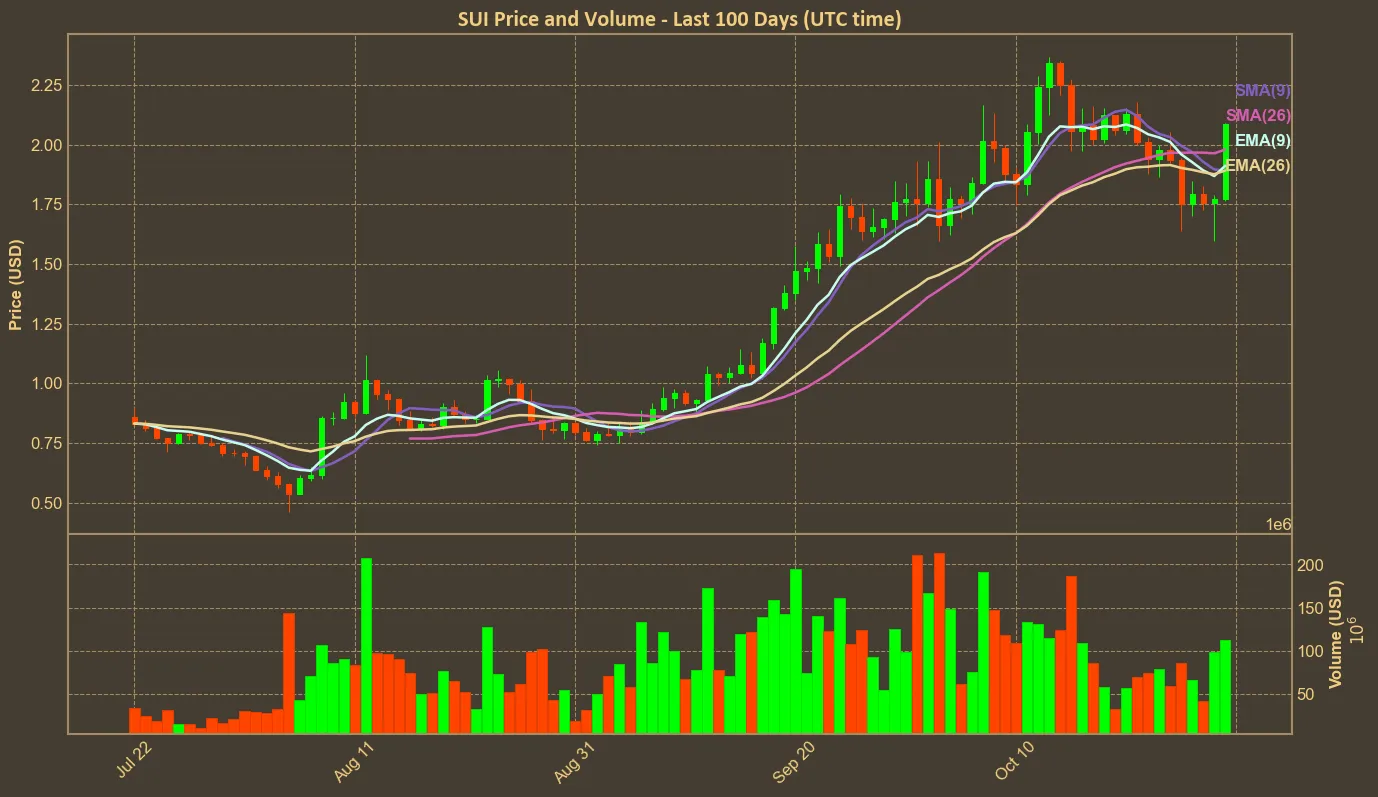

After setting a new ATH of $2.36 two weeks ago, SUI has been in a dangerous downward trend. Just yesterday, it was barely above $1.60. However, with recent Bitcoin surge and optimism on the market, SUI comes back above $2.00 with a spectacular 26% rise! Is it just the beginning of another surge – or even another ATH?

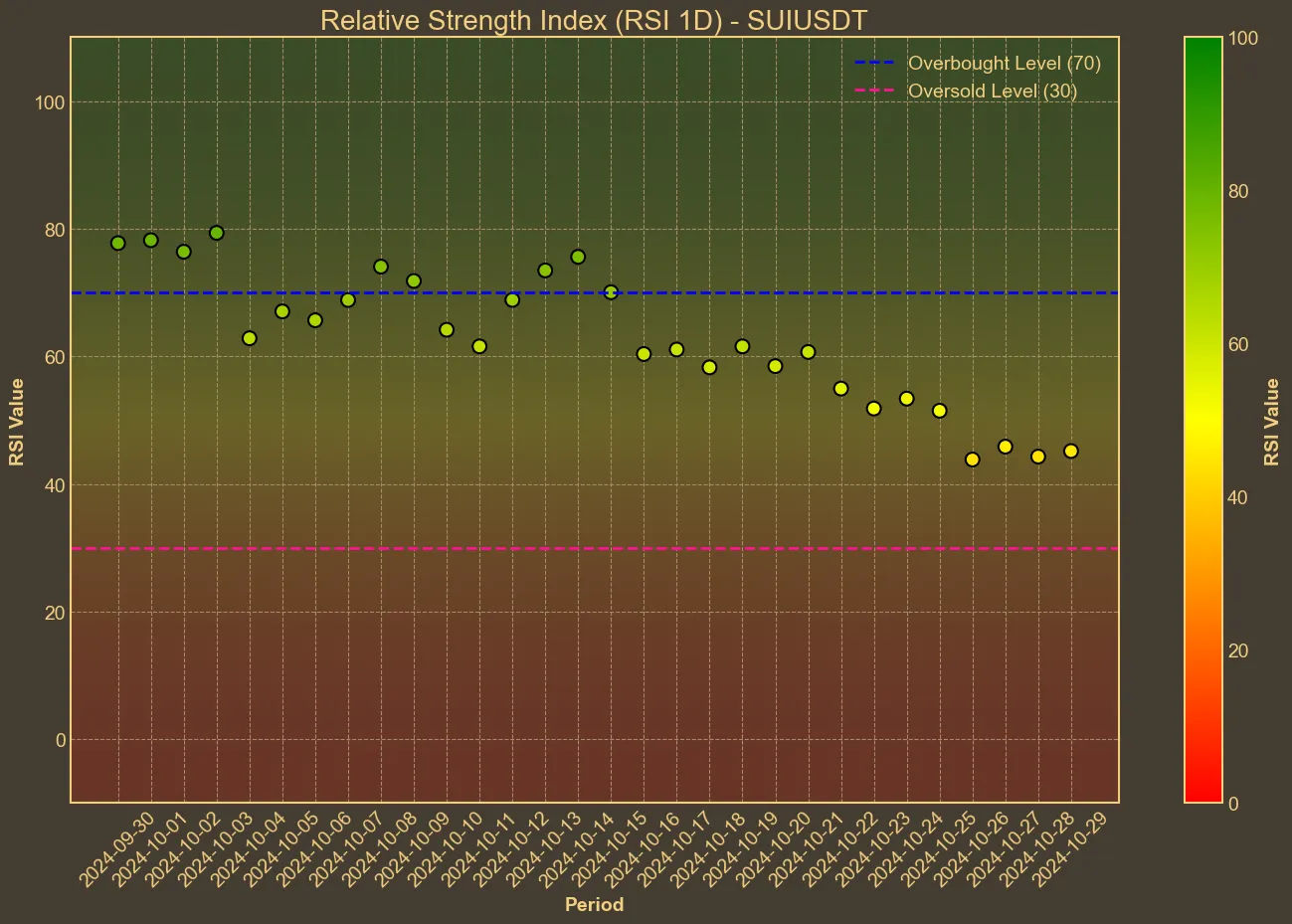

The technical indicators for Sui reveal a mixed but promising picture. The Relative Strength Index (RSI) was neutral the last few days, as we can see on the chart below. However, today it is estimated to be around 58, which would mean significant jump – but not yet to overbought territory.

While the Simple Moving Average (SMA) and Exponential Moving Average (EMA) echo an upward trend, other indicators like the Moving Average Convergence Divergence (MACD) suggest maintaining vigilance. The Awesome Oscillator (AO) indicates a shift in market sentiment, but reading these indicators is not foolproof. Fluctuations are prevalent and can shift the narrative unexpectedly.

While the Simple Moving Average (SMA) and Exponential Moving Average (EMA) echo an upward trend, other indicators like the Moving Average Convergence Divergence (MACD) suggest maintaining vigilance. The Awesome Oscillator (AO) indicates a shift in market sentiment, but reading these indicators is not foolproof. Fluctuations are prevalent and can shift the narrative unexpectedly.

In evaluating the potential future of SUI, one must consider the upcoming events that could play pivotal roles in shaping its trajectory, that technical indicators cannot take into account. The anticipated token unlock event on 1st November, set to introduce over 64 million new tokens into the market (over 2% of current supply), poses both opportunities and challenges. Furthermore, the upcoming U.S. presidential election is another external factor that might indirectly influence market sentiment, affecting Sui’s future performance.

As always, remember the limitations of technical analysis. While helpful in understanding current trends, cannot predict unforeseen market shifts or broader global events. Considering these limitations, in my opinion while Sui has shown an impressive recovery, it’s too early to say whether the momentum will continue. However, if Bitcoin manages to set a new ATH, we can expect a reaction in SUI price as well.