The latest analysis of Polymesh shows promising trends in its price and market behavior. Over the last year, the coin has experienced a substantial increase of 133% in its price. Recent trends are also positive, with an 18% rise over the past week and a 16% increase over the past month. This momentum, however, contrasts with a huge decline since March, suggesting volatility in the medium term.

Table of Contents

Technical Indicators Analysis

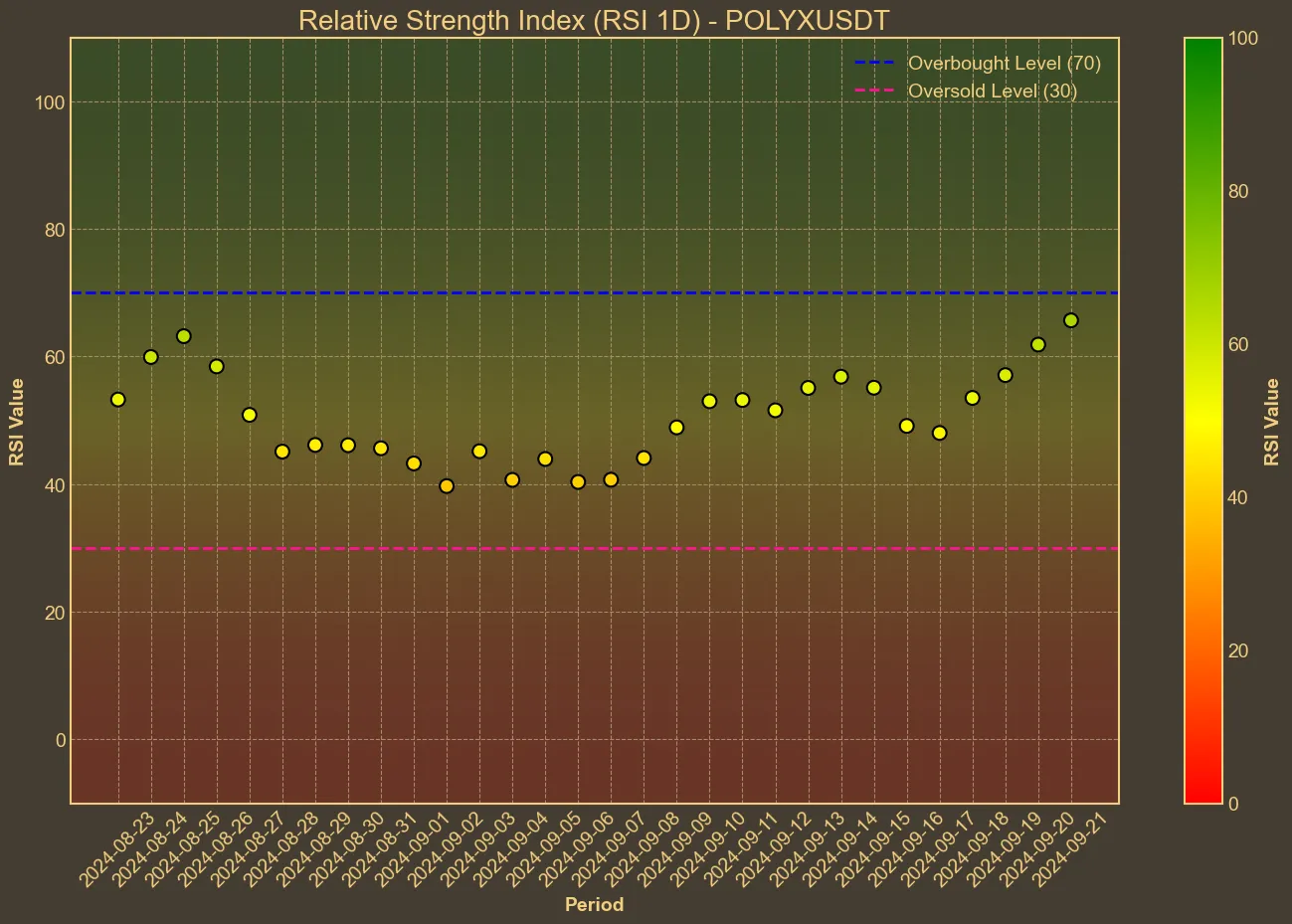

Delving into the technical indicators, the Relative Strength Index (RSI) for Polymesh has been rising steadily. It has increased from 48 six days ago to 70 today, indicating that the coin is approaching overbought territory. This could suggest a potential slowing down or even a correction in the near future.

The Simple Moving Average (SMA) and the Exponential Moving Average (EMA) also show gradual increases, reflecting recent positive price movements.

Market Cap and Volume Dynamics

The market capitalization has shown consistent growth, with an 19% increase over the past month. This uptick aligns with the rising trading volume, which saw a significant jump of 64% in the last week. However, note that the trading volume decreased by 4.3% over the last 30 days, highlighting some inconsistencies in trading behavior.

The Moving Average Convergence Divergence (MACD) value of 0.0075, coupled with a MACD Signal of 0.0024, suggests a bullish signal. Meanwhile, the Awesome Oscillator (AO) has sharply risen from 0.007 a week ago to 0.0173 today, further indicating strong upward momentum. The Bollinger Bands suggest a potential price range between $0.1878 and $0.2545.

Polymesh’s current trajectory presents an interesting opportunity for investors. Many technical indicators confirm strong bullish momentum. However, keeping an eye on the RSI and other technical indicators will be crucial in determining the sustainability of this upward trend. It’s also important to remember that technical analysis doesn’t take into account all factors influencing the price.