In the last few days, the cryptocurrency market has been marked by subtle yet significant shifts that reflect broader trends and investor sentiment. With a current market cap standing at $2.11 trillion, there is a notable drop over the past month. This downward trend is mirrored by a decrease in the market’s 24-hour volume, indicating reduced trading activity. This reduction in trading volume could be a sign of cautious market behavior or simply a short-term lull.

Investor Sentiment and Market Dynamics

Looking at the Fear and Greed Index, there is an observable fluctuation that has varied from extreme fear to moderate fear. A week ago, the index was at 29, and today it’s at 30, showing minor improvement. However, these small shifts in investor sentiment could play a substantial role in understanding the recent market behavior. The relative stability in this index suggests that while fear remains, it is not significantly deepening, which might be a sign of stabilization after a period of intense volatility.

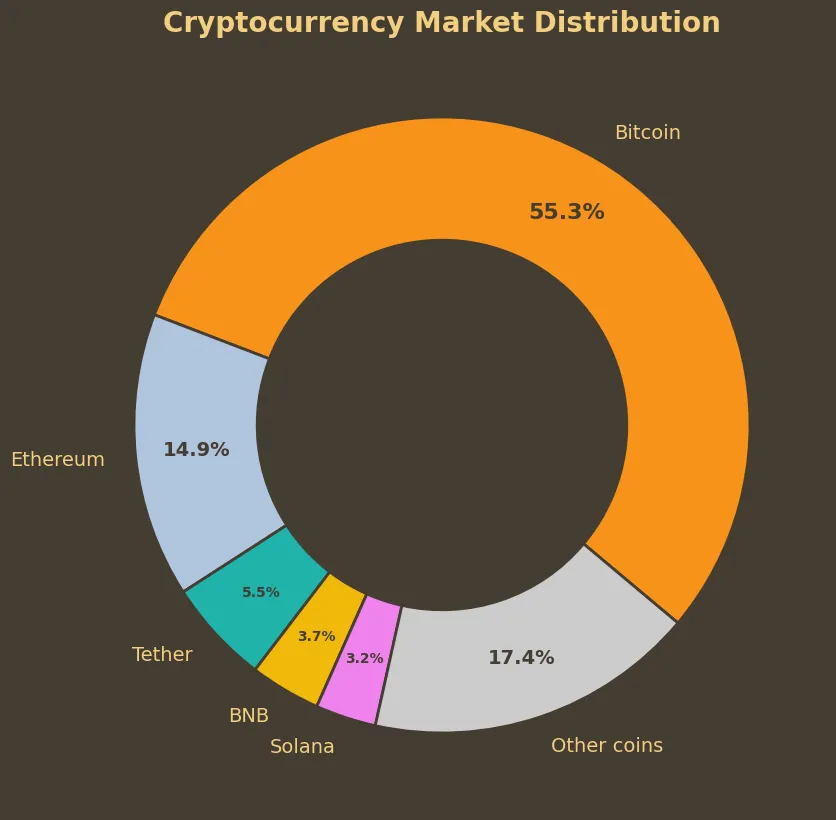

Another interesting aspect to consider is Bitcoin’s dominance, which continues to hold at 55.29%. This indicates that Bitcoin remains a major player and influences overall market sentiment. The performance of major coins like Ethereum and Bitcoin, which have seen slight declines, is another testament to the cautious sentiment prevailing in the market.

Broader Implications

The performance of various coins, both major and minor, is striking. For instance, the positive performance of coins like Aave and Toncoin contrasts sharply with the poor showing of Celestia and Ordinals. This divergence indicates the market’s selective optimism toward different projects, even amidst a broader downturn. Such inconsistencies in performance could signal that investors are becoming more discerning and possibly more risk-averse, choosing to invest in projects they perceive to have stronger fundamentals.

Analyzing these trends leads me to believe that the market is undoubtedly in a phase of consolidation. The consistent declines over the past 30 days indicate that we are not yet out of the woods. Yet, the minor upticks in certain coins and sentiment indices suggest that the market may be preparing for a potential rebound. However, technical analysis has its limitations, and projecting future movements based solely on past data can be misleading. Thus, while these indicators give us valuable insights, they should be considered in conjunction with broader economic factors.

In conclusion, the cryptocurrency market is currently navigating through a complex period of cautious investor behavior and reduced trading volumes. While there’s some stability emerging, the market’s future remains uncertain. Investors would do well to stay informed and consider broader market trends before making any investment decisions.