Lisk has had quite a turbulent journey over the past few years. Despite recent growth, LSK is over three times down since its March peaks and a staggering 98% down from its all-time high (ATH) in 2018. For many, this raises the question: Is there a chance for a comeback in 2024?

Table of Contents

Current Market Trends and Technical Analysis

Examining the most recent data, the Lisk price currently stands at $0.80 with an overall positive change over the past week. However, momentum over the past three months has been negative and shows a decline in market activity. Both its Simple and Exponential Moving Averages point to a stabilized yet stagnant trend.

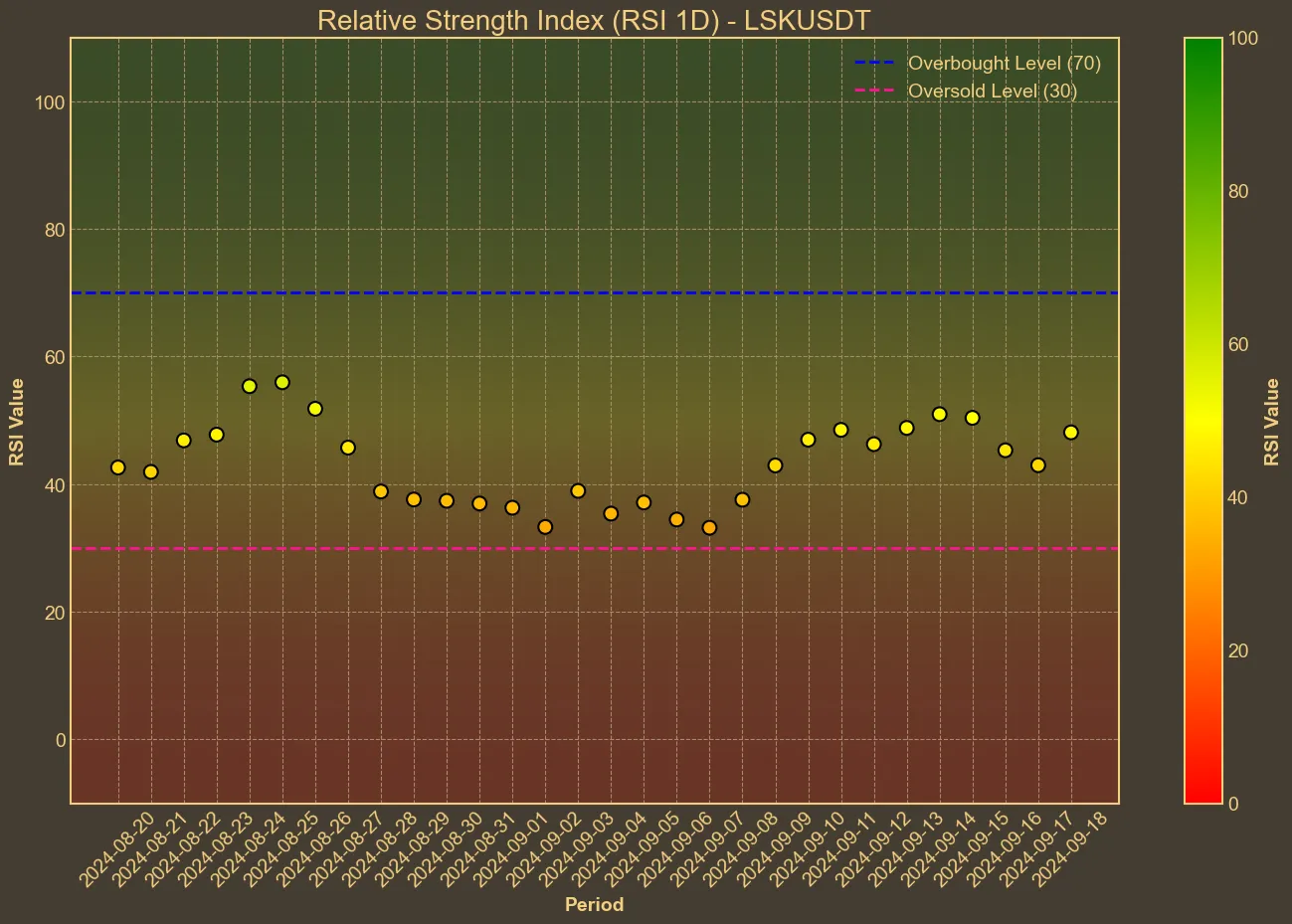

The RSI levels for Lisk have stayed mostly around the neutral mark, but there is no clear indication of any significant uptrend. The MACD values are also negative, suggesting a persistent bearish sentiment. Additionally, Awesome Oscillator readings remain in the red, which further dampens hopes for a rapid recovery.

Community and Market Sentiment

Beyond technicals, another critical factor to consider is market sentiment. Lisk’s community engagement has considerably dwindled. The project’s social media pages have limited interaction, and the official Reddit page saw just five posts last month. This lack of buzz around the project severely impacts its overall growth potential. Several posts online argue that Lisk is a “dead” coin, and this sentiment started appearing a few years ago.

On the positive side, the Lisk team continues to push developments forward. Recently, LSK went live on Uniswap, which is a step in the right direction. However, enthusiasm around these advancements appears limited. With so few active followers, new features may not sufficiently foster a strong recovery.

External Factors and Future Prospects

While the economic landscape holds its own challenges, the upcoming Federal Reserve’s interest rate decision might temporarily boost cryptocurrency markets, including Lisk. However, for those hoping for a return to ATH, the circumstances are not promising. The lack of broad community support and technical indicators paint a rather dull picture.

In conclusion, while technical analysis provides a snapshot of current performance, it is not always predictive of future success. Combined with sluggish community engagement and market sentiment, Lisk’s path to a robust comeback looks uncertain. For any meaningful rebound, both technical and community factors would need to shift positively in unison, and that seems unlikely in the near term.