Examining technical indicators reveals that Aave is showcasing strong positive momentum. Over the past week, the cryptocurrency has experienced a notable upward trend, with price increases reaching 27.65%. This surge has continued over the past month and quarter, bolstering investor confidence. Aave’s current price stands at $119, aligning closely with its upper Bollinger Band at $119.76, which often indicates a possible overbought condition.

Price Action and Market Sentiment

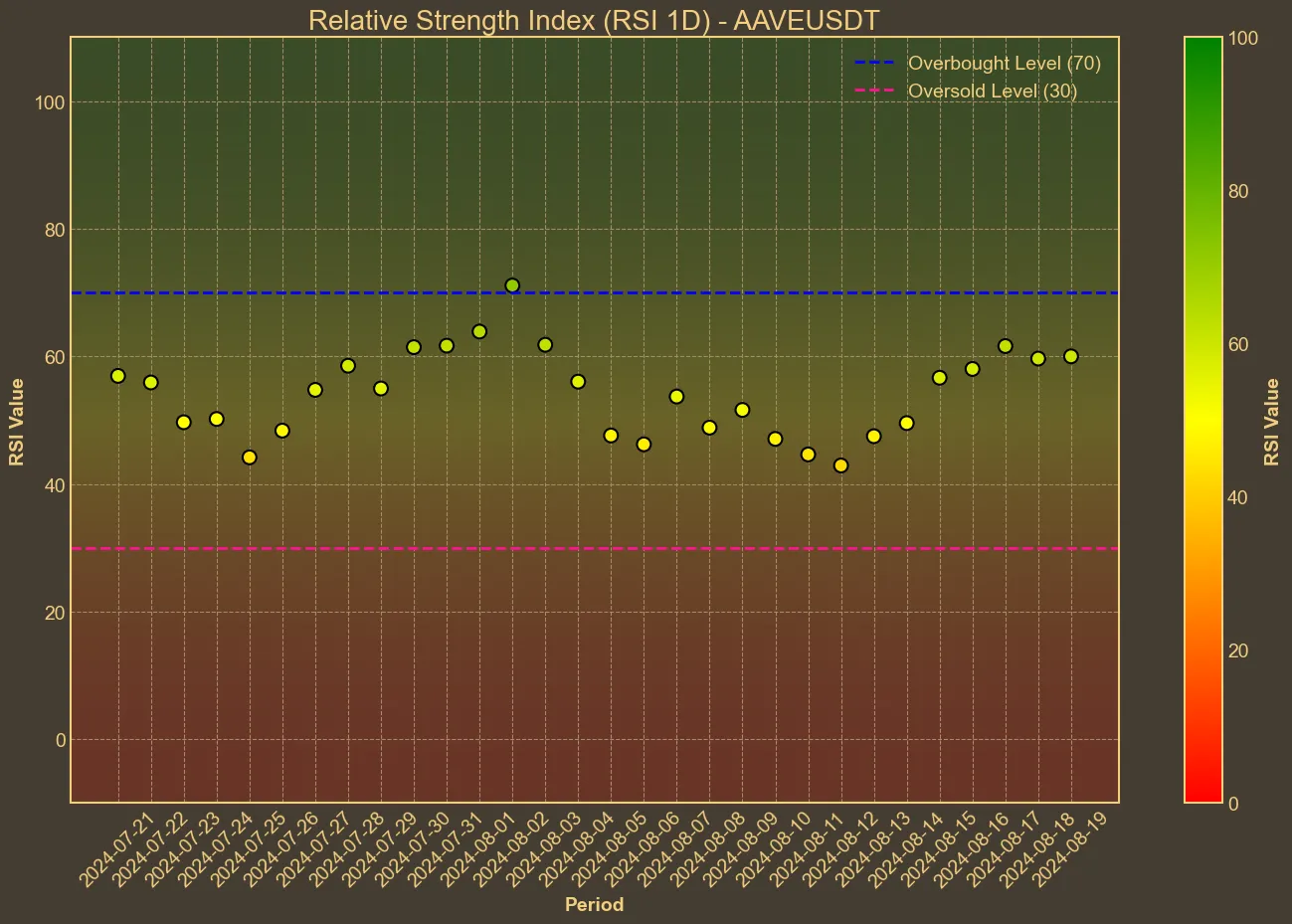

Looking at the Relative Strength Index (RSI), a critical measure of market sentiment, Aave’s RSI has climbed to 66, up from 47 just a week ago. This consistent rise suggests robust buying pressure but may soon venture into overbought territory. The Moving Average Convergence Divergence (MACD) indicator further supports a bullish outlook, with the MACD line significantly above the signal line, indicating strong upward momentum.

Implications and Analysis

Meanwhile, the Simple Moving Average (SMA) and Exponential Moving Average (EMA) both show clear upward trends. The SMA has risen from 99.53 a week ago to 103.05 today, while the EMA maintains a similar pace. This alignment in moving averages demonstrates the underlying strength in Aave’s price action.

Additionally, the surge in trading volume—an extraordinary 339% increase over the past 30 days—highlights growing market interest and liquidity in Aave. However, the substantial volume could also signify heightened fragility; swift movements might introduce price swings as traders look to capitalize on the asset’s volatility.

Market capitalization, crucial for gauging Aave’s market standing, has also shown a healthy increase, climbing 20.51% in the past month. This growth in market cap reflects broader investor interest and trust in the asset’s valuation.

Yet, it’s essential to acknowledge that technical analysis, while insightful, has its limitations. Market movements are influenced by many factors, not all of which are captured through technical indicators. Broader market trends, regulatory changes, and macroeconomic factors can also heavily impact Aave’s price performance.

In my opinion, while Aave’s technical indicators paint a positive picture, investors should remain cautious. The rapidly increasing RSI and close proximity to the upper Bollinger Band suggest that a price correction might be on the horizon. As always, diversifying investments and not relying solely on technical analysis can provide a more balanced investment strategy.