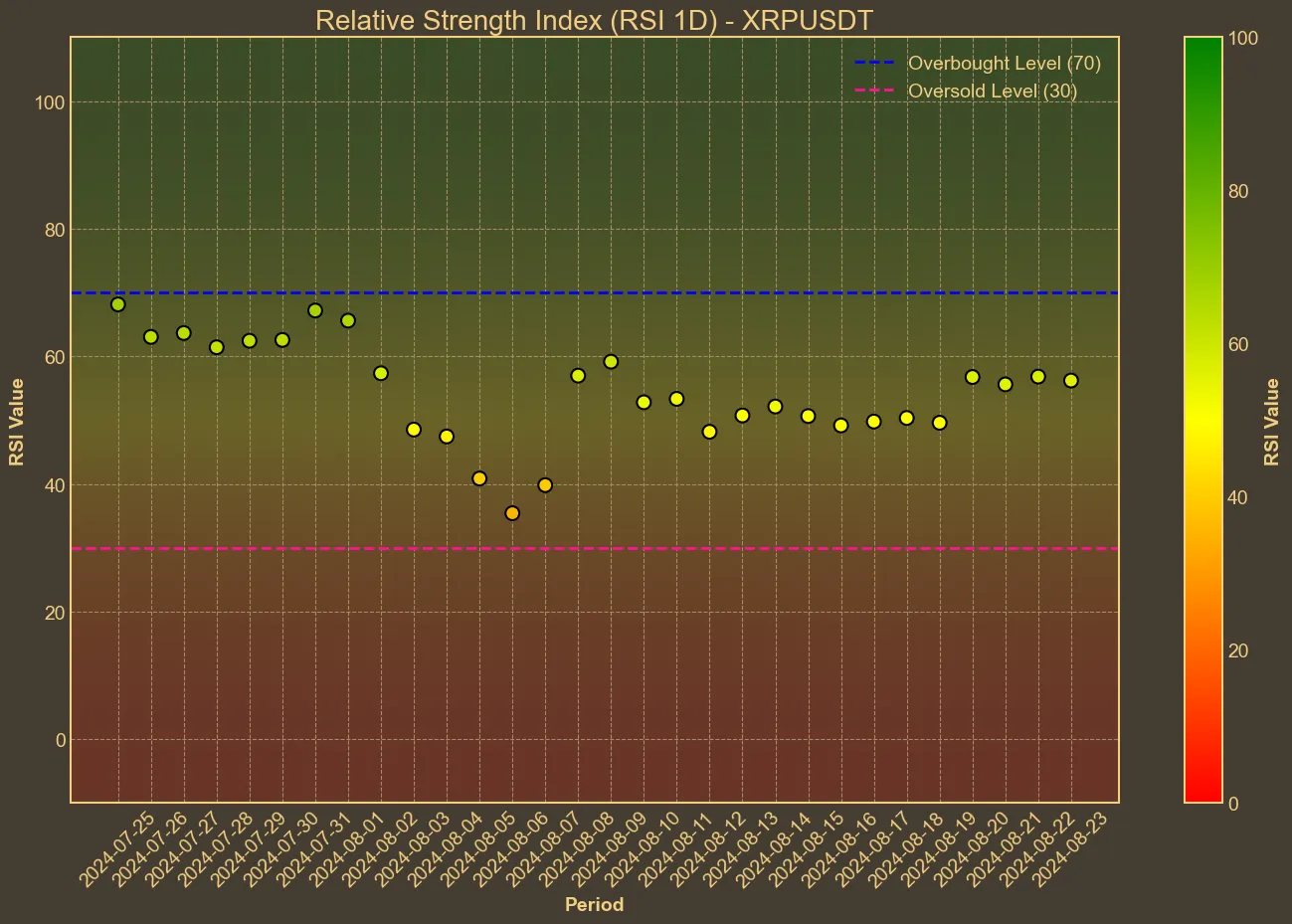

The current sentiment around Ripple (XRP) is brimming with optimism as technical indicators hint at a potential breakout. The price has been steadily recovering from a slight dip last month, with an 11.42% increase over the last quarter and a 15.98% rise over the past year. The RSI today stands at 57, suggesting a reasonably strong momentum without being overbought. Analyzing XRP’s recent price behavior, it’s clear that the coin is exhibiting signs of resilience and possible upward momentum.

Technical Indicators Are Positively Aligned

Starting with the Simple Moving Average (SMA) and Exponential Moving Average (EMA) both holding steady at $0.58, there’s an indication of strong price support at this level. The MACD and MACD Signal are aligned at 0.01, further supporting a bullish divergence that could trigger a price surge. The Bollinger Bands also shed light on potential price movements, with the high band at $0.64 and low band at $0.51. This suggests a relatively narrow trading range, meaning that if XRP does break past these levels, we could witness significant volatility.

Adding to the technical signals, the Accelerating Oscillator (AO) has remained positive for the recent days, although marginally. This subtle but consistent positive trend shows accumulation, likely setting a solid foundation for further gains. The Average True Range (ATR) at 0.03 reflects low volatility, at least for now, which might change soon if a breakout occurs.

Market Dynamics and Potential

Market capitalization and volume changes provide additional insights. While the market cap has slightly declined by 0.01% over the last day, it remains robust at $33.74 billion, indicating sustained investor interest. Daily volume has risen by 7.36%, signaling heightened trading activity and possible accumulation by both retail and institutional investors.

Recent developments and headlines reinforce this positive sentiment. Ripple’s ongoing projects and legal resolution have boosted confidence among investors. Ripple’s initiatives, including financial partnerships and innovative use cases for their blockchain, continue to create underlying value and attract long-term support from the financial community.

Given the constellation of positive indicators, Ripple seems well-positioned for a significant price movement. However, it’s crucial to remember that while technical analysis provides valuable insights, it doesn’t guarantee future performance. Market sentiments and external factors can shift rapidly, influencing price dynamics in unforeseen ways.

Understanding the limitations of technical analysis is key for all investors. While the current data points to a promising outlook for XRP, always consider diversifying your portfolio and staying informed on Ripple’s broader strategic moves. As always, it’s wise to combine technical indicators with fundamental analysis to make well-rounded decisions in the ever-evolving cryptocurrency landscape.