In this article:

- Bitcoin nears $100K, Ethereum eyes $3,400, Solana surpasses $200, and Ripple hits its highest level since 2018.

- A possible pro-crypto executive orders under Trump and favorable US inflation data boost market sentiment.

The cryptocurrency market has seen a significant growth in recent days, signaling a notable shift in investor sentiment and market dynamics. This recovery follows a period of corrections earlier this month, which brings back the confidence of investors – and restores the price levels of many coins.

Table of Contents

Bullish Momentum Takes Center Stage

Bitcoin, the leading cryptocurrency, is nearing the $100,000 mark again. This is particularly noteworthy given that just three days ago, Bitcoin briefly dipped below $90,000, making its current trajectory particularly impressive. This surge is not limited to Bitcoin alone though – most other major coins are also in positive territory today. Ethereum is approaching the $3,400 level, and Solana has bounced back above $200, indicating widespread optimism across major digital assets.

Ripple stands out as an exceptional performer, having broken past the $3 threshold and briefly reaching $3.18. Although it has since retraced to $3.09, these values remain impressive, marking Ripple’s highest levels since 2018 – outdoing even its recent rally in November. We described recent positive momentum about Ripple in this article.

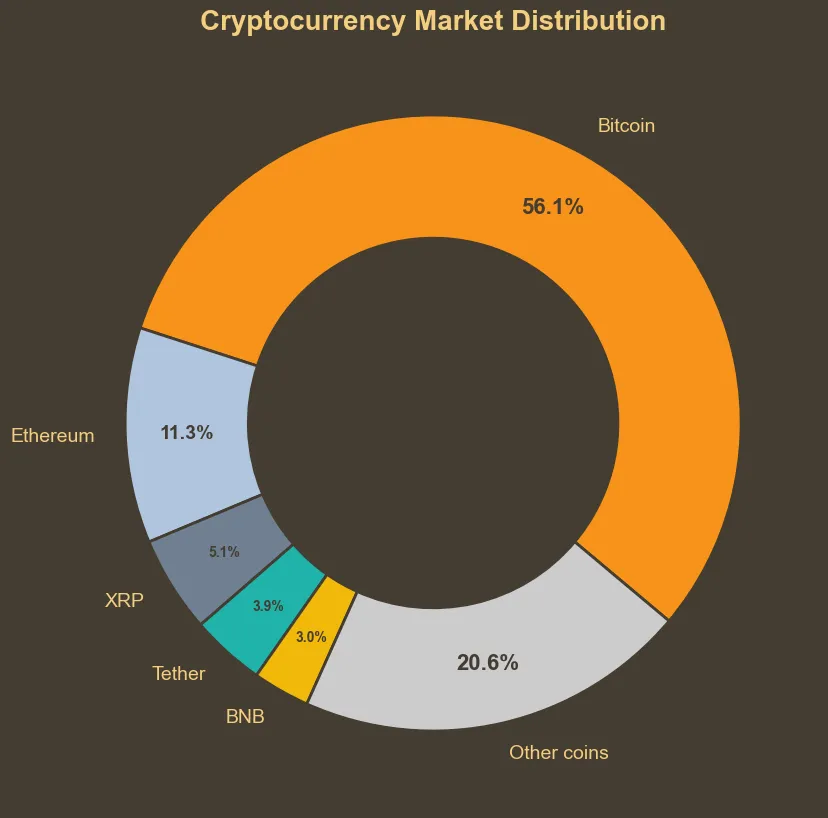

Should this bullish sentiment persist, Ripple could soon rise to half of Ethereum’s market cap:

Growing Confidence

The Crypto Fear & Greed Index, a key indicator of market sentiment, has risen to 75, moving further into the “Greed” territory. This increase reflects a growing appetite for risk among investors, who are increasingly optimistic about the market’s direction.

Over the past week, the overall market capitalization has grown by nearly 4%, despite a slight dip few days ago. Trading volumes have also shown variability, with a notable increase in the last day but a decline over longer periods.

This positive sentiment is further reinforced by significant movements in the market. Top performer today, Virtuals Protocol (VIRTUAL) surged 31%. Litecoin surged by 17%, driven by substantial accumulation from large investors and optimism surrounding the potential approval of a Litecoin exchange-traded fund (ETF) in the United States.

Regulatory Developments Fuel Optimism

Regulatory news has played a crucial role in the recent market dynamics. Binance, one of the largest cryptocurrency exchanges, saw a surge in Bitcoin open interest following favorable US inflation data. This influx indicates increased participation and confidence in Bitcoin’s future prospects.

Additionally, the anticipation of a pro-crypto executive order from the incoming Trump administration has injected further optimism into the market. This potential policy shift aims to reduce regulatory barriers, provide beneficial crypto taxes for US-based coins and support the growth of the cryptocurrency industry, addressing issues like restrictive guidelines that have previously hindered innovation.

Such regulatory advancements will be beneficial for the cryptocurrency market. They not only enhance the legitimacy of digital assets but also encourage broader adoption among both retail and institutional investors.

The Road Ahead

While the current market trends are undeniably positive, it is essential to approach this growth with a balanced perspective. The rapid rise in prices and market enthusiasm may attract more investors, but the potential risks and volatility remain. Technical analysis, while useful, has its limitations and should be complemented with a comprehensive understanding of market fundamentals and external factors.

That being said, the recent surge in the cryptocurrency market reflects a period of renewed optimism and significant growth. With Bitcoin approaching $100,000, Ripple reaching new heights, and strategic regulatory and technological advancements, the market outlook look promising. It’s crucial to rememebr though that the performance in coming days will likely be decided by the developments around Trump’s inauguration and his first decision.