Aave has made a remarkable leap into the top 30 cryptocurrencies following a 30% surge in just 24 hours. This caps off an exceptional year for AAVE, with its price nearly quadrupling since December 2023. Now trading at $360 – the highest level since 2021 – investors are asking the big question: can it climb even higher?

Table of Contents

Technical Indicators Signal Upward Momentum

Analyzing Aave’s recent technical indicators reveals a clear upward trend. The Simple Moving Average (SMA) and Exponential Moving Average (EMA) have both been moving higher, indicating sustained buying pressure. The SMA today stands at $229, up from $222 yesterday, while the EMA maintains a strong position at $248. These rising averages suggest that the momentum behind Aave is building steadily.

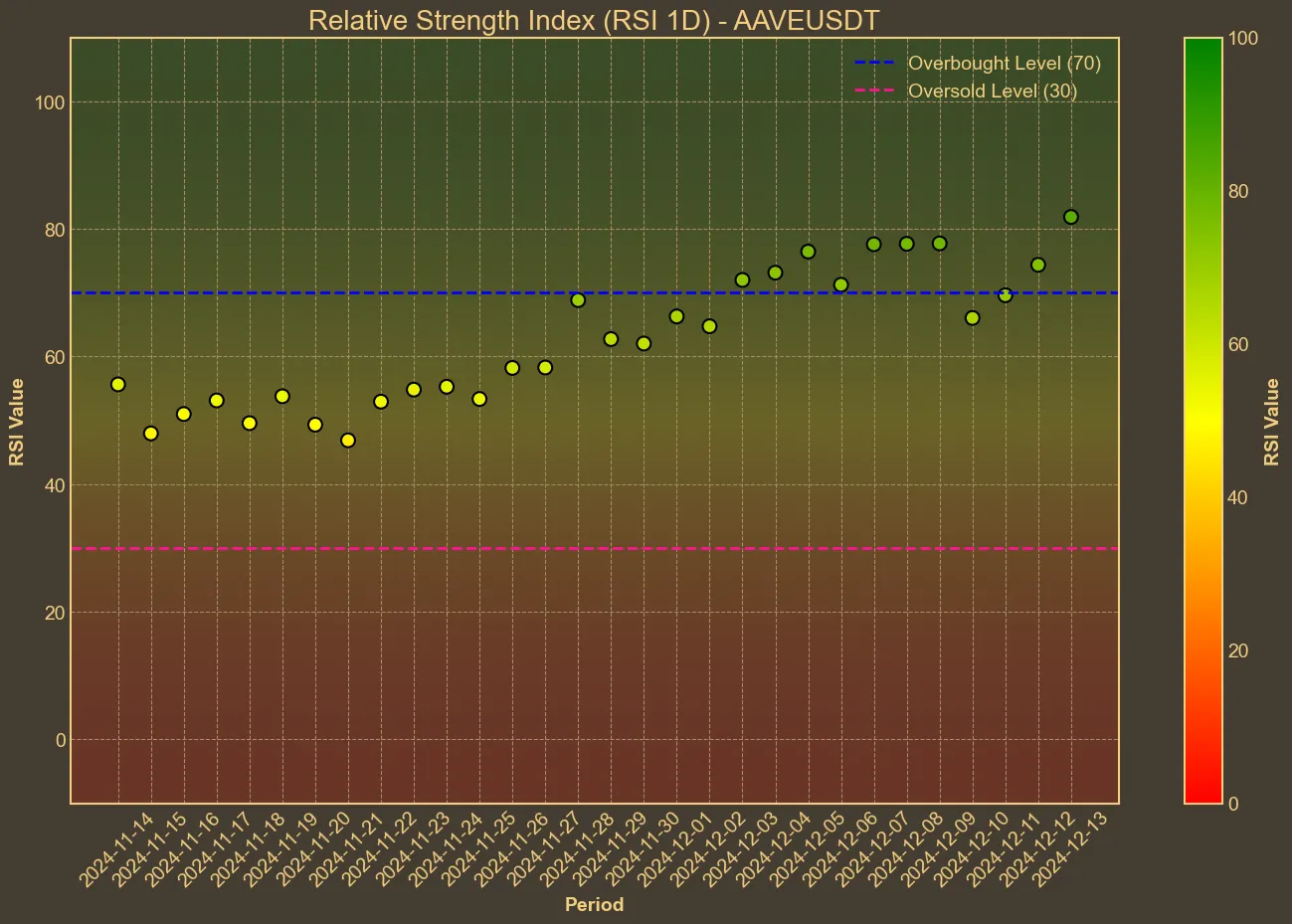

The Relative Strength Index (RSI) is another key indicator to watch. Currently at 79, the RSI suggests that Aave is approaching overbought territory. While this can sometimes signal a potential pullback, the trend remains positive, indicating strong bullish sentiment. Additionally, the Moving Average Convergence Divergence (MACD) is positive, further supporting the notion that Aave is in a favorable trend. The Average True Range (ATR) shows that volatility is present but manageable, allowing for sustained growth without excessive price swings.

Institutional Interest and Strategic Partnerships Boost Confidence

Aave’s recent performance is also driven by increased institutional interest and strategic partnerships. Notably, Donald Trump’s World Liberty Financial has made substantial investments in Aave, signaling a vote of confidence. Furthermore, Aave has forged a strategic partnership with Balancer for the launch of Balancer V3. This collaboration aims to enhance liquidity optimization and provide improved tools for developers, which are crucial for fostering a more efficient trading environment. By integrating Balancer’s automated market maker technology, Aave is enhancing its liquidity pools, making the platform more attractive.

Galaxy Digital’s recent withdrawals from cryptocurrency exchanges, including a substantial amount of AAVE tokens, also play a role in the current market dynamics. While withdrawals might initially appear concerning, they often indicate that major holders are securing their assets, potentially reducing market volatility and signaling long-term confidence in Aave’s prospects.

On-Chain Metrics Reflect Active Growth

Beyond technical indicators and institutional moves, Aave’s on-chain metrics paint a picture of active and growing participation within its ecosystem. The Total Value Locked (TVL) in Aave has seen a significant increase, demonstrating that more users are depositing and utilizing assets within the platform. This rise in TVL is a strong indicator of growing trust and reliance on Aave’s lending and borrowing services.

Active addresses on the Aave network have also been climbing, suggesting increased user engagement and adoption. Higher trading volumes further corroborate this trend, as more investors are participating in Aave’s market activities. The influx of trading volume means that Aave is gaining more attention and liquidity, which can help sustain its upward trajectory.

Whale activity, or the movements of large holders, has been particularly influential. Significant token acquisitions by major investors have injected fresh liquidity into the market, driving up Aave’s price. This whale activity not only supports the current rally but also builds a foundation for potential future growth. However, it is essential to monitor whether this level of whale participation continues, as any slowdown could impact the sustainability of the rally.

The Limitations

While the technical analysis and on-chain metrics present a positive outlook for Aave, it is important to approach these indicators with caution. Technical analysis provides valuable insights into market trends, but it is not foolproof. Market sentiment can shift rapidly due to external factors, such as geopolitical tensions or macroeconomic events, which are beyond the scope of technical indicators.

Institutional support, while encouraging, also does not guarantee long-term success. The cryptocurrency market remains highly volatile, and even strong projects like Aave can experience significant price fluctuations. Investors should remain cautious and consider a range of factors, including fundamental developments and broader market conditions, when making investment decisions.

Moreover, the reliance on whale activity poses a risk. If large holders decide to reduce their positions or withdraw their support, it could lead to a sharp decline in Aave’s price. Diversifying investments and not solely depending on whale movements is advisable to mitigate such risks.

Conclusion

Aave is currently riding a wave of positive momentum, driven by strong technical indicators, institutional interest, and strategic partnerships. The platform’s growth in TVL and active user engagement further underscores its expanding role within the DeFi ecosystem. These factors collectively paint a promising picture for Aave’s future, suggesting that it could continue to climb to $400 if current trends persist.

However, investors should remain aware of the risks associated with cryptocurrency investments. While the data points to a bullish trend, the market’s unpredictable nature means that Aave’s price could also face downward pressures. RSI near overbought territory, and it is not uncommon to see some profit-taking after significant growth. Balancing optimism with caution and staying informed about ongoing developments will be key for those looking to invest.