Aave has continued to assert its presence in the decentralized finance (DeFi) space, showing resilience and growth amidst a turbulent crypto market. With a current price of $110 and a market cap of $1.64 billion, Aave has not only managed to climb 13.86% in the last week but also maintained a year-over-year growth of 77.71%. These figures underline Aave’s ability to attract and retain investor interest, despite the broader volatility in the crypto space.

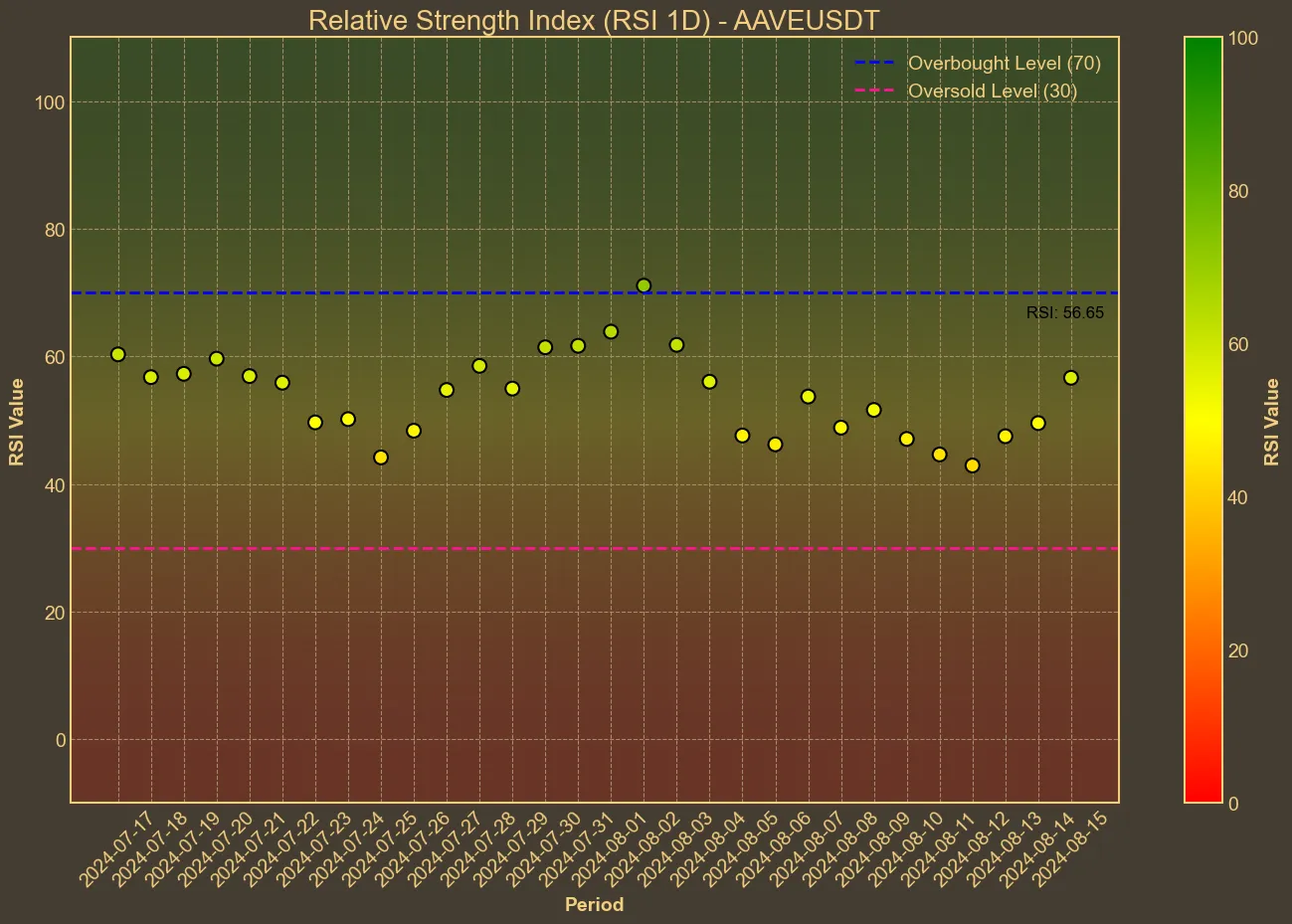

The technical indicators paint an intriguing picture of Aave’s current performance. The 14-day Relative Strength Index (RSI) has gradually risen to 60, indicating that the token is entering a more neutral to slightly bullish phase. This is further supported by the Simple Moving Average (SMA) and Exponential Moving Average (EMA), both of which have shown steady upward trends, signaling a potential continuation of the current price trajectory.

Moreover, Aave’s MACD (Moving Average Convergence Divergence) standing at 1.15, with a signal line at 0.81, suggests that bullish momentum is building, though it’s not yet fully dominant. This is a crucial point for traders to consider, as it reflects a market in the midst of deciding its next move, with a possible bullish breakout on the horizon if momentum sustains.

The Bollinger Bands, with a high of $114.53 and a low of $89.13, indicate that Aave is trading within a relatively wide range. This range provides both opportunities and risks, as the token could either surge past resistance levels or face further corrections, particularly if external market factors play against it. Meanwhile, the Average True Range (ATR) of 8.56 highlights the potential for higher price volatility, which traders need to navigate carefully.

In the context of recent news, Aave’s platform has seen a significant uptick in user activity. The surge in weekly active borrowers to around 40,000 is a testament to Aave’s growing adoption, especially on newer platforms like Base and Scroll, which are driving a significant portion of new activity. The success of Aave’s V3 protocol, along with its strategic expansion across various Layer-2 solutions, has positioned it well for continued growth in the DeFi sector.

However, it’s important to remember that while technical analysis provides valuable insights into Aave’s current market behavior, it cannot predict the future with certainty. Market sentiment, external economic factors, and developments within the broader crypto ecosystem will continue to play pivotal roles in shaping Aave’s trajectory. Investors should remain cautious, balancing optimism with the understanding that the crypto market’s inherent unpredictability can lead to swift changes in fortune.

In conclusion, Aave’s recent performance and technical indicators suggest that it is well-positioned for potential gains, but with the ever-present risks that come with any DeFi investment. As Aave continues to evolve and adapt, its ability to navigate these challenges will be crucial in determining whether it can maintain its upward momentum or if a more conservative approach will be necessary in the coming months.