The recent data for PowerPool Concentrated Voting Power (CVP) illuminate a challenging phase for the cryptocurrency. A deeper dive into the metrics brings forward an overarching negative trend. Since the Binance announced its delisting, it lost almost 90%. With the delisting taking effect today we analyzed technical indicators to provide further insights into its current state and future prospects.

Technical Indicators Highlight Weakness

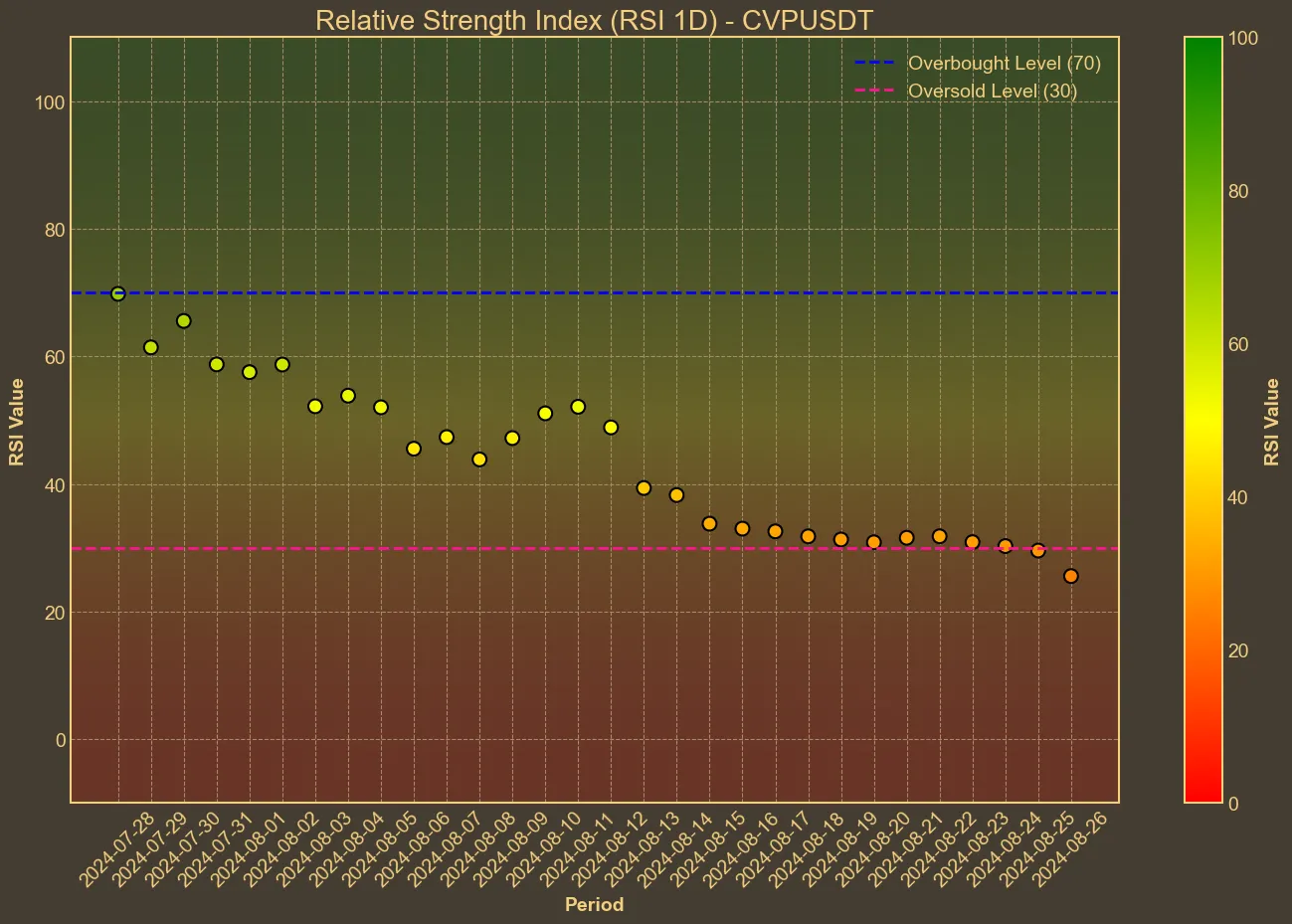

The Relative Strength Index (RSI) currently stands at 24, signifying a deep bearish sentiment since it consistently remained below the 30 mark over the past week. This implies an oversold condition, often interpreted as a potential pivot point for a price rebound. However, the ongoing decline indicates dwindling buying interest.

The Moving Averages present a similar outlook; both the Simple Moving Average (SMA) and Exponential Moving Average (EMA) are on a downward trend. The SMA has fallen from 0.286 a week ago to 0.2073, and the EMA saw a decline from 0.1851 yesterday to 0.1739 today. Both suggest that prices are trailing their averages, confirming a persistent bearish trend.

The Bollinger Bands indicate high volatility with the upper band at 0.3525 and a lower band in negative territory. This spread suggests an unstable market condition. Further affirming this instability, the Moving Average Convergence Divergence (MACD) value of -0.0631 and its signal line of -0.0534 indicate a bearish divergence. The Awesome Oscillator (AO) also remains negative, pointing out continuous downward momentum.

Market Sentiment and Future Outlook

Volume data unveils a worrying trend. Daily and weekly trading volumes have sharply declined, indicating reduced market participation, with a change of -20.90% in daily volume and -58.22% over the last week. Market capitalization has also plummeted, underscoring a shift in investor sentiment and reduced confidence in CVP’s future.

It’s essential to consider the broader context – particularly the delisting from Binance, which has amplified the negative price action. The move from one of the largest exchanges has sown doubt about CVP’s viability and eroded its market perception. This significant event is a stark reminder of the risks inherent in relying too heavily on centralized platforms for liquidity and visibility.

Is there any hope?

Based on the technical indicators, the short-term outlook for PowerPool appears dire. The declining RSI, negative MACD, and shrinking volumes all point to limited bullish activity. However, this does not spell the end. The RSI’s oversold condition may attract some contrarian investors looking for a potential rebound, but such bets remain high-risk.

While technical analysis provides valuable insights, it is important to remember that it cannot predict sudden market events. The current metrics offer a snapshot of prevailing trends, but they can’t foresee future market sentiment shifts or unexpected positive developments. My advice for potential investors would be to tread cautiously, remain aware of the inherent risks, and not discount the potential for sudden shifts that could alter the current outlook.

In conclusion, PowerPool’s current technical indicators paint a bleak picture. However, in the volatile world of cryptocurrencies, conditions can change rapidly, and the recovery often depends on broader market dynamics and unforeseen developments.