Understanding the current technical landscape of JasmyCoin reveals a mix of bullish and bearish signals, driving investor sentiment and market forecasts. The recent data depicts an intriguing picture, one that necessitates closer examination to fully understand its implications.

Short-Term Trends and Market Activity

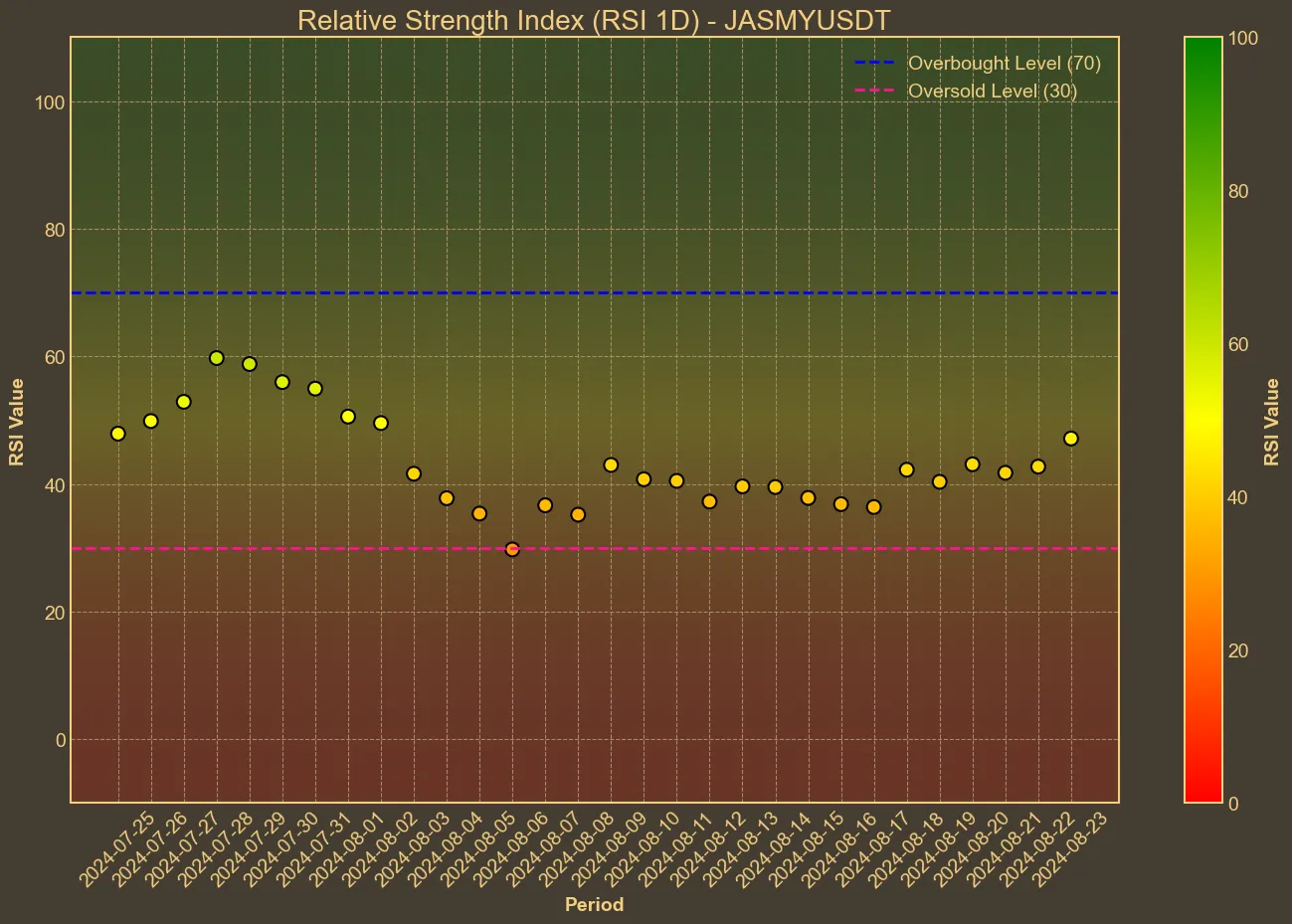

Recent price trends indicate short-term upward momentum for JasmyCoin, highlighted by an 11.32% price increase over the past week. This surge aligns with a 9.63% rise in market cap during the same period, reflecting renewed investor interest. Interestingly, the current Relative Strength Index (RSI) stands at 47, a neutral zone suggesting the asset is neither overbought nor oversold. The Elliott Wave Oscillator (AO) also displays cautious optimism, hovering around the zero mark, indicating potential stability rather than volatility.

Despite these positive movements, a broader view reveals mixed performance. The past month saw a 19.41% drop in price and a 22.25% decline in market cap. This downward shift followed a strong quarter where prices generally rose by 4.75%. However, the most striking statistic is the year-on-year price change of 538.41%, showcasing the formidable growth dynamics that JasmyCoin has experienced over the long term.

Technical Indicators and Strategic Takeaways

Key technical indicators like the Simple Moving Average (SMA) and the Exponential Moving Average (EMA) remain consistent, providing a steady baseline at around $0.02. These averages suggest that while daily fluctuations occur, the long-term trend maintains a stable pathway. Bollinger Bands (BB_H and BB_L) steady near the same level, implying low volatility. The Moving Average Convergence Divergence (MACD) remains at -0.0, suggesting cautious market sentiment without a clear bullish or bearish trend.

The trading volume for JasmyCoin has seen a revival, posting an 8.63% increase in the last day. However, a mixed volume pattern over the past month indicates intermittent trading interest, which may affect liquidity. Significant volume changes over brief spans often precede shifts in trend, so keeping an eye on these fluctuations is crucial for strategic market entry or exit.

JasmyCoin reveals both opportunities and cautionary signs. The recent uptick in short-term metrics might attract investors seeking quick gains. However, the past month’s dip and neutral technical indicators advise prudence. Technical analysis provides insights into trends and potential price movements, but it is essential to recognize its limitations. Market sentiment, external news, and macroeconomic factors can have substantial impacts that technical tools may not fully capture. Hence, combining technical analysis with comprehensive market research is paramount for informed decision-making. Investors should remain vigilant, adopting a diversified approach while keeping an eye on emerging signals and market narratives that can reshape the landscape.