The recent performance of Binance Coin (BNB) reveals intriguing trends that are noteworthy for both seasoned investors and those new to the cryptocurrency market. Currently valued at $526, BNB remains a dominant force with its market cap ranking it #4. Despite some fluctuations, its overall trajectory invites a closer inspection to understand where it might be headed.

One of the most significant observations is BNB’s notable resilience over the past year. The price surge of 118.37% over this period reflects strong market confidence. However, the short-term trends present a more complex image. Over the last quarter, BNB experienced a 12.01% decline, a stark contrast to its yearly performance. This indicates that while long-term holders may be reaping substantial gains, the short-term market conditions have been less predictable.

Market Dynamics and Technical Indicators

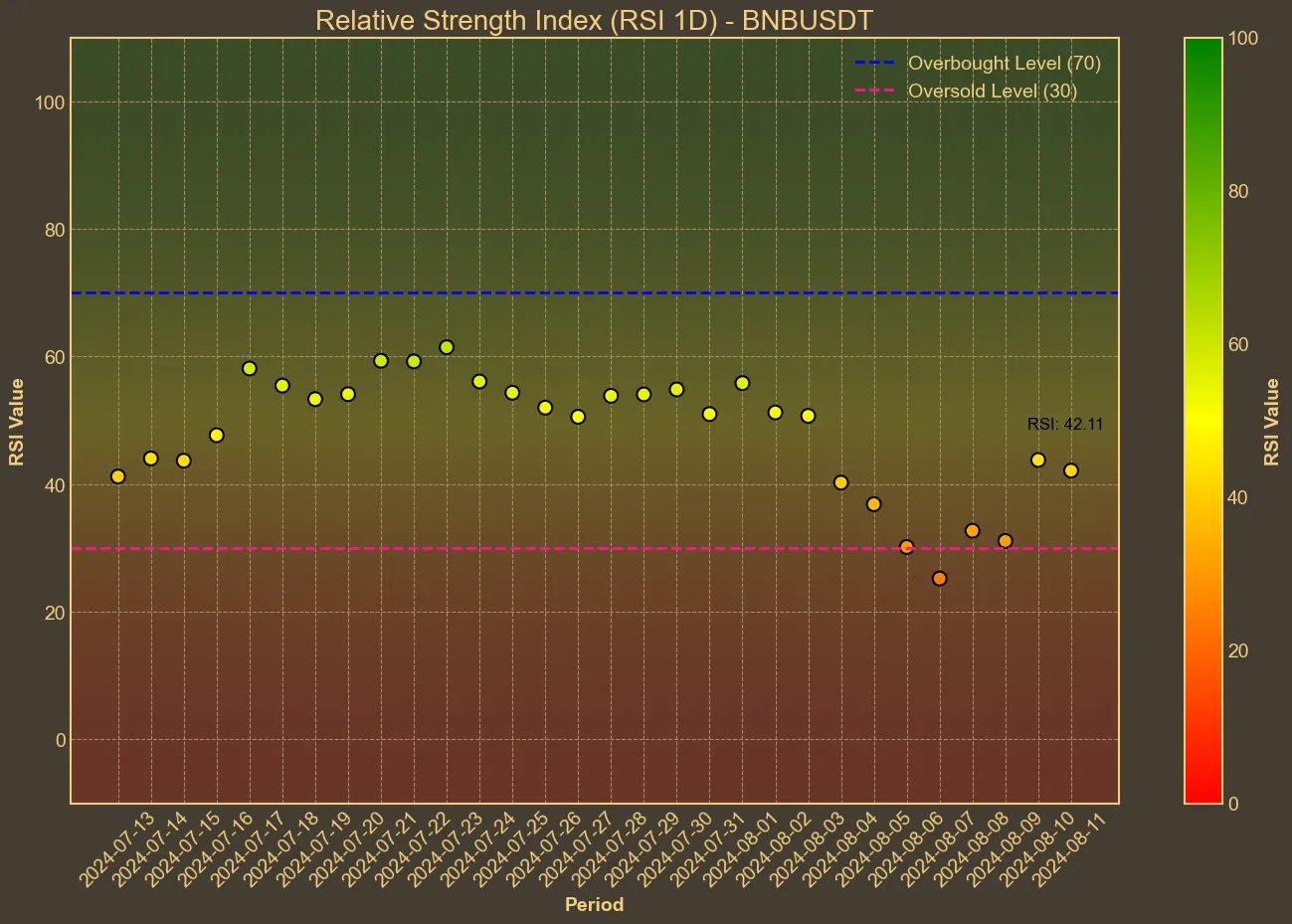

Analyzing key technical indicators provides further clarity on BNB’s current state. The Relative Strength Index (RSI) has been climbing steadily over the past week, moving from a notably oversold territory of 25 five days ago to a more balanced 46 today. This suggests a recovering buying pressure, potentially signaling upcoming stabilization or a reversal in the recent downtrend.

Moreover, the Simple Moving Average (SMA) and Exponential Moving Average (EMA) present a slightly bearish outlook as they are both trending higher than the current price. Specifically, today’s SMA and EMA stand at 554.77 and 538.93, respectively. Meanwhile, the Bollinger Bands (BB) confine the price between 463.92 (lower band) and 627.87 (upper band), illustrating a relatively wide volatility range.

The Moving Average Convergence Divergence (MACD) is currently negative at -17.93, with the signal line lingering at -13.71, hinting at a weak bearish momentum. The Awesome Oscillator (AO), showing a value of -51.35 today, reinforces this notion with persistent negative readings over the past week, indicating that bearish sentiment has been prevailing recently.

Implications and Considerations

Interpreting these patterns, it becomes clear that BNB is experiencing a phase of consolidation after market turbulence from the beginning of the week. The decreased volume over the last 30 days, falling by 41.34%, may hint at less trading activity and possibly more cautious participation from traders.

It’s essential to remain cautious despite the generally positive long-term outlook. Technical analysis offers insights based on historical data and trends but can’t predict future market movements with certainty. Factors such as market sentiment, regulatory news, or macroeconomic shifts can quickly impact price dynamics.

BNB remains a strong contender within the cryptocurrency market, riding on the back of its utility and the strength of the Binance exchange. However, investors should be mindful of the short-term technical indicators and consider a strategic approach, possibly focusing on longer-term holdings over speculative short-term trades.