The BOOK OF MEME (BOME) project, which integrates meme culture with decentralized technologies, has seen better days. Currently ranked #115 in the crypto market with a price of $0.00667, the recent data paints a mixed picture. While noting a slight uptick this past week, the overall trend over the past three months shows significant downturns.

Table of Contents

Short-Term Indicators

A glance at the recent technical indicators shows a combination of stability and mild fluctuations. The Simple Moving Average (SMA) and Exponential Moving Average (EMA) display minimal variations, suggesting that short-term movements are relatively steady. The current SMA stands at 0.006202 while the EMA is pegged at 0.006491. Both indicators only show slight movement, hinting at a period of consolidation. On the other hand, the Awesome Oscillator (AO) has turned positive after a series of negative values, further hinting at a potential shift in momentum.

Volatility and Market Interest

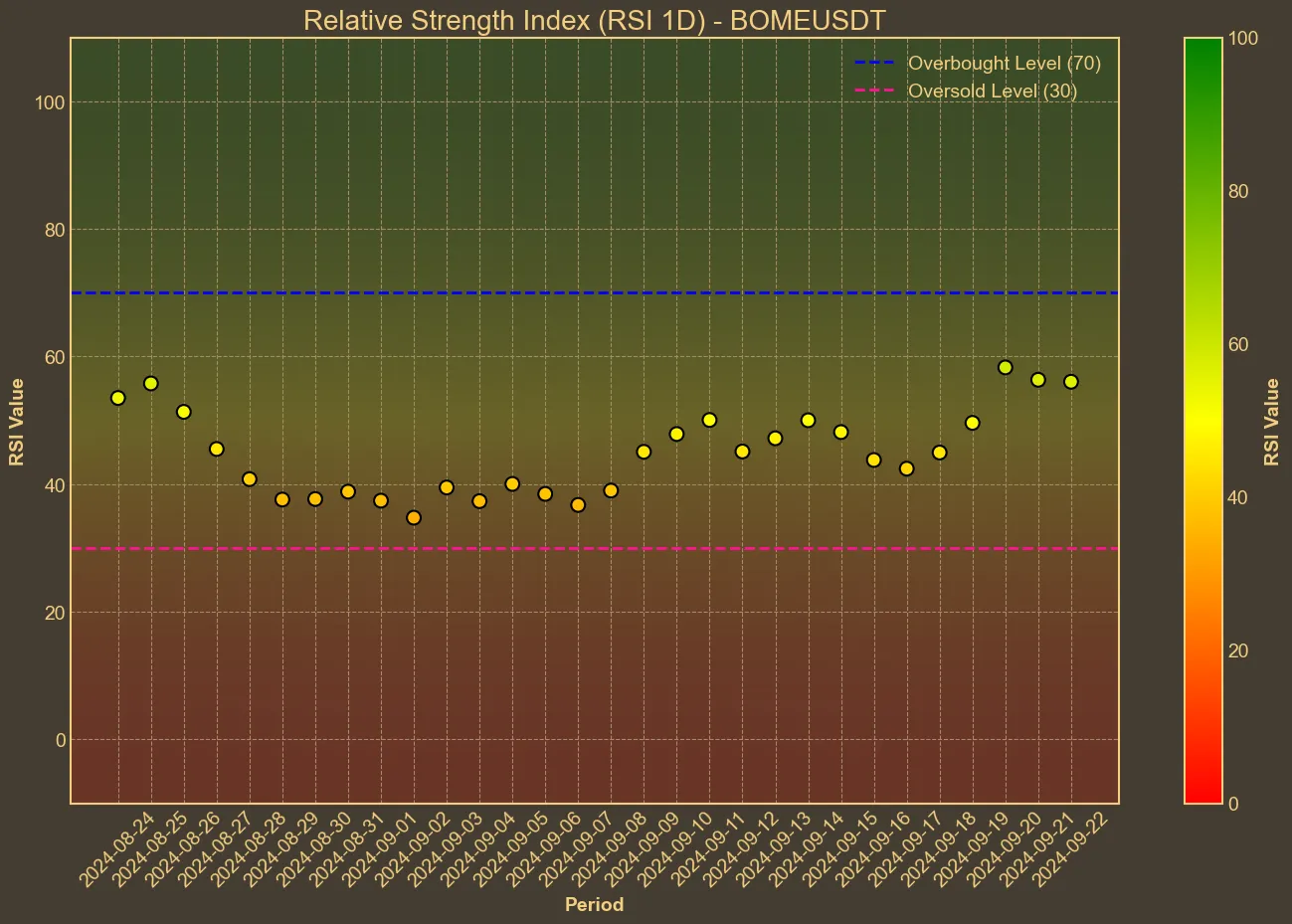

Despite modest price changes, the trading volume has seen drastic shifts, plummeting by around 31% over the past month. This drop in volume can be a red flag, as it might indicate waning interest among traders and investors. Meanwhile, the Relative Strength Index (RSI) currently stands at 53, up from 42 a week ago. An RSI within this range generally indicates neither overbought nor oversold conditions, but the upward trend could suggest growing interest or a strengthening position.

The price movements and the changing volume highlight the complexities of establishing a clear trend for BOME. While the coin shows some signs of life in the short term, long-term indicators raise questions about its sustainability.

The Road Ahead

There’s a possibility that BOME might regain its footing, given the volatility of memecoins. Yet, the notable decline in market cap and volume over recent months would concern potential investors. It’s essential to remember the limitations of technical analysis though – it can’t account for sudden market shifts or external factors that might influence the coin’s value. Investors should remain cautious and consider the broader context surrounding the coin.

Whether BOME can stage a comeback depends on a variety of factors, including renewed interest in memecoins, broader market conditions, and the project’s ongoing developments. The future remains uncertain, but the signs of stabilization offer a sliver of hope for its proponents.