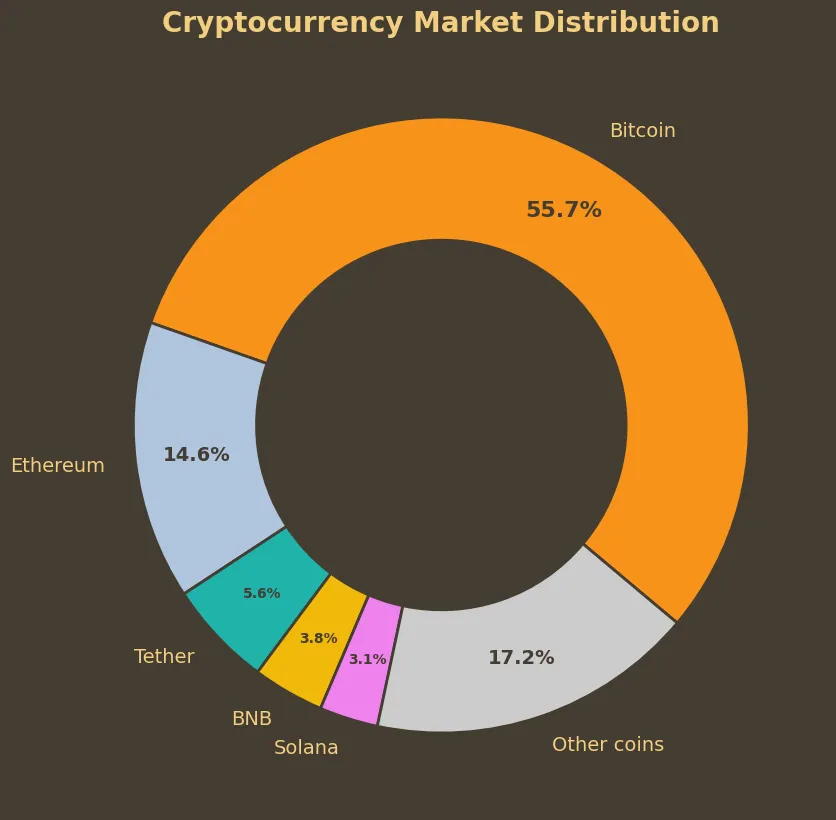

The cryptocurrency market has experienced significant shifts in the last few days. Analyzing these changes offers insight into what might lie ahead for investors and enthusiasts. The current market cap stands at a robust $2.1 trillion, with a 24-hour volume of $55 billion. Bitcoin continues to dominate the market with a 55.72% share, a metric that hasn’t seen much fluctuation recently. This steady dominance suggests Bitcoin’s continued role as the cornerstone of the crypto market.

Sentiment and Market Behavior

The overall sentiment in the cryptocurrency market demonstrates noticeable bearish undercurrents. The “fear and greed” index, fluctuating between 25 and 40 over the past week, has consistently leaned towards fear. This sentiment indicates apprehension among investors, likely stemming from broader economic uncertainties and recent market performance. The index reveals a consistent drop, exacerbated by a significant decline earlier in the week from 39 to the current 25. Such low levels of sentiment can deter new investments and may prompt existing investors to hold their assets rather than engage in trading.

Despite the subdued sentiment, the market cap has shown resilience, with marginal positive changes in the last one and three days. This stability suggests that while investor sentiment is fearful, it hasn’t translated into a wholesale exit from the market. Instead, investors appear to be cautiously observing and reacting to market cues.

Implications

Looking at the past month, the cryptocurrency market has seen a notable 11.14% decrease in market cap. Such a decline, coupled with a drop in trading volume by approximately 15.69%, indicates a period of consolidation. These figures mirror a market grappling with reduced activity and declining prices, which are common during bearish phases.

However, reducing this to mere numbers misses the broader implications. Strong-performing coins such as Helium and TRON reflect the ongoing evolution within the crypto space where utility and unique use cases can spur investor interest against broader market trends. Conversely, disappointing performances from newer or more speculative coins highlight the inherent risks in the sector.

The Road Ahead

In conclusion, the cryptocurrency market is at a pivotal juncture, characterized by cautious investor sentiment and reduced trading volumes. This should serve as a reminder of the limitations of technical analysis; while it provides valuable insights, it cannot predict the future with certainty. Investors must remain cognizant of the macroeconomic landscape and technological advancements within the crypto space.

Markets perpetually evolve, and today’s environment could be laying the foundation for tomorrow’s opportunities. Diversification, informed decision-making, and a long-term perspective will be crucial as we navigate these turbulent times.