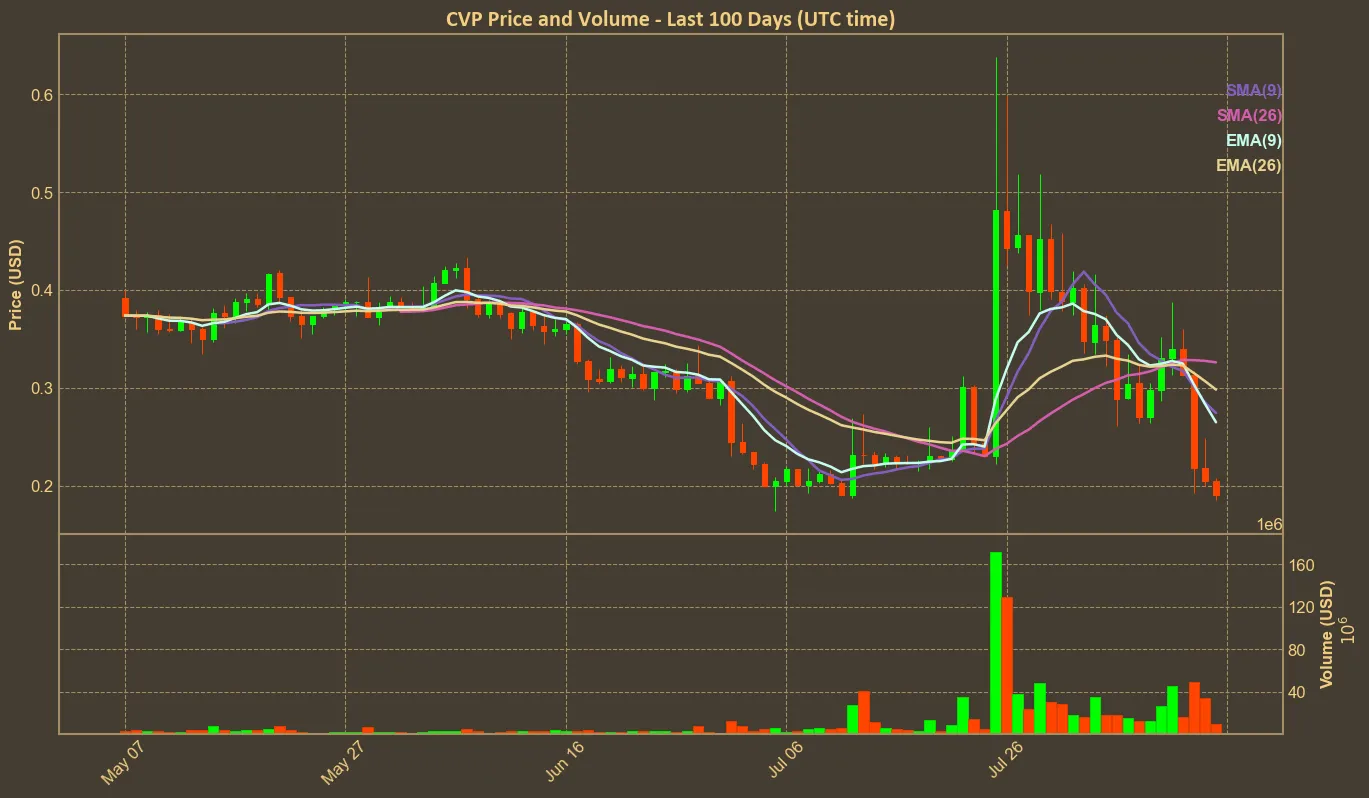

The recent data for PowerPool (CVP) paint a rather concerning picture. Over the past few days, the value of CVP has seen a significant decline. The price dropped by almost 20% in the last day alone, continuing a downward trend after the announcement that the cryptocurrency will be delisted from Binance. This persistent drop in price corresponds with a noticeable decrease in market capitalization, highlighting a pessimistic market sentiment towards this cryptocurrency.

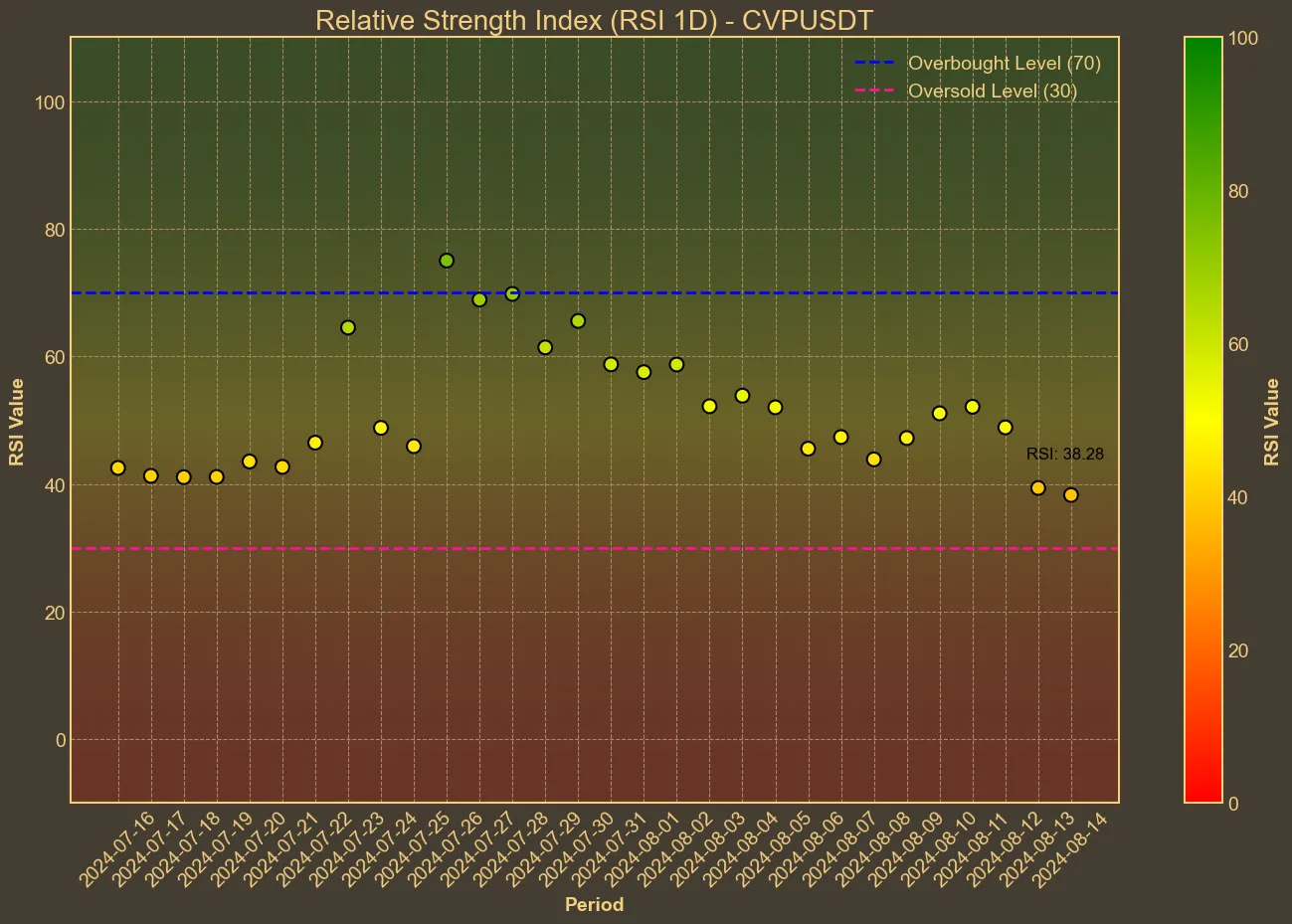

Among the technical indicators, the Relative Strength Index (RSI) consistently shows a value below 50, indicating that CVP is in a bearish trend. Notably, today’s RSI stands at 37, lower than it was seven days ago. This suggests a continuing trend of declining buying interest. The MACD (Moving Average Convergence Divergence) and the AO (Awesome Oscillator) are also negative, pointing towards waning momentum. Despite the small changes observed, these indicators do not signal an immediate reversal.

The Simple Moving Average (SMA) and Exponential Moving Average (EMA) further corroborate the bearish outlook. Both indicators remain flat or slightly descending, indicating that recent price movements have not strayed far from their averages. The Bollinger Bands (BB_H and BB_L) show a wide range, suggesting increasing volatility. However, the broader implication is one of instability rather than opportunity.

Volume & Market Dynamics

Volume metrics over the past month show a significant increase of nearly 120%, albeit with decreased volume in the short term. This increased volume might typically indicate growing interest or activity, but given the negative price trend, it suggests a higher number of sellers exiting their positions rather than new investors coming in.

More concerning is the delisting event from Binance, one of the world’s largest cryptocurrency exchanges. This event doesn’t just reflect in the sharp price decline it triggered but also impacts market perception and future investment potential. The consequences of this delisting are still unfolding, and while the PowerPool team is advocating for community support and operational continuity, the loss of such a significant exchange listing cannot be understated.

Implications

While the data provides a clear narrative of a struggling asset, it’s also crucial to acknowledge the limitations of technical analysis. These indicators largely reflect past data and trends and therefore, cannot predict sudden market upheavals or changes in investor sentiment. The delisting from Binance serves as an all-too-real example of how unforeseen events can dramatically influence market conditions.

The recent trends and technical indicators for CVP suggest that potential investors should be cautious. While PowerPool’s underlying technology and project fundamentals may still hold promise, the immediate outlook appears quite challenging. Prospective investors must be mindful of the risks and consider diversifying their holdings to mitigate potential losses. Metrics suggest defensive strategies over aggressive buying at the current stage.

In conclusion, PowerPool is at a critical juncture. Its community and the broader crypto market will be watching closely to see how the project recovers from recent setbacks. Investors must remain vigilant and thoroughly assess the risks before making any decisions.