Celestia, currently ranked #56 in the cryptocurrency market, is trading around $5 per token. While this is a notable drop from its peak in February, the token has seen an impressive 18.5% gain over the past week, including a 7.5% increase in the last 24 hours. Could this signal the end of the bear market for TIA?

Decoding the Technical Indicators

The market cap is currently at $1.05B, showing a slight increase of 3.5% in the last day and 11% over three days. This points to a modest recovery, yet the longer-term trend still shows a 1.3% decline over the last month. A similar trend can be observed in trading volumes, which jumped by 46% in the last day. However, over the past week, volumes dipped by 14.5%. Interestingly, the 127% increase in volume over the last month suggests periods of heightened trading activity.

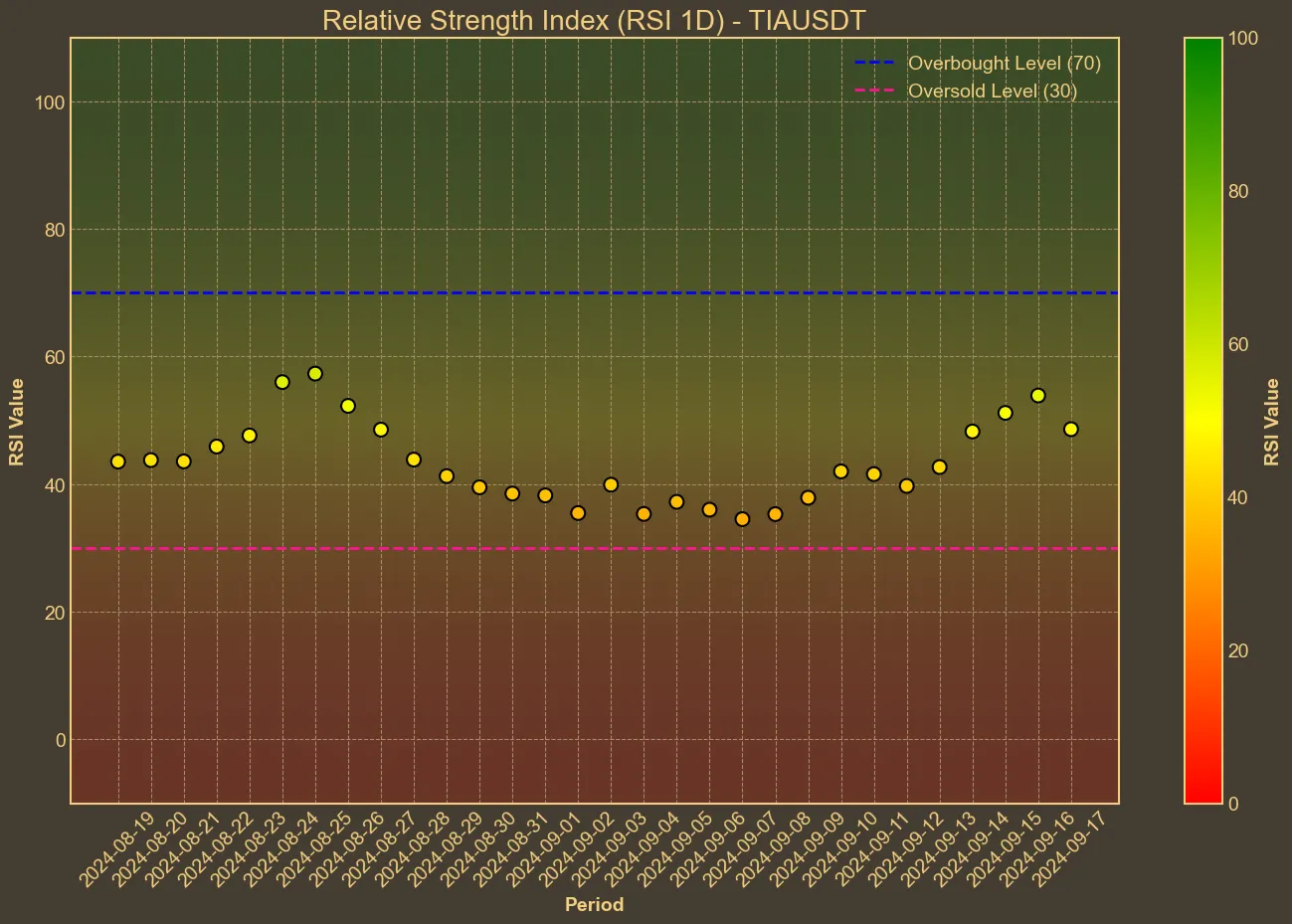

Technical indicators provide further insight. The Relative Strength Index (RSI) has climbed from a low of 40 over the past week to a current value of 57. This suggests increasing bullish sentiment. Support is also described by the Simple Moving Average (SMA) and Exponential Moving Average (EMA), which have stabilized around the $4.60 range, showing less volatility in the short term.

Other technical indicators such as the MACD and Awesome Oscillator (AO) suggest mixed sentiment. The MACD is currently at -0.09, slightly better than the signal line at -0.22, yet still in negative territory. The AO also shows improvement from -0.92 a week ago to -0.10 today. These indicators hint at potential bullish reversals but don’t yet confirm a strong upward trend.

The Bollinger Bands (BB) reveal that the price is hugging the lower band, indicating that the asset might be oversold. ATR stands at 0.42, signaling moderate volatility in the market.

What’s Next for Celestia (TIA)?

Though there are promising signs, caution is warranted. The gains over the short term could be transient, and the longer-term trends suggest persistence of downward pressure. It’s crucial for investors to regard this information with measured optimism and consider all factors before making decisions.

It’s also essential to acknowledge the limits of technical analysis. These tools don’t account for sudden market shifts driven by external factors, such as breaking news or macroeconomic changes. In particular, tomorrow’s Federal Reserve decision on interest rates could have a significant impact on the broader crypto market, including Celestia’s price movement in the coming days.