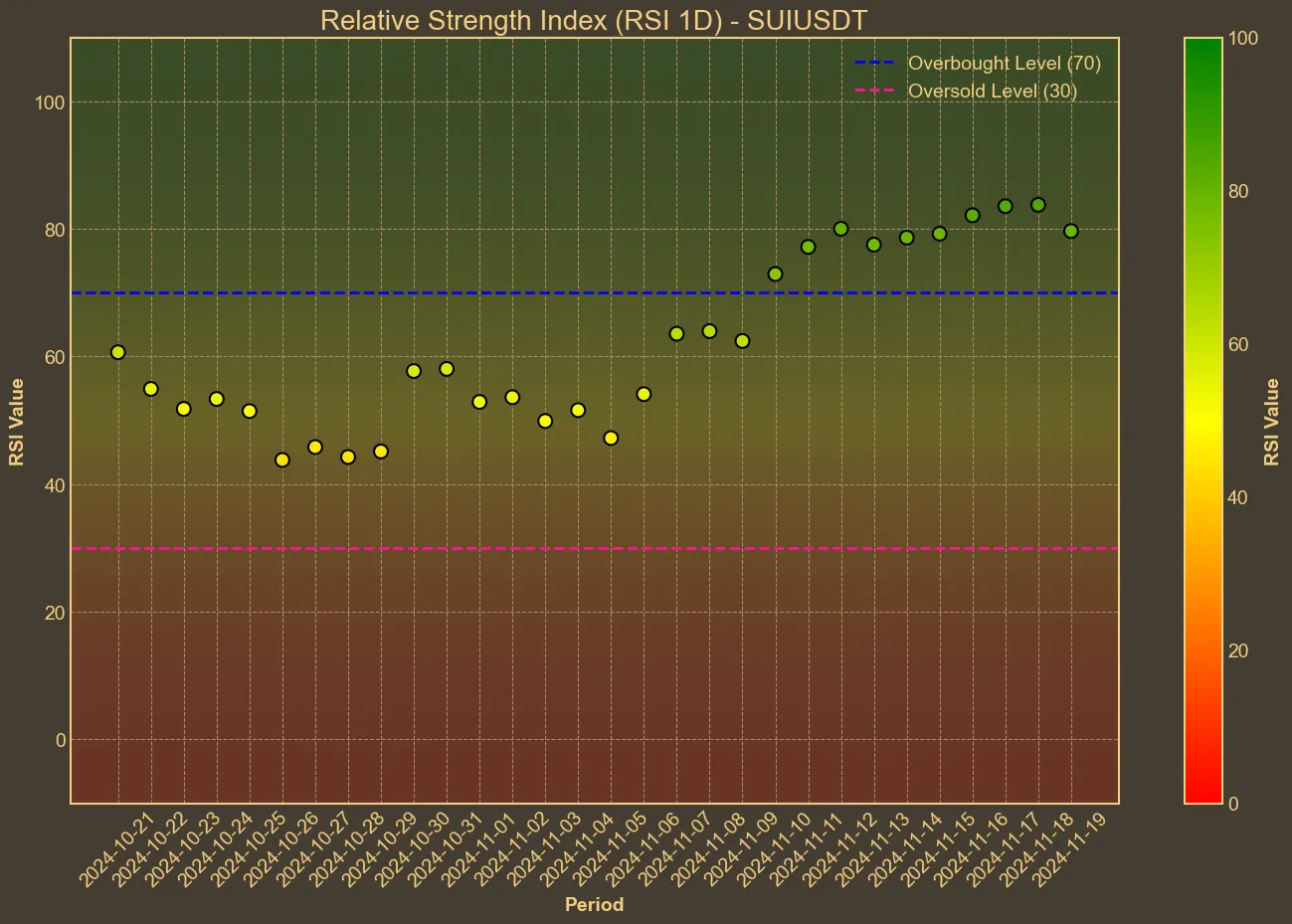

The technical analysis shows some compelling indicators of Sui’s ongoing momentum. The Relative Strength Index (RSI) at 80 suggests the coin is in overbought territory, indicative of strong buying pressure. The Fear and Greed Index for the general cryptocurrency market stands at a record 90, signaling extreme greed, which often precedes market corrections.

Despite this, the moving averages – both simple (SMA) and exponential (EMA) – point towards a continued upward trend, aligning with the positive sentiment around the altcoin. The Bollinger Bands indicate potential price volatility but also room for further upward movement, enhancing the appeal of Sui in a bullish setup as long as it remains close to its upper band without overshooting.

Market Sentiment and Future Outlook

Sui’s ongoing growth has captured the interest of market watchers who are eagerly speculating about what lies ahead. The token has been in a phase where its valuation seems set to break free from its former highs. Should this enthusiasm sustain, we can expect Sui to become a more significant contender in the crypto realm. This sentiment heating up around Sui marks it as a ‘must-watch’ in the cryptocurrency field. However, while most technical indicators are bullish, some highlight the possibility of short-term corrections and profit-taking. As always, caution is advised.