Celestia has quickly become a focal point in crypto markets, not just for its cutting-edge technology but for its intense price swings. Over the past month, Celestia’s volatility has been particularly striking. After being one of the biggest losers when news of escalating conflict in the Middle East rattled markets, it’s now one of the fastest gaining coins. This dramatic rebound underscores the coin’s wild volatility, which has seen it climb significantly over the past month, only to tumble sharply in the past week.

Celestia’s price currently sits at $5.35, reflecting an impressive monthly rise, but the recent week’s downturn highlights the coin’s inherent unpredictability. Its status as both a loser and a gainer in such a short span has made it a prime example of how external geopolitical events can rapidly influence the crypto market. For those with a high-risk tolerance, these wild fluctuations offer both significant opportunities and potential pitfalls.

Evaluating Market Changes and Indicators

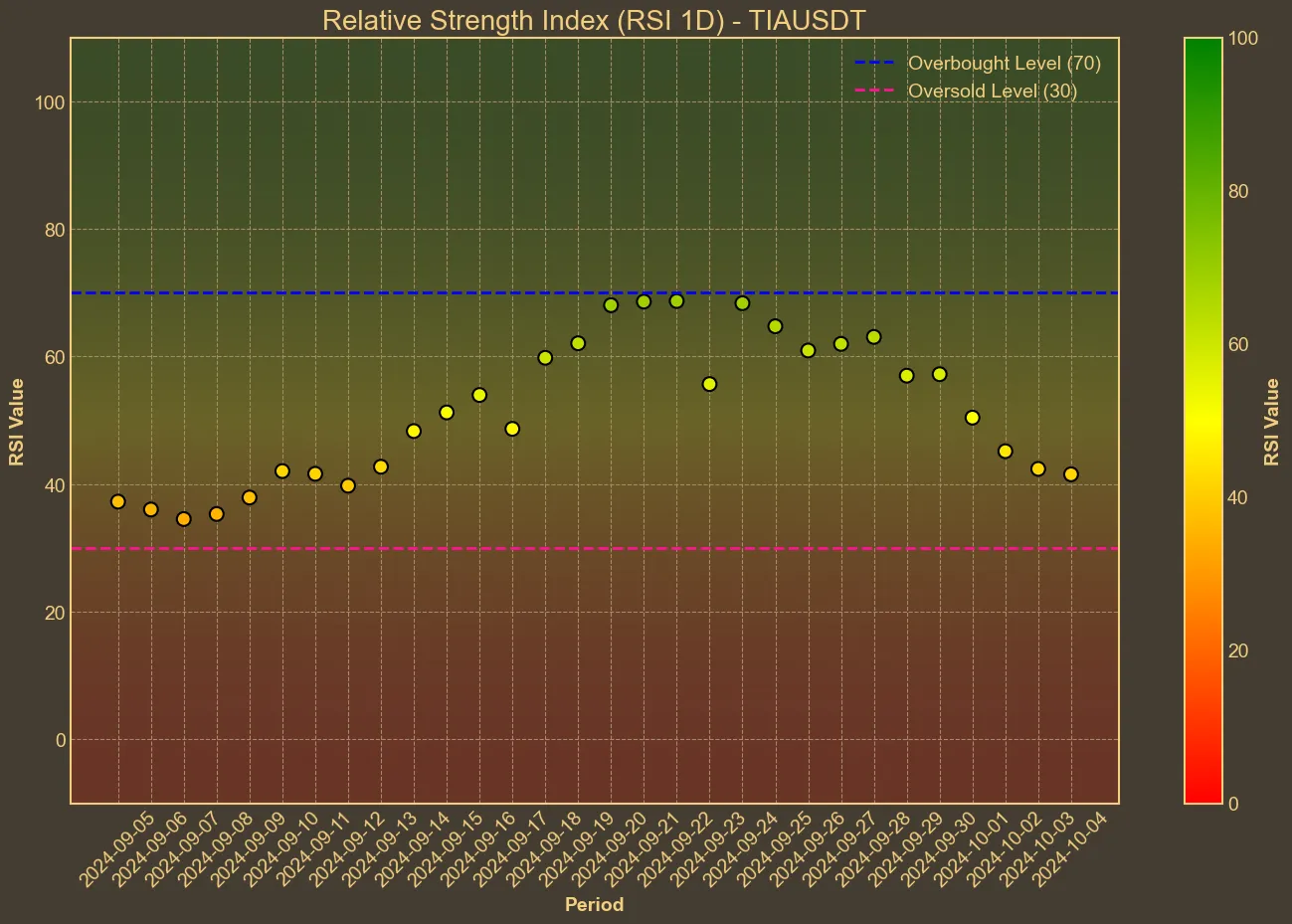

Despite the recent turbulence, Celestia’s market cap has continued to climb, currently placing it as the 58th largest cryptocurrency. The surge in trading volume also reflects increased market interest. On a technical level, the Relative Strength Index (RSI) hovering around 50 suggests a neutral position—neither overbought nor oversold—indicating a balancing act between buyers and sellers.

The MACD shows signs of bullish momentum but hints at a slowdown, while the Awesome Oscillator’s decline suggests downward pressure may be building. These mixed signals emphasize the complex nature of Celestia’s current market movements and the delicate balance between optimism and caution.

Looking ahead, Celestia’s future is full of promise, but also risk. A recent $100 million capital inflow shows that investors remain confident in Celestia’s modular blockchain potential. However, with a significant token unlock scheduled next month, selling pressure could increase, amplifying the already volatile environment.

For investors, Celestia’s rapid shifts can be both a blessing and a curse. The token’s ability to skyrocket in a short time is enticing, but its sharp declines are a reminder that volatility can wipe out gains just as quickly. While technical analysis provides some insight into trends, it can’t account for every market-moving factor, particularly external events like geopolitical conflicts.

As always, cautious optimism should guide investment decisions, with a keen eye on both technical indicators and the broader global landscape that’s increasingly influencing crypto markets.