Stellar’s cryptocurrency, XLM, has experienced a remarkable surge in recent weeks, capturing the attention of investors and analysts alike. With the price soaring by 55% today, over 188% in the last week, and an astonishing 357% in the past month, many are wondering what factors are fueling this growth.

Table of Contents

Institutional Interest and Potential Collaborations

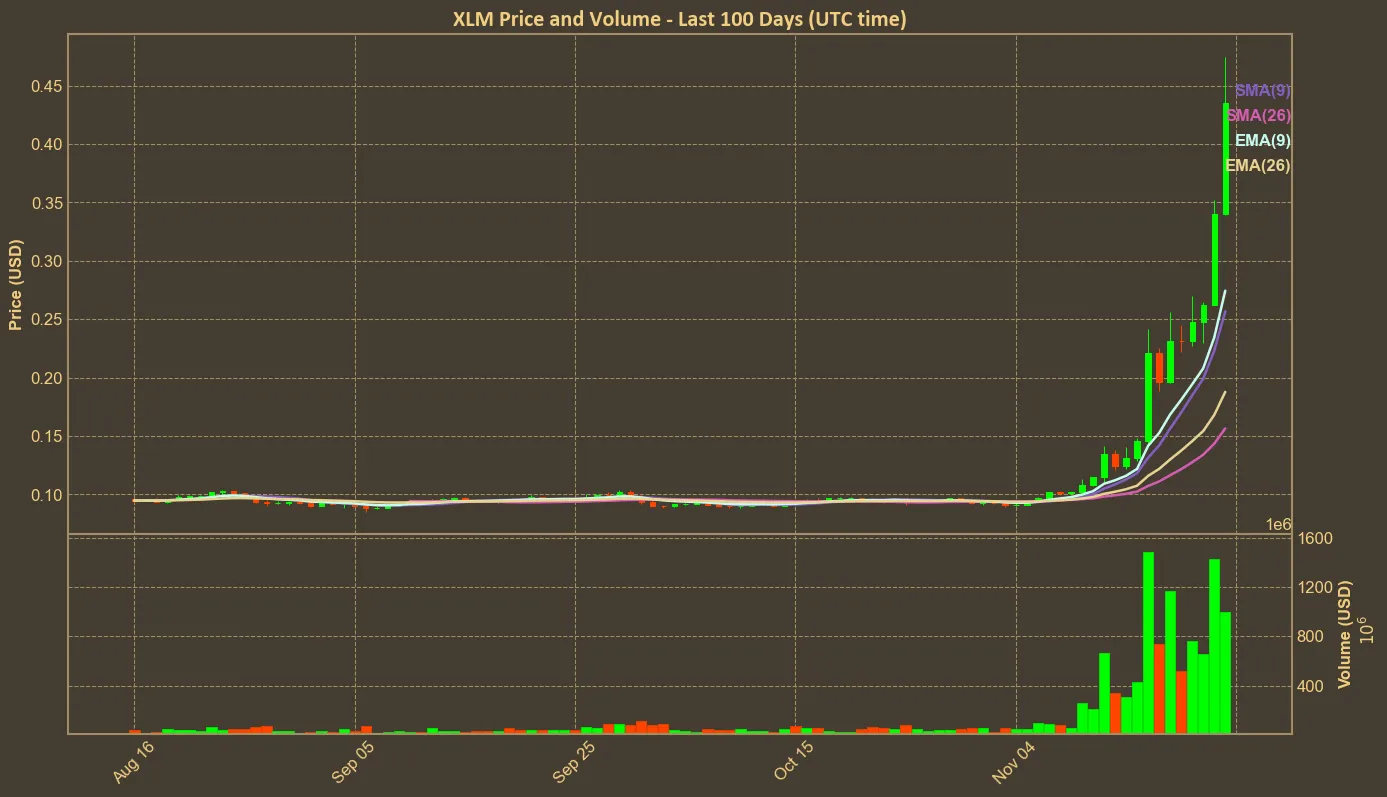

One of the primary reasons behind Stellar’s price increase is its recent technical breakout from a long-term downtrend. After years of downward and sideways price action, XLM has surged past critical resistance levels. This breakout is significant because it signals a potential reversal of the prolonged bearish trend, instilling confidence among traders and investors.

The cryptocurrency market as a whole has been experiencing a resurgence, with increased optimism fueling investments. Stellar’s ability to break through historical resistance points has made it a frontrunner in this broader market recovery.

Speculation about potential collaborations has also contributed to Stellar’s recent price rise. Discussions between key industry figures suggest that Stellar may be exploring partnerships that could enhance its utility and adoption. For instance, talks involving leaders from other prominent blockchain projects have hinted at possible cooperative efforts, which investors interpret as a positive sign for future growth. Such potential collaborations can lead to increased use cases for Stellar’s technology, attracting more users and increasing demand for XLM tokens.

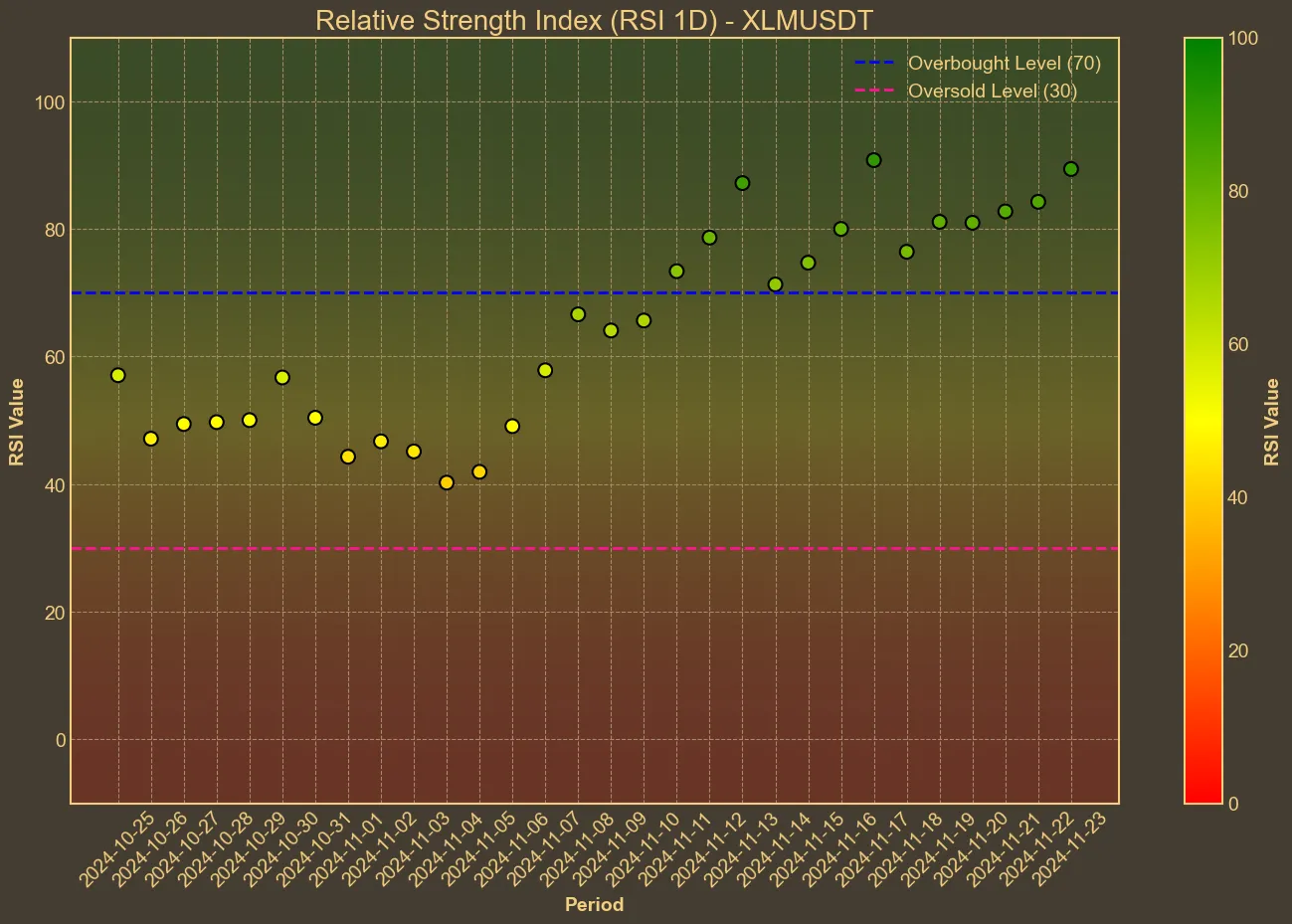

Technical Indicators Point to Overbought Conditions

Several technical indicators suggest that XLM is currently in overbought territory. The Relative Strength Index (RSI) has climbed to 92, well above the typical threshold of 70. This indicates that the asset may be overvalued in the short term and could be due for a correction.

Moving averages also reflect strong upward momentum. The Simple Moving Average (SMA) and the Exponential Moving Average (EMA) have both been rising steadily, highlighting increased buying pressure. The Moving Average Convergence Divergence (MACD) is positive, signaling bullish sentiment in the market.

Trading volume has spiked dramatically, increasing over 12,500% in the past month. This surge suggests heightened interest and activity, which can contribute to price volatility. The significant growth in market capitalization, now nearly $13 billion, underscores the scale of this movement.

Conclusion

Stellar’s recent surge is the result of a combination of technical breakouts, increased investor confidence, potential collaborations, and heightened market activity. While the current momentum is strong, a balanced perspective is crucial. Rapid price increases can sometimes be followed by corrections as the market adjusts. By staying informed and considering both the opportunities and risks, investors can make more informed decisions in this evolving market.

Need a quick and easy way to see what’s happening in crypto over the next few days? Check out our Crypto Events Calendar!