Dogwifhat (WIF), a Solana-based memecoin, is facing a tough period, with its price plummeting over 59% in the past month and more than 38% in just the last week. Currently trading near $0.75, this marks its lowest level since its rise in March 2024.

The downturn has been made worse by the emergence of the TRUMP coin, which has attracted liquidity away from other memecoins. Moreover, the recent controversy surrounding the highly anticipated Las Vegas Sphere display also did not help. With sentiment shaken, the key question remains: can WIF stage a recovery?

Table of Contents

Momentum Indicators

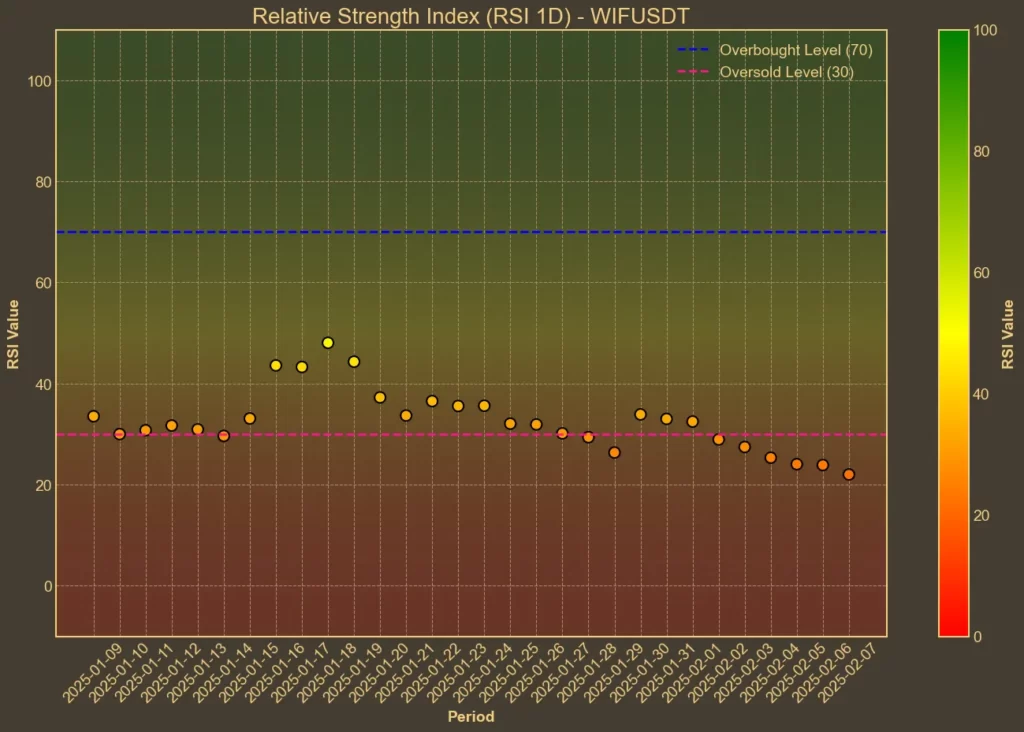

RSI: Oversold, Bearish momentum

The Relative Strength Index (RSI) stands at 25, signaling WIF is firmly in oversold territory. Its continued decline suggests bearish momentum is likely to persist.

MFI: Weak

The Money Flow Index (MFI), which incorporates volume into its analysis, has slightly improved to 20 from 18 yesterday but remains near oversold conditions, indicating weak buying interest.

Fear & Greed Index: Neutral

Currently at 44 (down from 49 yesterday and 54 two days ago), the index reflects a neutral sentiment but with a growing bearish inclination. A broader shift in market sentiment could help WIF, given that memecoins thrive on hype and momentum.

Moving Averages

SMA & EMA: Bearish

Both the short-term and long-term moving averages (SMA and EMA) indicate a sustained downtrend, with no signs of reversal yet.

Bollinger Bands: Downtrend

WIF’s price has consistently hugged the lower Bollinger Band over the past month, reinforcing the ongoing downtrend while hinting at potential oversold conditions.

Trend & Volatility Indicators

ADX: Strong Bearish Trend

With an ADX reading of 41 and rising, WIF’s bearish trend remains strong, showing no immediate signs of weakening.

ATR: Lower Volatility

The Average True Range (ATR) at 0.176 suggests declining volatility, potentially signaling price stabilization in the near term.

AO: Negative

The Awesome Oscillator (AO) is at -0.61, dropping from -0.45 a week ago, confirming the bearish momentum.

VWAP: Bearish Pressure

With WIF trading below its Volume Weighted Average Price (VWAP) of 2.16, downward pressure remains dominant.

Relative Performance

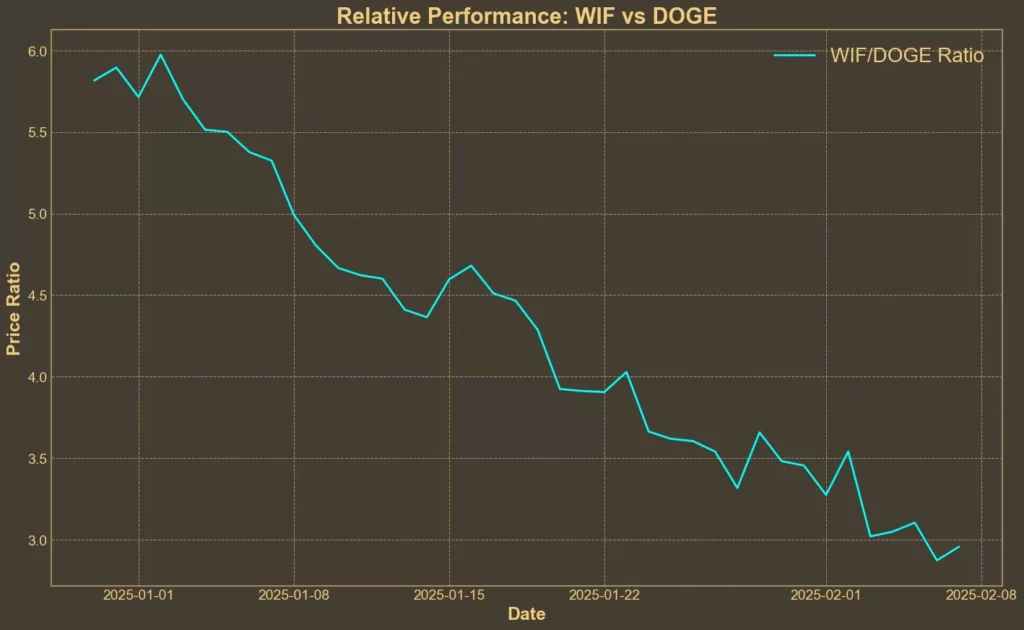

Comparison Against DOGE: Underperforming

While the entire memecoin market has faced declines, WIF’s performance relative to Dogecoin (DOGE) has been notably weak. The WIF/DOGE ratio has dropped by 14.3% in the last seven days and by 38% over the past month, highlighting WIF’s underperformance despite its smaller market cap.

Las Vegas Sphere Controversies

Adding to the uncertainty, the much-hyped Las Vegas Sphere marketing campaign remains in limbo. The WIF team raised approximately $700,000 in March 2024 to showcase its mascot on the Sphere, but little progress has been reported since.

Last week, the team teased a possible Q1 2025 launch with a cryptic post. However, a report from Decrypt claims that Sphere representatives denied any formal agreement.

The WIF team responded, stating that negotiations are ongoing through an established third-party brand and assured investors that the funds would be refunded if the deal falls through.

Despite reassurances, the lack of concrete updates has fueled skepticism, reflected in WIF’s continued price decline. However, if the Sphere deal materializes, it could reignite interest in WIF and trigger a potential recovery.

Conclusion

WIF’s technical indicators paint a largely bearish picture. Momentum indicators suggest oversold conditions, but moving averages and trend indicators confirm the downtrend. The unresolved Sphere controversy has further dampened investor confidence.

That said, technical analysis has its limits. A surprise bullish catalyst – such as a confirmed Sphere deal -could rapidly shift market sentiment and drive a strong rebound. However, until then, WIF remains under pressure, with its future hanging in the balance.

Need a quick and easy way to see what’s happening in crypto over the next few days? Check out our Crypto Events Calendar!