No Security Breach: Addressing the Fake News

First of all, it’s crucial to clarify that recent social media posts claiming a security breach on FLOKI and a few other coins are entirely false. After our investigation, we confirmed that these rumors are baseless and are not connected to the recent price movements of FLOKI. The coin remains secure, and the ongoing price fluctuations are driven by other factors.

Table of Contents

Market Dynamics: The Real Reason Behind the Dip

The significant drop in FLOKI’s price can be attributed to concerns surrounding the selling activity by a wallet linked to the Floki Inu team. This wallet was reactivated after over two years of dormancy, just before the price plunge. The wallet deposited approximately $2.27 million worth of FLOKI tokens to Binance, which has stirred anxiety among holders about a possible large-scale sell-off. Notably, this wallet received the tokens in early 2022 from the Floki deployer, when they were valued at $468,000. This reactivation and subsequent deposit have contributed significantly to the bearish sentiment currently affecting FLOKI.

It’s also important to note that the entire cryptocurrency market has seen a downturn, with all top 10 cryptocurrencies currently in the red. While FLOKI’s drop is more pronounced than the general market trend, this broader context of a crypto-wide decline cannot be ignored.

FLOKI’s Technical Landscape: Mixed Signals

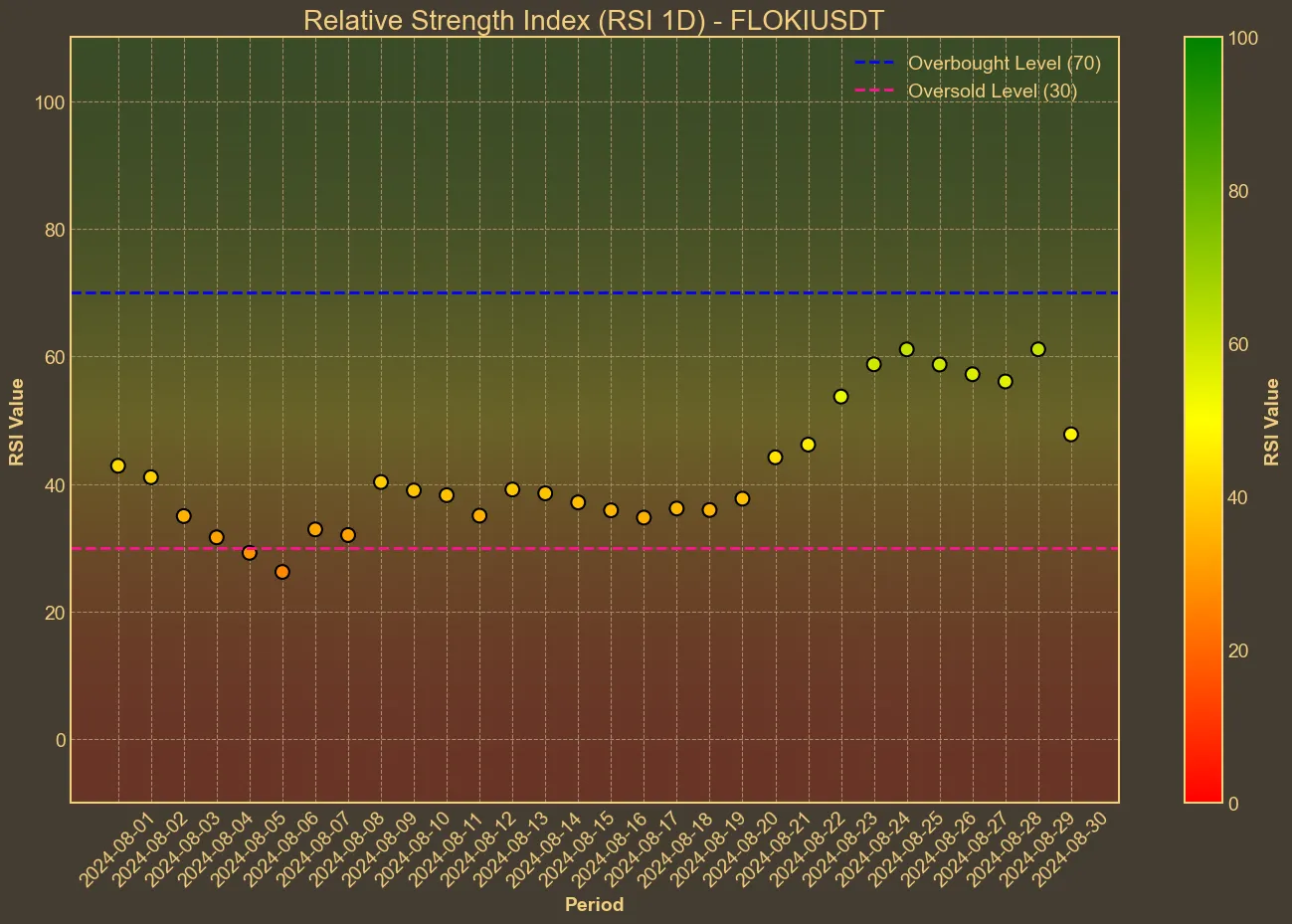

Amid these developments, Floki Inu’s technical indicators reveal a blend of caution and opportunity. In the past month, FLOKI’s price has seen a significant decline, with the relative strength index (RSI) now at 42, placing it in neutral to slightly oversold territory.

Market Dynamics and Volume Insights

The trading volume for FLOKI has seen a dramatic increase, especially over the last 30 days, surging by over 246%. This rise in volume typically hints at heightened trader interest and activity, which can be seen as a positive sign for potential price stability or rebound. Despite the price setbacks, such volume boosts can provide liquidity and possibly curb further dramatic price drops.

However, it’s essential to recognize that volume alone cannot predict price movements entirely. The increased volume against a backdrop of falling prices may suggest more sellers than buyers, contributing to FLOKI’s overall price decline.

Moving Averages and Momentum Indicators

Looking into the moving averages, the simple moving average (SMA) and the exponential moving average (EMA) have slightly declined. This suggests that despite brief recoveries, the overall sentiment leans bearish. However, the MACD indicator, though below zero, shows a bullish crossover, signaling that the downward momentum might be easing, offering a hint of reversal potential.

It’s also noteworthy that the Awesome Oscillator (AO) values have oscillated around zero, indicating weak momentum. However, the recent positive values in AO could be early signs of a trend shift, which aligns with the MACD’s suggestion of reduced bearish momentum.

Potential Oversold Conditions: A Strategic Entry Point?

Given the recent price drop and sudden drop in RSI, there is a possibility that FLOKI is oversold. For those who believe in the project’s long-term potential, this might be an opportune moment to buy the dip. It’s worth remembering that a similar 20% drop occurred in March, after which the price generally recovered. This historical context might offer some reassurance to investors considering entering the market at this point.

Conclusion

FLOKI’s current technical landscape presents a mixed bag. For investors, this is a period requiring careful observation and potential for strategic entry points considering the recently oversold conditions. However, technical analysis alone does not guarantee future performance and should always be complemented with broader market insights and fundamental news.