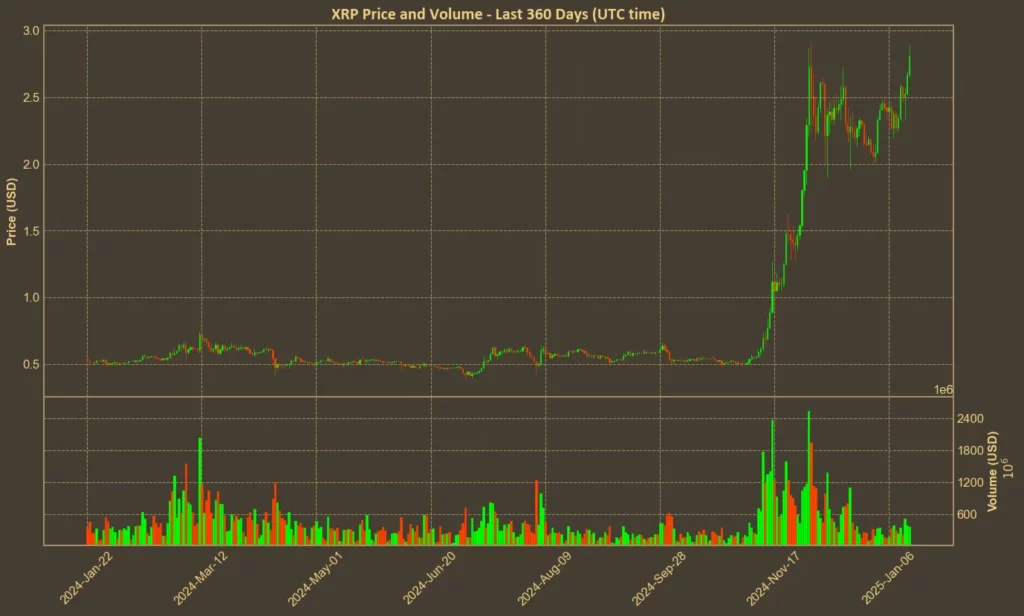

Ripple’s XRP has surged nearly 10% today, breaking the $2.80 mark and reaching a new high since the beginning of December. With a bullish outlook, many investors hope that the momentum might push XRP to break the $3 mark – bringing it just one step away from its all-time high of $3.84, set back in January 2018.

Table of Contents

Technical Indicators Supporting Growth

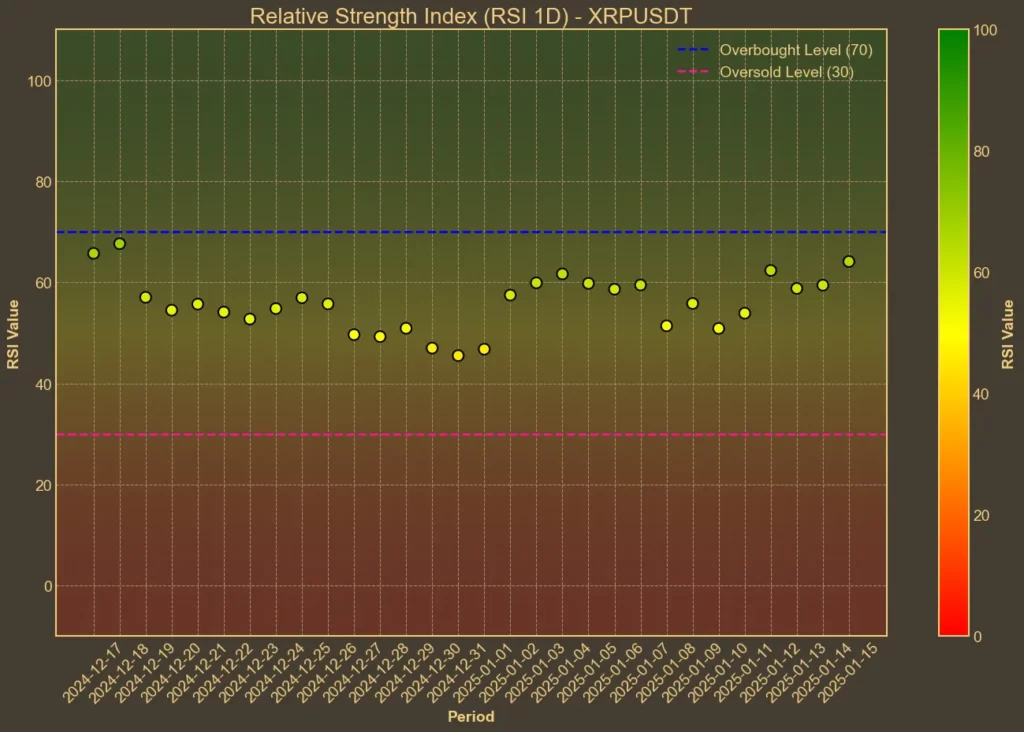

From a technical analysis standpoint, XRP has several bullish indicators that suggest the upward trend may continue. The Relative Strength Index (RSI) currently stands at 68, which, while approaching the overbought territory, still indicates room for growth. An RSI trend increasing over the past days supports the notion of sustained buying pressure.

Moving averages further reinforce the positive outlook. The Simple Moving Average (SMA) has consistently risen, with today’s SMA at $2.34 compared to $2.32 yesterday. Similarly, the Exponential Moving Average (EMA) is at $2.38, up from $2.35 the previous day. These upward-moving averages indicate a steady increase in XRP’s price momentum, suggesting that the current trend is likely to persist.

Additionally, the Bollinger Bands (BB) show XRP trading near the upper band at $2.75, which often signals a strong bullish phase. The Moving Average Convergence Divergence (MACD) is also positive at 0.12, above the signal line of 0.09, indicating that the buying momentum is likely to continue. The Average True Range (ATR) at 0.18 suggests moderate volatility, providing a balanced environment for further price appreciation.

Another key indicator is the Awesome Oscillator (AO), currently at 0.22, up from 0.14 just a day ago. This upward trend in the AO reinforces the bullish sentiment, showing that buying momentum is increasing. These technical factors combined paint a positive picture for XRP, suggesting that the cryptocurrency is well-positioned for continued growth.

The ETF Factor: A Potential Game Changer

One of the most compelling factors contributing to XRP’s recent surge is the anticipation surrounding the approval of Exchange-Traded Funds (ETFs). JPMorgan Chase analysts have predicted that XRP ETFs could attract between $4 billion and $8 billion in investments within the first six months of approval. Such a development would significantly enhance XRP’s market liquidity and accessibility, drawing in traditional investors who prefer ETF structures over direct cryptocurrency investments.

The potential approval of XRP ETFs is seen as a major catalyst for its price increase. ETFs allow investors to gain exposure to XRP without directly purchasing the cryptocurrency, making it easier for institutional and retail investors to include XRP in their portfolios. This increased demand from ETFs could drive XRP’s price to new heights, potentially pushing it towards $3 and beyond. As reported here, Polymarket investors believe Ripple is among the most likely projects to receive ETF approval this year.

Moreover, Ripple’s strategic partnerships and the launch of its stablecoin, RLUSD, have added to the positive sentiment. RLUSD’s integration into major exchanges broadens XRP’s use cases and enhances its appeal as a reliable digital asset. Additionally, a potential collaboration between RLUSD and Cardano is under discussion. These developments, combined with strong market indicators, position XRP favorably for sustained growth.

Legal Developments

Ripple’s ongoing legal battle with the SEC has been a significant factor influencing XRP’s market performance. The recent court ruling that XRP is not a security has alleviated some of the regulatory pressures, allowing Ripple to focus on expanding its ecosystem and partnerships. Although the SEC’s appeal creates an element of uncertainty, the overall market sentiment remains positive, driven by Ripple’s ability to navigate these challenges effectively.

The appointment of a new SEC chair, Paul Atkins, who is seen as more crypto-friendly than Gary Gensler, has further boosted investor confidence. Analysts believe that Atkins might adopt a more favorable stance towards Ripple, potentially leading to a smoother regulatory environment for XRP and possibly a drop of the appeal. This expectation has contributed to the positive momentum surrounding XRP, as investors remain optimistic about the outcome of the ongoing legal proceedings.

Ripple also stands to gain significantly if Donald Trump implements pro-crypto policies, particularly tax incentives for U.S.-based crypto businesses. Ripple’s leadership is already showing initiative in anticipation of these changes – just a few days ago, Ripple’s CEO had a dinner meeting with Donald Trump.

Opportunities and Risks

While current trends look promising, it is crucial to remember that technical analysis has its limitations. Although these indicators offer insight into market sentiment and price movements, they cannot predict unexpected events or sudden shifts in investor mood. Any delay in implementing Donald Trump’s pro-crypto initiatives or emerging regulatory hurdles could swiftly alter market optimism.

That said, XRP’s potential to reach new all-time highs is backed by strong technical indicators, growing institutional involvement, and favorable legal outcomes. The anticipation of ETF approvals and Ripple’s strategic moves further boost XRP’s growth prospects. Nonetheless, as with any investment, despite an encouraging outlook, nothing is guaranteed.