Celestia (TIA) is one of the pioneers in modular blockchain architecture, which aims to solve the scalability problems that have long plagued monolithic blockchains. By separating consensus, data availability, and execution into different layers, Celestia allows for more efficient and flexible development of decentralized applications. This could be particularly valuable as blockchain adoption grows and applications require more scalable infrastructure.

While it sounds promising, the coin has seen its price plummet by over 80% since February, now hovering under $4. Despite major technological advancements and a growing developer community, the market sentiment surrounding Celestia remains grim. So, what’s behind this price decline, and does Celestia have the potential to rebound?

Technical Analysis: A Bearish Market Outlook

Celestia’s price has declined significantly since February, losing over 80% of its value. This drop is mirrored in key technical indicators like the Simple Moving Average (SMA) and Exponential Moving Average (EMA), both of which demonstrate sustained downtrends. The consistent decline in SMA reflects the persistent bearish sentiment surrounding the token.

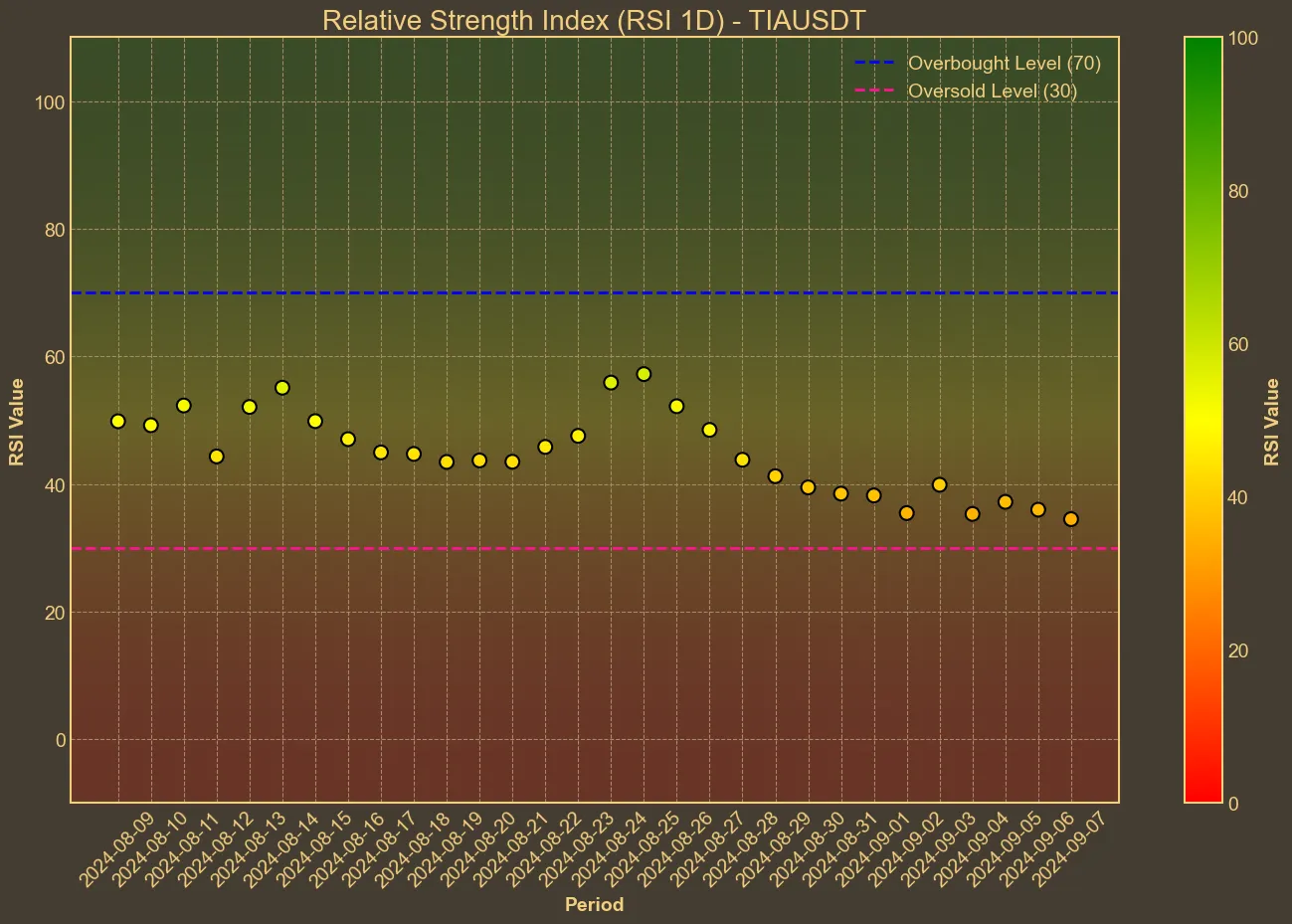

The Relative Strength Index (RSI) hovers around 36, indicative of a market that leans towards being oversold, but not severely enough to cause immediate concern for reversal. This figure reflects weak buying pressure, insufficient to counteract the prevailing selling momentum. Further supporting this bearish outlook, the Fear and Greed Index sits at 23, signaling extreme fear in the market.

The Moving Average Convergence Divergence (MACD) is in negative territory, aligned with the overall market trend for Celestia. This bearish divergence, with MACD below its signal line, indicates ongoing downward momentum. Adding to this, the Awesome Oscillator (AO) remains negative, pointing to a continued weakening in market strength. While trading volume has increased recently, this appears to reflect more sell-offs rather than renewed buying interest, especially in light of ongoing macroeconomic concerns.

Recent Developments: Can Innovation Drive a Rebound?

Despite the ongoing bearish market sentiment, Celestia continues to push forward with impressive technical developments. The most notable recent advancement is the announcement of scaling to 1-gigabyte blocks, a major upgrade aimed at significantly increasing data throughput for decentralized applications built on its modular blockchain.

Celestia’s Mainnet Beta, launched last year, already supports over 20 rollups, and its innovative “blobs” now represent 40% of the total data published on the network. The platform’s roadmap includes major upgrades, such as the upcoming Lemongrass release, which aims to scale throughput and improve developer experiences.

The vision of Celestia is bold: to deliver Visa-level transaction capacity, allowing for high-throughput DeFi, fully on-chain games, and many other performance-heavy applications. These developments could dramatically improve Celestia’s technical capabilities, positioning it as a key player in the modular blockchain space.

However, despite these promising advancements, the market price has yet to respond positively. Celestia remains under $4, and there’s a noticeable disconnect between the platform’s technical progress and market performance.

Conclusions

Despite Celestia’s technological promise, the market hasn’t yet priced in these developments. Investor confidence remains low, as evidenced by the token’s ongoing decline. The contrast between Celestia’s roadmap and its market performance raises questions about whether the platform can meet its lofty goals and, more importantly, whether it can restore investor confidence.

For now, prospective investors should remain cautious. Technical indicators suggest that bearish momentum continues, and Celestia may face ongoing downward pressure until it demonstrates greater stability and growth. External factors, such as the Federal Reserve’s upcoming decision on interest rates on September 18th, could also influence market sentiment and the token’s price.

That said, Celestia’s modular approach is innovative, and if it can overcome the hurdles of adoption and technical challenges, it could become a foundational infrastructure layer in the blockchain space. But for now, its ability to rebound from current lows remains uncertain.