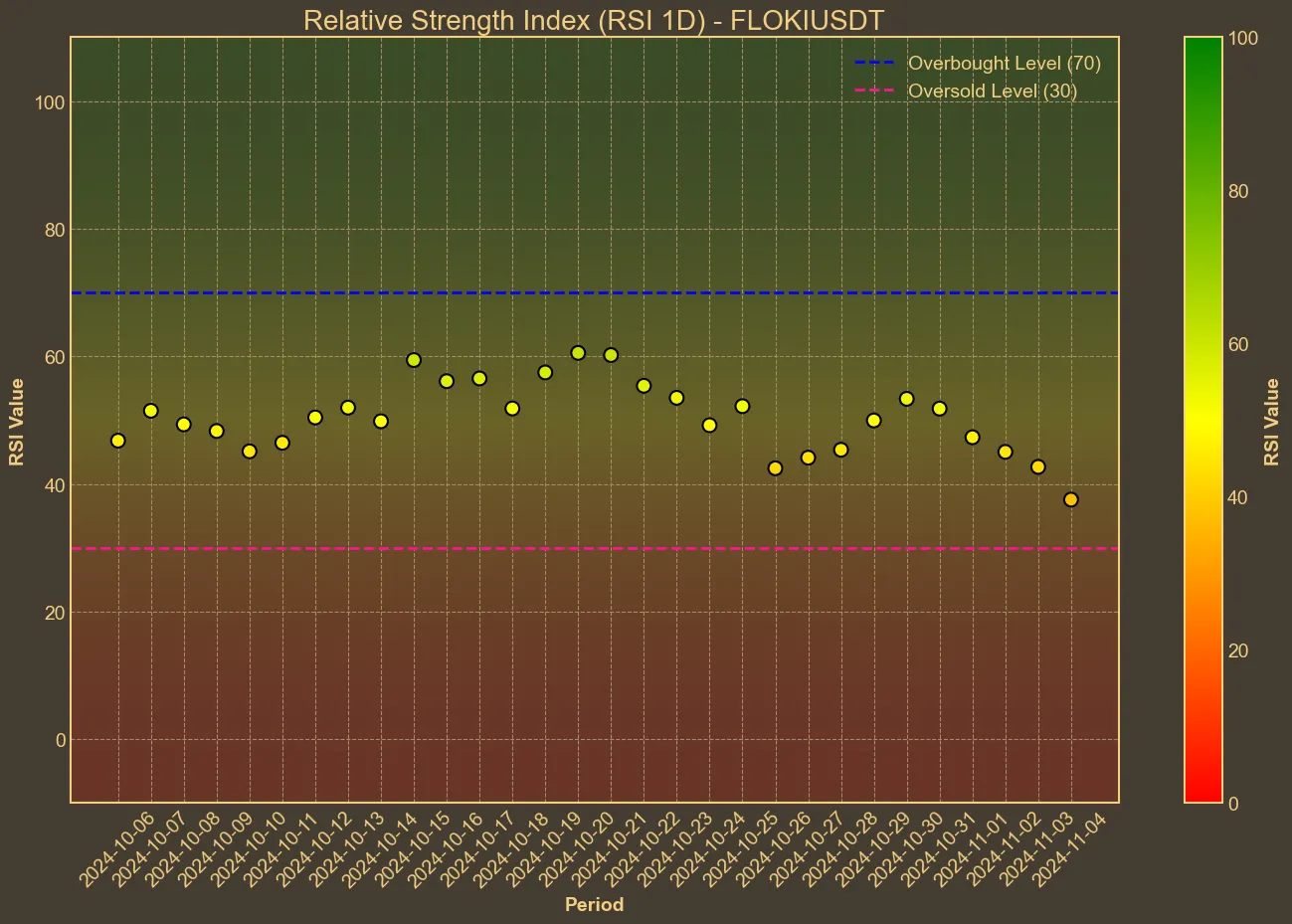

The recent data for Floki Inu paints a picture that is both intriguing and concerning. On one hand, its price has seen notable growth over the last year, boasting an impressive increase of over 290%. Yet, the short-term indicators reveal a story of recent turbulence and uncertainty. The coin has experienced a gradual decline in value over the past month, with a marked decrease in its price and market cap. This trend is reinforced by the Relative Strength Index (RSI) sitting below 40, which hints at a weakened buying pressure and potential overselling.

The bearish signals are further supported by other technical indicators. The Moving Average Convergence Divergence (MACD) is in negative territory, suggesting a bearish momentum, while the Awesome Oscillator (AO) remains below zero, indicating that the bearish sentiment could persist. These signals align with the market’s guarded outlook, contributing to a growing apprehension among investors about the coin’s immediate trajectory. The persistent pressure is mirrored in recent volume changes as well, with a drastic increase in volume over the last seven days, although this has not translated into a significant price recovery.

Looking Ahead: Challenges and Opportunities

It should be noted that technical analysis, while useful, is not infallible. It largely focuses on past price movements and volume trends, which means it can sometimes miss out on fundamental changes or news that could impact Floki’s future. For instance, presidential elections, broader economic factors, new developments in the cryptocurrency sector, or memecoin hype could alter the market’s direction. While some news articles suggest potential short-term rallies for the coin, these predictions should be approached with caution.

In conclusion, while Floki Inu faces current challenges and technical indicators are bearish, the possibility of future growth should not be dismissed outright. Investors should keep a watchful eye on both the technical indicators and the broader market environment. Analytical tools can provide valuable insights but must be complemented with an understanding of external factors that might drive the market.