Bonk’s current performance in the cryptocurrency market tells a compelling story of potential and risk. The coin is holding its ground as the #56 cryptocurrency by market capitalization, currently valued at $1.3 billion. Despite recent dips, particularly a 44.09% decrease over the last quarter, Bonk has shown a surprising resilience, as evidenced by an 8254.16% increase over the past year. Such dramatic fluctuations underscore the dynamic nature of this asset.

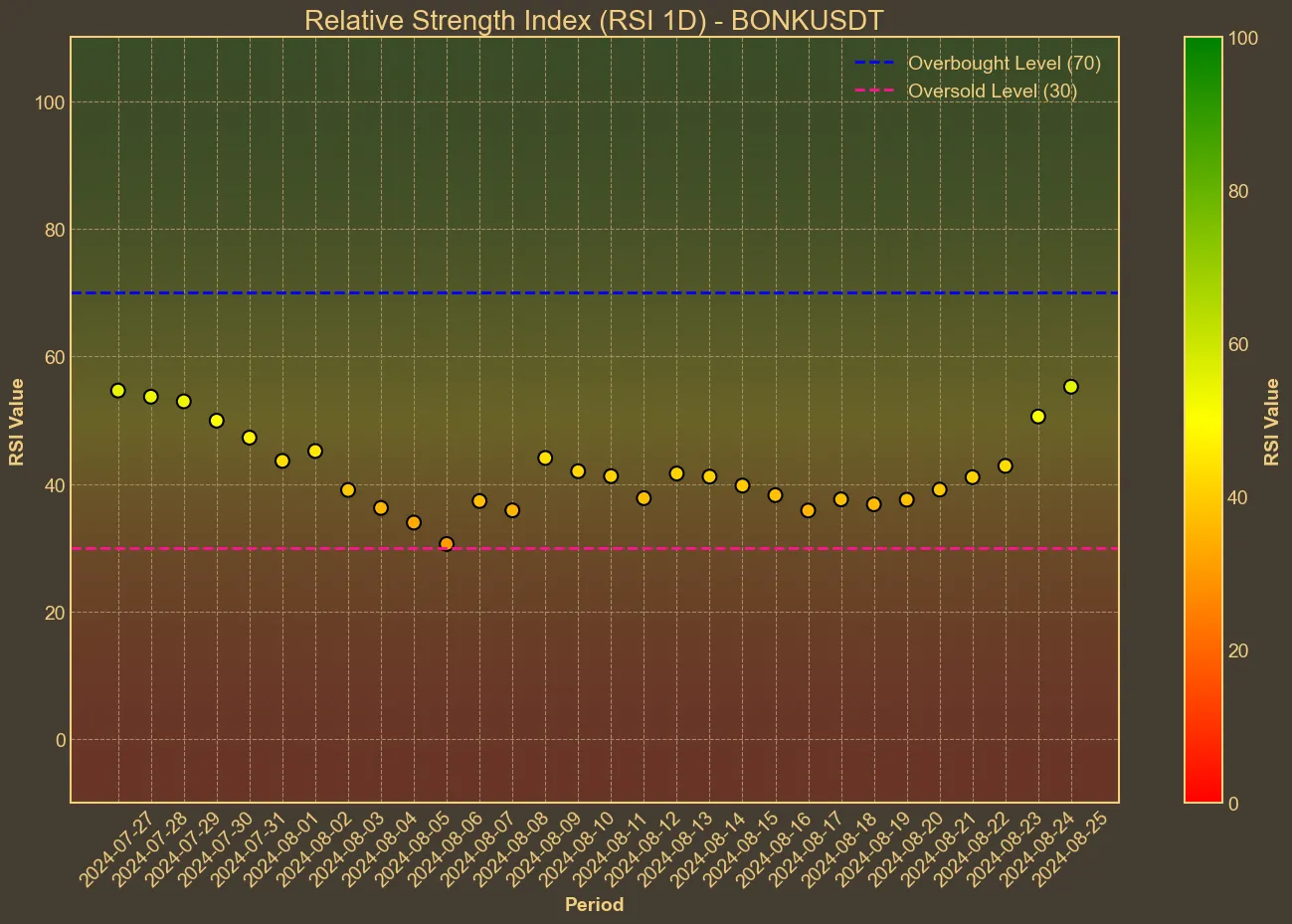

Technical indicators provide a picture of Bonk’s potential trajectory. The Relative Strength Index (RSI) has shown intriguing turns; rising from 37 a week ago to 53 today indicates a temporal buying momentum. This upward trend could suggest that the asset might be gaining strength for a potential rebound. However, the recent dips in key metrics like the Simple Moving Average (SMA) and Exponential Moving Average (EMA) highlight caution, particularly the recent bearish crossover noted in the SMA data.

Traders’ Perspective

The recent data suggests a cautious short-term outlook as volumes have seen a significant drop by 34.77% over the last month. This decline in trading volume might point to a period of stabilization or waning interest among traders, at least temporarily. Meanwhile, the Average True Range (ATR) indicates a moderate level of volatility, which needs to be considered for short-term trading strategies.

Market sentiment, as reflected in news sources, points to a divided perspective. While some predict a potential short squeeze could drive prices upward, others highlight the bearish trends currently present in the moving averages. This dichotomy is emblematic of the broader market uncertainty and the speculative nature surrounding this asset.

Implications and Opinions

The mixed signals should encourage investors to proceed with balanced caution. While the RSI suggests some emerging bullish momentum, the overall decline in trading volume and consistent bearish signals from moving averages warrant careful consideration. Technical analysis offers valuable insights, yet it is not an infallible predictor of future performance. External factors, market sentiment, and broader economic conditions remain significant influencers of Bonk’s market behavior.

Given Bonk’s history of volatile swings, short-term traders may find opportunities, albeit amid high risks. Long-term investors should closely monitor upcoming market developments and analyze macroeconomic indicators to make informed decisions. While optimism persists among some market watchers, the evident declines invite a measured approach, keeping in mind the inherent limitations of technical analysis.