While many altcoins have been surging in recent days, XRP remained relatively steady – until yesterday, when Ripple finally broke through the $0.60 resistance level, climbing to the $0.65 range. This marks a 5% gain in the past 24 hours and a 14.5% increase over the last month.

Table of Contents

Technical Indicators and Market Implications

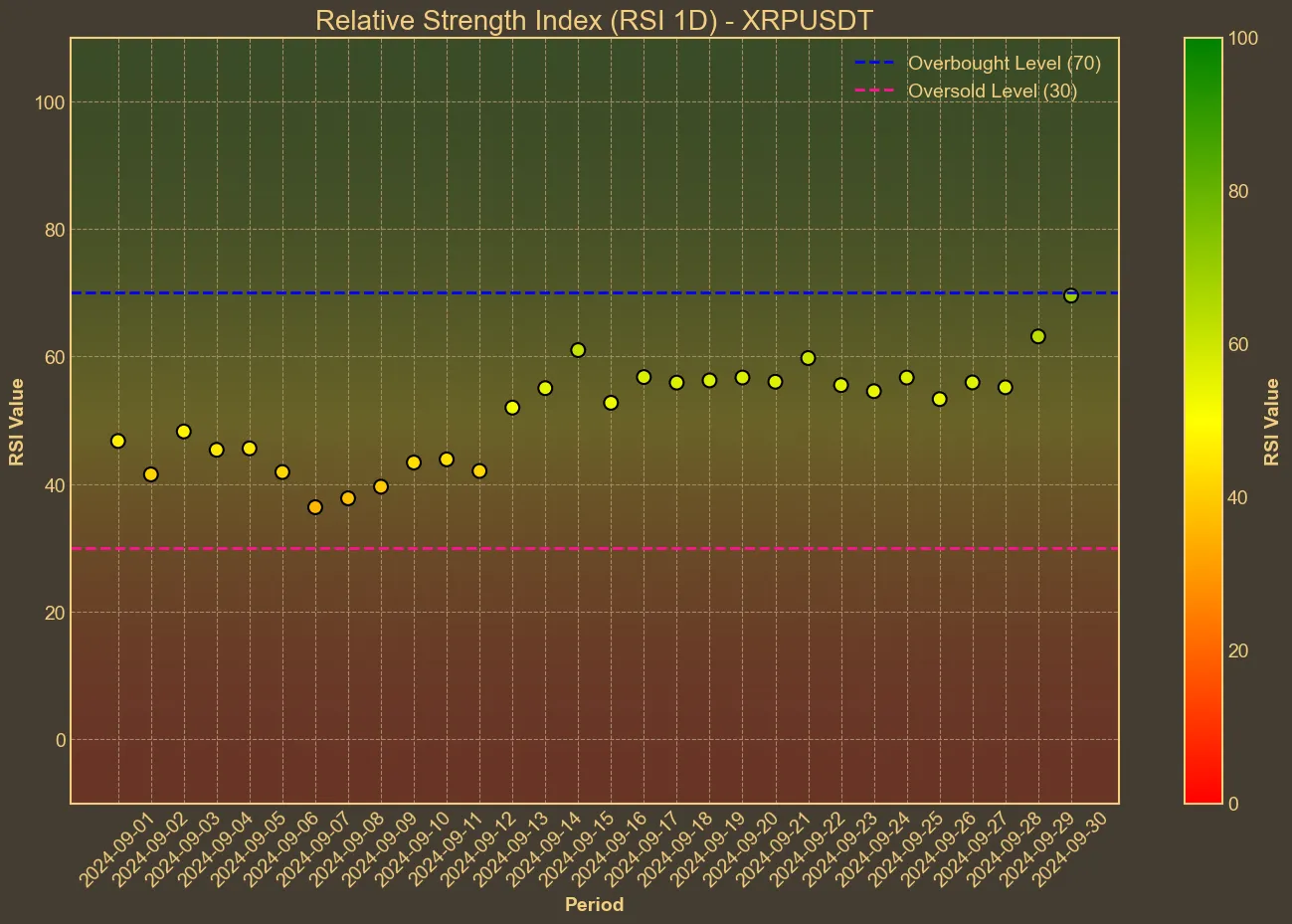

Examining the technical indicators, the Relative Strength Index (RSI) for the past week shows a sharp rise, moving from 55 to 72. An RSI of 70 and above typically suggests that the asset may be overbought, potentially implying a future pullback. However, in a strong upward trend, such levels could also signify a prolonged bullish phase.

The Simple Moving Average (SMA) and Exponential Moving Average (EMA) further support this view. The SMA today is at 0.5767, up from 0.5649 a week ago, while the EMA remains consistently high at 0.5894.

The MACD indicator is also displaying bullish signals. With a MACD value of 0.0158 and a signal line at 0.0093, the positive divergence suggests continued momentum. The Average True Range (ATR) at 0.0253 points to increased volatility, which may offer both opportunities and risks for traders.

Volume Surge and Market Capitalization

Another aspect worth noting is the significant increase in trading volume. In the last 30 days, the volume has surged by 172.5%, reaching $2.24 billion, which is indicative of heightened interest and participation in XRP trading. Such a rise in volume often precedes significant price movements, hinting at sustained action in the near term.

Market capitalization has also seen a noteworthy rise. XRP’s market cap stands at $36.85 billion, a 15.5% increase over the past month. This upward movement in market cap is an encouraging sign, showing that the asset is gaining a substantial share of the cryptocurrency market.

Final Thoughts

While XRP’s recent performance points to a solid bullish trend, it’s important to remain cautious. Market conditions can shift rapidly due to factors such as regulatory developments, economic changes, or shifts in broader market sentiment. In XRP’s case, there are several significant factors to consider, including the potential SEC appeal, the upcoming stablecoin launch, new partnerships in Asia, and developments surrounding the Grayscale Trust Fund.