In recent weeks, Aave’s price has shown mixed signals. Despite some fluctuations, the overall trend provides insights into where Aave might be headed.

Price and Volume Analysis

Aave’s current price stands at $96.63, showing a slight 2.98% increase over the last day. However, when we zoom out, the picture becomes more complex. Over the last week, Aave’s price has decreased by 3.66%. The decline continues over a month with a 6.73% drop. Surprisingly, a different trend emerges over the last quarter with a notable 13.25% increase. This short-term volatility seems less impactful when we consider the impressive 47.89% rise over the past year.

The market cap, a critical indicator of the coin’s overall value, tells a similar story. The daily market cap change shows a minor decline of 0.48%, but looking back over a week, it would reveal an overall increase of 2.15%. However, the recent monthly drop of 7.89% suggests some underlying shifts in market sentiment. The 24-hour trading volume, showing an increase of 4.73%, further crescendos over the past week and month with rises of 72.35% and 52.95%, respectively. This surge in volume might indicate heightened trader interest, which often precedes significant price movements.

Technical Indicators and Momentum

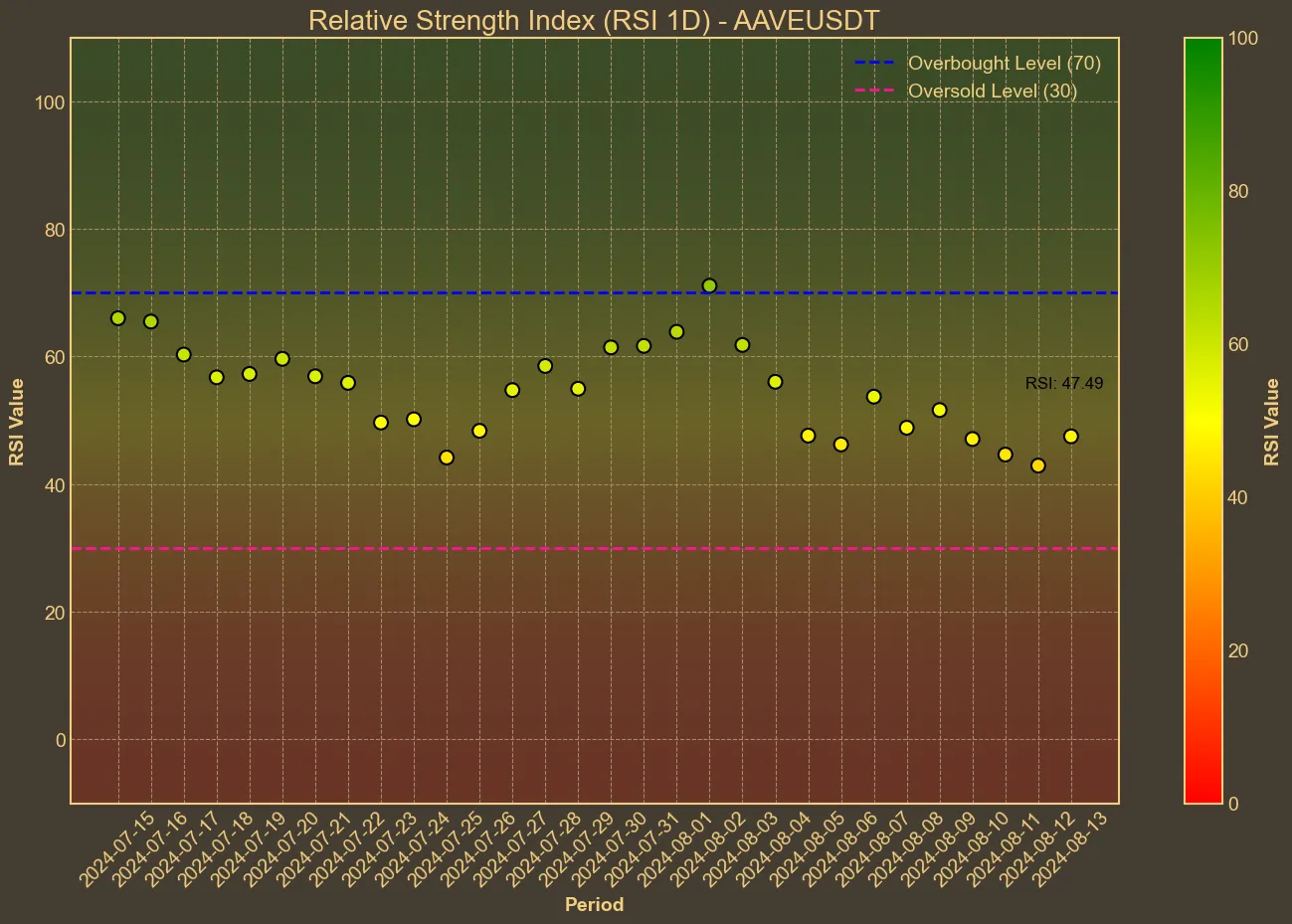

The Relative Strength Index (RSI) sits at 49, indicating a balance between buying and selling pressures. It suggests that the coin isn’t currently overbought or oversold. During the past week, RSI numbers hovered around the same range, reflecting a market lacking strong conviction in either direction.

Moving average indicators like the SMA (Simple Moving Average) and EMA (Exponential Moving Average) paint a nuanced picture. The SMA has seen a gradual decline from 100.66 a week ago to 99.49 today, signaling slight bearish sentiment. The EMA remains relatively stable, hovering around 98.21 over the recent week, indicating less pronounced price movements.

Bollinger Bands (BB_H at 113.12 and BB_L at 87.89) show a broad range, suggesting that Aave’s price has room to swing either way without immediately breaking established support and resistance levels. The MACD (Moving Average Convergence Divergence) at -0.46 with a signal of 0.81 indicates a bearish crossover, which might suggest a continuation of the present downtrend. Furthermore, the Awesome Oscillator (AO) shifting from positive to negative over the week tilts towards bearish momentum, hitting -4.13 today from 6.95 a week ago.

While technical analysis provides an immediate look at market sentiment and potential short-term movements, it has its limitations. Predictions based solely on technical indicators can often be misleading, especially with numerous external variables affecting the crypto market.

Despite some bearish signs from SMA, MACD, and AO, there are also bullish patterns in trading volume. This dual nature emphasizes the importance of balanced analysis, combining technical insights with broader market indicators and events.

While the data offers a snapshot of the present and hints at possible futures, it is crucial to recognize that technical analysis is but one layer in understanding Aave’s market behavior. Traders should remain cautious, using these tools in conjunction with careful market observation and strategic financial planning.