The Nervos Network has shown some intriguing patterns recently. Its current standing at #104 in the cryptocurrency market indicates its significant presence. While the current price stands at $0.0163, it has seen a price change of -3.5% over the last day, further sliding to -8% over the past week. However, it’s worth noting that just two weeks ago, the coin surged by 50% in a single day, followed by an additional 20% jump two days later.

The market cap for Nervos Network is currently set at $0.57 billion, which saw a slight decrease of -2.5% over the last day and -4% over the past three days. However, the market cap improved by 1.3% over the last week and a significant 70.22% over the last month. These numbers signal a strong and resilient growth phase.

Analyzing Technical Indicators

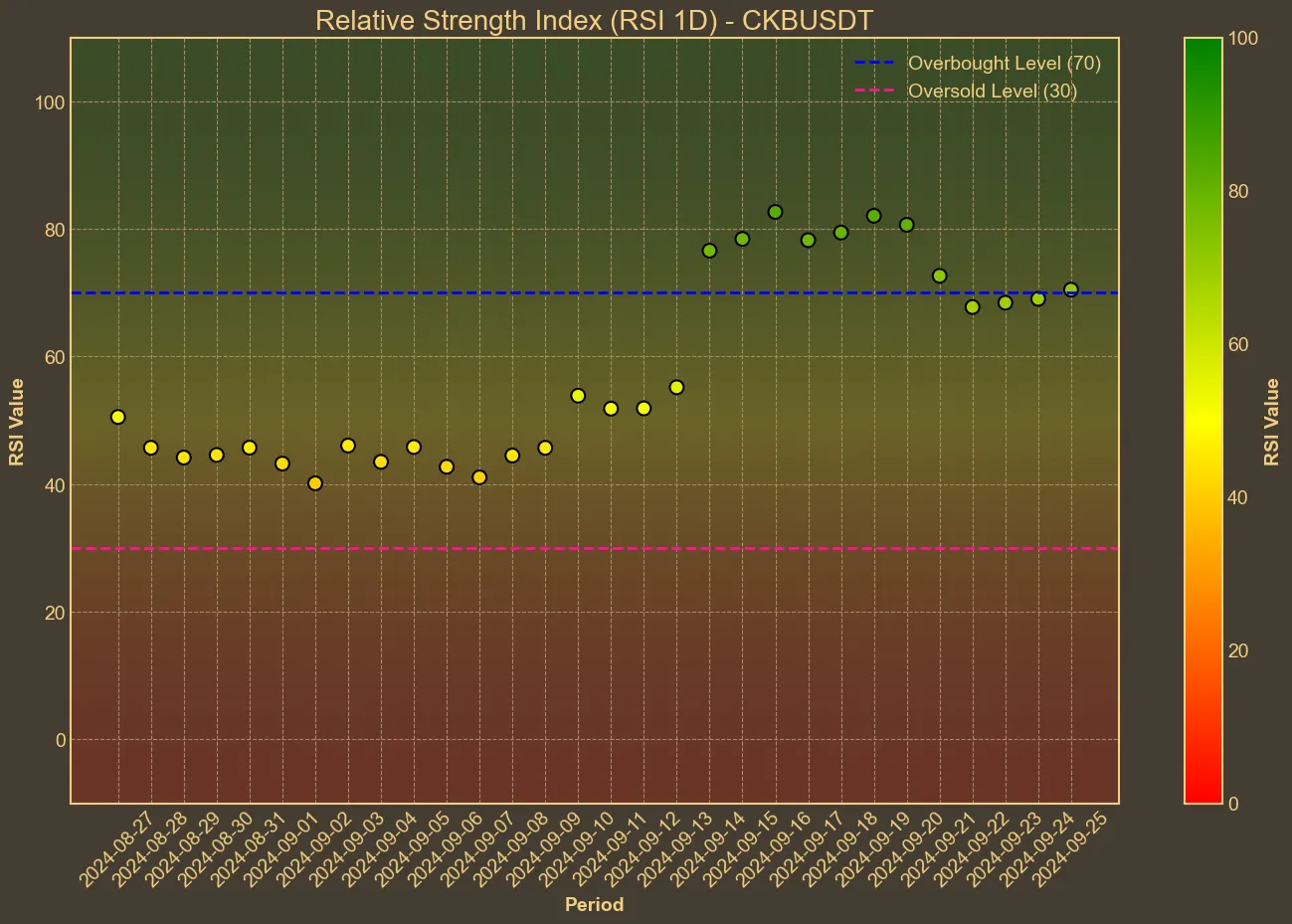

Technical indicators offer mixed signals about the future path of Nervos Network. The Relative Strength Index (RSI) which had been quite high at 82 a week ago has now cooled down to 66, suggesting that the coin may have been overbought and is now stabilizing. The Simple Moving Average (SMA) and Exponential Moving Average (EMA) trends support this view. The SMA observed today is $0.0123, up from $0.0105 seven days ago. Similarly, the EMA has remained mostly steady around $0.0136 over the week.

An extraordinary gain in the Average True Range (ATR), standing at 0.0014 today, suggests fluctuating volatility. Bollinger Bands (BB) indicate an upper limit (BB_H) of $0.0215 and a lower limit (BB_L) of $0.0057, signifying a potentially wide range of price movements. The MACD indicator, presently at 0.0021 with a signal line of 0.002, shows a slight bullish trend. Meanwhile, the Awesome Oscillator (AO) has been declining over the last week. It stands at 0.005 from a high of 0.007 six days ago, showing a decrease in short-term momentum.

Implications and Caveats

Looking forward, Nervos Network appears to have mixed implications. Its recent and substantial gains imply strong potential, while technical indicators provide a more cautious outlook. Trends in RSI, SMA, and volume suggest that the market might be cooling off after an aggressive buying period. However, the long-term growth signals robust interest and investment.

Investors should always remember that while technical analysis offers useful insights, it’s not foolproof. Market conditions, external changes, and unexpected events can sharply shift trends. Therefore, it is vital to use technical analysis as one of many tools in decision-making rather than relying on it exclusively. Still, given current trends, Nervos Network remains a fascinating project in the cryptocurrency space.