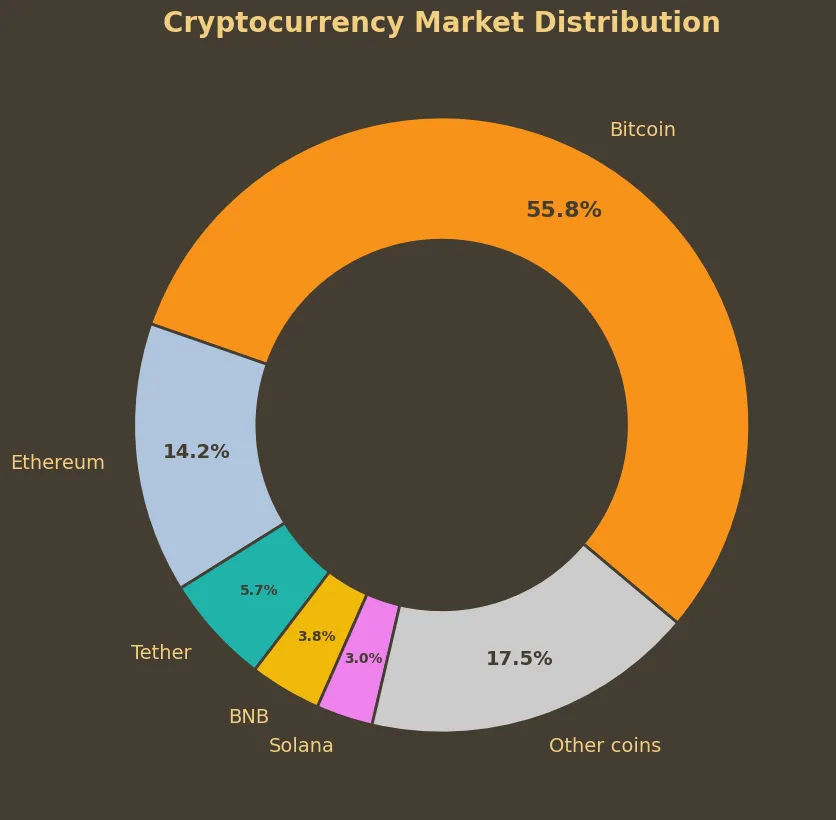

In the past week, the cryptocurrency market has shown some notable fluctuations. The overall market capitalization stands at $2.07 trillion, with a 24-hour trading volume of $39 billion. Bitcoin continues to dominate with a 55.79% market share. This data lays the groundwork for understanding the recent trends and their broader implications.

A Decline in Market Cap and Volume

A glance at the market cap reveals a consistent downtrend over various time frames. The market cap change in the last 24 hours is a slight decrease of 0.29%, building on a three-day drop of 1.04%, and a seven-day decline of 1.31%. Over a 30-day period, the market cap has plunged a significant 11.18%. The trading volume paints a similar picture. While there’s been a recent 1.81% uptick in the past 24 hours, the three-day volume has plummeted by 38.25%, with a seven-day and 30-day drop of 49.35% and 60.64%, respectively. This shift suggests an overall reduction in market activity, reflective of possibly waning investor interest or market exit.

Fear and Greed: A Changing Sentiment

The Fear and Greed Index, a critical sentiment indicator, has shown considerable movement. From a high of 55 a week ago, the score has now dropped to 26. This trend signals growing apprehension among investors, manifesting in increased caution and decreased market participation. Sentiment swings in crypto markets aren’t rare, but a drastic drop like this could indicate deeper concerns, perhaps linked to broader economic factors, such as a possible recession in the USA.

Major Coin Performance

Examining the performance of major cryptocurrencies like Bitcoin, Ethereum, and BNB, it’s evident that the market sentiment has impacted these assets as well. Bitcoin and Ethereum have both seen minor declines of around 1%, while BNB has fallen by 2.8%, and Solana by a steeper 3.43%. These losses, even though not colossal, continue to highlight the current market’s negative tilt.

Outliers in Performance

Some cryptocurrencies have bucked the trend. Coins such as Klaytn have managed to rise by 2.22%, while Notcoin and Toncoin have also seen modest gains today. On the flip side, Immutable X and Beam have experienced substantial losses of around 9.41% and 8.23%, respectively. These outliers illustrate that while the broader market is on a downward trend, opportunities for gains still exist, albeit with higher risk.

My Thoughts

The current data indicates a market in decline, characterized by falling market caps and trading volumes along with shifting sentiment. Technical indicators can offer valuable insights, but they can’t forecast future performance with certainty. It’s crucial to consider both the quantitative data and the qualitative market sentiment when attempting to make informed decisions. The decreasing Fear and Greed Index score over the past week especially underscores the cautious stance of investors right now.

While this downturn may appear unsettling, it’s a reminder of the inherent unpredictability of cryptocurrencies. Investors should maintain a balanced perspective, recognizing both the high risk and potential high reward. As always, diversification and a well-thought-out strategy remain key to navigating this turbulent landscape.